Paytm Kyc Online Verification at Home Form

What is the Paytm KYC Online Verification at Home

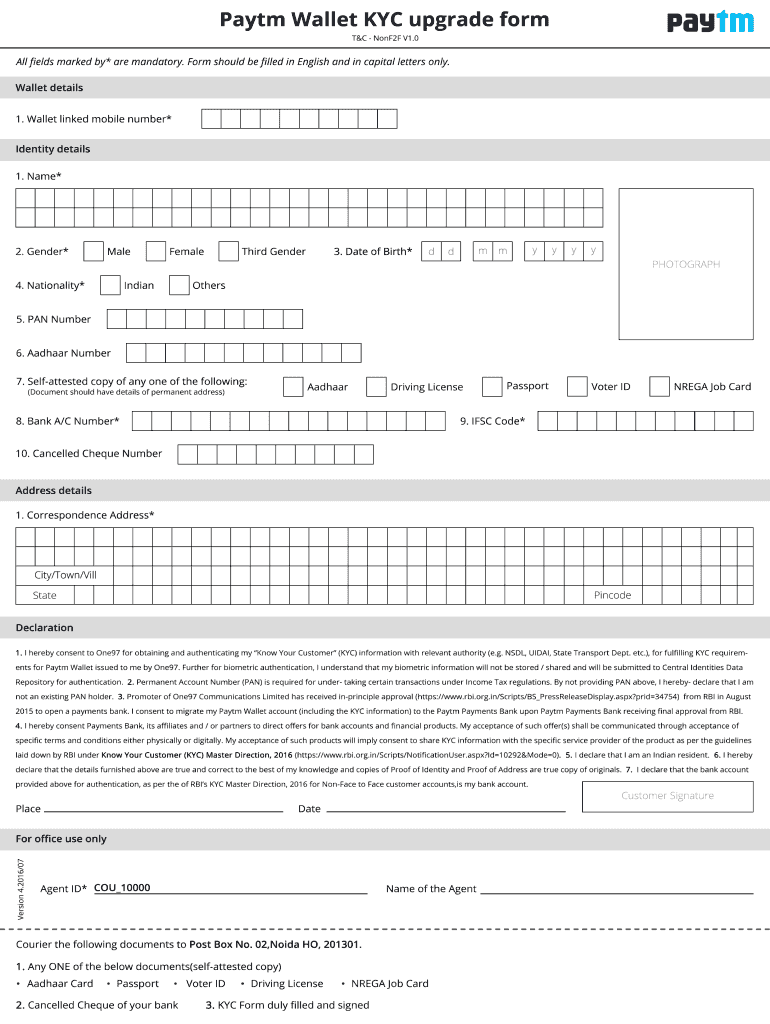

The Paytm KYC online verification process allows users to complete their Know Your Customer (KYC) requirements from the comfort of their homes. This process is essential for individuals who wish to use Paytm services, such as making payments, transferring money, or accessing financial services. The online verification ensures that users provide accurate personal information, which is crucial for compliance with regulatory requirements. By completing the KYC process, users can enhance their account security and gain access to higher transaction limits.

Steps to Complete the Paytm KYC Online Verification at Home

Completing the Paytm KYC online verification involves several straightforward steps:

- Log into your Paytm account using the mobile app or website.

- Navigate to the KYC section, usually found in the account settings.

- Select the option for online verification.

- Provide the required personal information, including your name, address, and identification details.

- Upload necessary documents, such as a government-issued ID and proof of address.

- Submit the application and wait for verification, which typically takes a few hours to a few days.

Required Documents for Paytm KYC Online Verification

To successfully complete the Paytm KYC online verification, users must prepare specific documents. The standard documents required include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of address, which can be a utility bill, bank statement, or lease agreement.

- A recent passport-sized photograph.

Having these documents ready can streamline the verification process and reduce potential delays.

Legal Use of the Paytm KYC Online Verification at Home

The Paytm KYC online verification process complies with legal standards set by regulatory authorities in the United States. By completing KYC, users help prevent fraud and money laundering, which are critical concerns for financial institutions. This process ensures that Paytm adheres to the necessary legal frameworks, such as the Bank Secrecy Act and the USA PATRIOT Act, which mandate customer identification and verification.

Key Elements of the Paytm KYC Online Verification at Home

Several key elements are integral to the Paytm KYC online verification process:

- Identity Verification: Users must provide valid identification to confirm their identity.

- Document Submission: The process requires users to upload necessary documents securely.

- Data Security: Paytm employs encryption and secure methods to protect user data during the verification process.

These elements ensure a smooth and secure verification experience for users.

Examples of Using the Paytm KYC Online Verification at Home

Users can benefit from the Paytm KYC online verification in various scenarios. For instance:

- A new user setting up a Paytm account for the first time will need to complete KYC to access full services.

- Existing users may need to update their KYC information if they change their address or name.

- Individuals looking to increase their transaction limits will also need to complete the KYC process.

Each of these examples illustrates the importance of KYC in maintaining account functionality and security.

Quick guide on how to complete paytm kyc form

The optimal method to obtain and endorse Paytm Kyc Online Verification At Home

Across the entire organization, ineffective procedures surrounding paper approval can waste signNow working hours. Endorsing documents like Paytm Kyc Online Verification At Home is an inherent aspect of operations in any enterprise, which is why the efficacy of each agreement’s lifecycle signNowly impacts the overall performance of the organization. With airSlate SignNow, endorsing your Paytm Kyc Online Verification At Home can be as simple and rapid as possible. This platform provides you with the latest version of virtually any document. Even better, you can sign it immediately without the necessity of installing external software on your device or printing physical copies.

Steps to obtain and endorse your Paytm Kyc Online Verification At Home

- Browse our collection by category or utilize the search box to locate the document you require.

- Examine the form preview by clicking on Learn more to confirm it is the correct one.

- Press Get form to start editing right away.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to endorse your Paytm Kyc Online Verification At Home.

- Choose the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your documentation efficiently. You can discover, complete, edit, and even send your Paytm Kyc Online Verification At Home in a single tab without difficulty. Enhance your workflows with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What are the benefits of upgrading Paytm and filling out the KYC form?

You can open savings account in Paytm Payment Bank by upgrading it and submitting KYC documents. Read more about Paytm Payment Bank and its features.

-

Is a cyber cafe business in India still profitable?

It is most profitable business in current situation. Normal people will think Cyber cafe has only PC, Internet and print out. If you provide following services then you can earn more than 1.5 lakhs only in direct profit.(personal experience from Chennai).Fund transfer and micro atms. People need immediate transfer and if your cafe is open from 9 am to 10 pm you can cross 800 to 1500rs per day. Bank Holidays higher profits.Train ticket agent. Avoid personal login booking. Non bailable offense.Seat seller Agent(red bus).Flight ticket, Tour planner and hotel booking.Visa Services and passport.Pan card and DSC.IT returns and GST filings. Tie up with local Tax people or learn yourself. IT return filing for Salaried people is much easier.EB payment, postpaid, rechargesCredit card payment.Movie ticketsCollege and school fees paymentsExam fees(state and Central)Online form filling for exams from Neet to UPSC.Certificates from caste, Employment, Life, birth and death.Corrections in Aadhar, PAN any online documents.Life insurance renewals and royalty if you are LIC agent.bike and car insurance, road tax etcCurrency exchangeXerox , Plastic card , Color print out & Lamination For cropping, resizing additional cost.PF update and withdrawal.International and local Courier if you have space.Ola collections, Paytm KYC etcTTD, Sabarimala, Shirdi darshans.Typing in local languages & EnglishLand EC checking, Online tax paying like water, property etcIn some states there are different online schemes to get enrolled, renewals and withdrawals.CIBIL Score certificateCredit card swiping(2 to 3% commission)Moreover with digital India, people are looking for local knowledge nearby.All payments are becoming digital and cyber cafes with good reputation will give you best returns. Make sure your cafe never closes on any day even for lunch break. Trust, reliability, friendliness will yield positive feedback from customers.No matter how many Smartphones, Paytm, TEZ services comes, People looks for specific Knowledge locally. You can be creative and make changes as per consumer needs and requirements in future.Your cafe should be one stop solution for all. Use credit cards to make online payments which gives you back rewards points in most cases.Reward points alone provides more than 1 Lakh if you use continuously(indirect profit) and specific bank cards only provides 4x to 10x benefits while using online.Make sure you use Credit card after statement date so that the money will be in rotation for 50 days. My Statement generates on 10th January and due date is 30th January. I will start using from 11th January and Next due date is on February End or March 1st week. That gives me 45 to 49 days.Have 3 to 5 or more credit cards and be calculative on when, where and how to use. Minimum use if emergency arise.CAFE should be at center point or near to bank area for visibility. Even top geek will have to set foot once to avail one of the services above. Trust is one thing that make business popular. It takes more months to avail.Google, Digital God.

-

How can I fill out a KYC form online for SBI?

Fill out ? If you want to update your kyc, you can just write up a formal letter with your cif/ac details and attach photo copies of the proofs, self attested by you and send them by post to your home branch or you can do it yourself, if you have online banking facility.

-

Will a bank account be created after filling up the KYC form for Paytm?

After filling up KYC form, you will be KYC verified.If you wish to open bank account so click on “Bank” icon of Paytm app

-

How is KYC completed?

KYC can be done online or offline.In case of offline, this is how you do.There are two ways to do Offline verification:Offline Aadhar XMLQR code.Generation of the XML file for Offline Verification:a. Visit www.uidai.gov.inb. Click on Aadhar Services tab and select Aadhar Paperless local e-KYC.c. A new page will open where you will have to enter your 12 digit Aadhar number and an OTP will be sent to your registered mobile number.d. In the redirected page mention your Name, address as it is mentioned in your Aadhar Card.e. Your name and address will appear on the shareable document. Enter ‘Share Code’ as per the instruction of the website. Enter the Security code and submit. On your successful submission, an XML file will be downloaded on your PCVerification using the QR code:a. Download the QR reader application.b. Click on ‘Scan from the QR reader’ in UIDAI website.c. Scan the QR code given in your Aadhar card, your demographic details and photo will be displayed and verified.You can do e-KYC at your place by aadhaar OTP based authentication, where you will have to give your 12 digit aadhaar number and an OTP will be sent to your registered number. After you enter your OTP your verification process is complete.Follow this link below to know various KYC methodshttps://bit.ly/2EiYi7S

-

Is it compulsory to do KYC for Paytm? Can a person below the age of 18 complete a KYC form?

Yes as per new RBI guidelines it complesury to complete KYC for using Paytm Wallet.For more details given link can be used.Few important changes in Paytm from 1st March – Paytm Blog

-

Will Paytm give cashback "in form of gold" to minimum KYC customers?

Yes, Paytm will give cash back in the form of Gold for non KYC users.Means if your KYC is not completed you will also receive the cashback in the form of Gold after deduction of 3% GST.

Create this form in 5 minutes!

How to create an eSignature for the paytm kyc form

How to generate an eSignature for the Paytm Kyc Form in the online mode

How to create an eSignature for the Paytm Kyc Form in Chrome

How to make an electronic signature for putting it on the Paytm Kyc Form in Gmail

How to make an eSignature for the Paytm Kyc Form right from your smartphone

How to make an electronic signature for the Paytm Kyc Form on iOS

How to make an eSignature for the Paytm Kyc Form on Android devices

People also ask

-

What is the kyc version update process in airSlate SignNow?

The kyc version update process in airSlate SignNow ensures that your Know Your Customer requirements are met with the latest compliance standards. This update helps businesses maintain regulatory adherence effortlessly while using our eSigning platform. Users can easily navigate the interface to implement the update, ensuring a smooth transition.

-

How can the kyc version update benefit my business?

The kyc version update offers businesses enhanced security features that protect sensitive customer information. Additionally, it streamlines documentation processes, saving time and resources. By keeping your compliance measures up to date, you build trust and reliability with your clients.

-

What features are included with the kyc version update?

The kyc version update includes advanced identification verification tools, upgraded document templates, and automated workflows. These features not only simplify the compliance process but also improve user experience. With these enhancements, businesses can effectively manage customer onboarding and documentation.

-

Is there any additional cost for the kyc version update?

The kyc version update is included in our standard subscription plans at no extra cost. We aim to provide our users with the best tools without worrying about hidden fees. By including these updates, airSlate SignNow continues to prioritize compliance and value for all customers.

-

Are there integrations available for the kyc version update?

Yes, the kyc version update seamlessly integrates with popular CRM and management tools to provide a comprehensive solution. By connecting with tools like Salesforce and HubSpot, businesses can automate their compliance processes. This integration maximizes efficiency and ensures your kyc obligations are met.

-

How often is the kyc version update rolled out?

We roll out kyc version updates regularly to accommodate new regulatory changes and enhance existing features. This constant improvement cycle helps our users stay compliant and secure in their dealings. Our commitment is to keep your organization up to date with the best practices.

-

Can I customize the kyc version update to fit my needs?

Absolutely! airSlate SignNow allows users to customize the kyc version update according to specific business needs and compliance requirements. This flexibility ensures you can adjust workflows and documentation processes effectively. Customizability maximizes usability for your unique operational environment.

Get more for Paytm Kyc Online Verification At Home

Find out other Paytm Kyc Online Verification At Home

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy