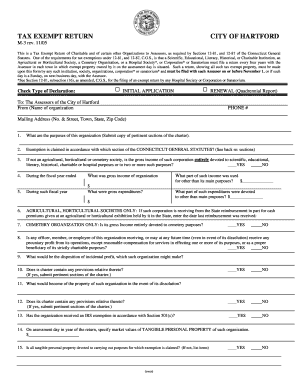

TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford Form

What is the TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford

The TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford is a specific form used by individuals and organizations in Hartford to claim tax-exempt status. This form is essential for those who qualify for exemptions under local tax laws, allowing them to avoid certain tax liabilities. Understanding the nuances of this form is crucial for ensuring compliance with Hartford's tax regulations.

Steps to complete the TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford

Completing the TAX EXEMPT RETURN Assessment requires careful attention to detail. Here are the general steps involved:

- Gather necessary documentation that supports your tax-exempt status.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford

Legally, the TAX EXEMPT RETURN Assessment must be completed in accordance with Hartford's tax laws. This includes adhering to the guidelines set forth by local tax authorities. Proper execution of the form ensures that it is recognized as valid in legal contexts, which can protect against potential tax liabilities.

Eligibility Criteria

To qualify for using the TAX EXEMPT RETURN Assessment, applicants must meet specific criteria established by Hartford's tax regulations. This typically includes being a non-profit organization, educational institution, or other entity eligible for tax exemption. It is essential to review these criteria to determine if you qualify before completing the form.

Required Documents

When preparing to submit the TAX EXEMPT RETURN Assessment, several documents may be required. Commonly needed items include:

- Proof of tax-exempt status, such as IRS determination letters.

- Financial statements that demonstrate the organization's operations.

- Any additional supporting documents that validate the claim for exemption.

Filing Deadlines / Important Dates

Filing deadlines for the TAX EXEMPT RETURN Assessment are critical to ensure compliance. Typically, these deadlines align with local tax filing schedules. It is advisable to check Hartford's tax authority website for specific dates to avoid penalties or complications.

Quick guide on how to complete tax exempt return assessment hartford hartfordassessor hartford

Complete TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and safely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The optimal method to edit and eSign TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford without hassle

- Find TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Edit and eSign TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt return assessment hartford hartfordassessor hartford

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TAX EXEMPT RETURN Assessment in Hartford?

A TAX EXEMPT RETURN Assessment in Hartford refers to the process of evaluating properties that qualify for tax exemption. It is crucial for property owners to understand their eligibility and the requirements set by the Hartford Assessor's office.

-

How can airSlate SignNow help with TAX EXEMPT RETURN Assessments in Hartford?

airSlate SignNow provides an efficient platform for businesses to digitally sign and send documents related to TAX EXEMPT RETURN Assessments in Hartford. This streamlines communication with the Hartford Assessor's office, making it easier to manage essential documentation.

-

What features does airSlate SignNow offer for managing TAX EXEMPT RETURN Assessments?

airSlate SignNow includes features like electronic signatures, document templates, and secure storage, all of which are beneficial for managing TAX EXEMPT RETURN Assessments in Hartford. These tools ensure compliance and efficiency in handling assessment documents.

-

Is there a cost associated with using airSlate SignNow for TAX EXEMPT RETURN Assessments?

Yes, while airSlate SignNow is a cost-effective solution, there are subscription plans that vary based on the features needed. Investing in this platform can save time and resources while managing TAX EXEMPT RETURN Assessments in Hartford effectively.

-

What are the benefits of using airSlate SignNow for TAX EXEMPT RETURN Assessment documentation?

The primary benefits of using airSlate SignNow include improved efficiency, reduced paper usage, and enhanced security for your TAX EXEMPT RETURN Assessment documentation in Hartford. Digital solutions minimize the risk of errors and ensure timely submission.

-

Can airSlate SignNow integrate with other tools for TAX EXEMPT RETURN Assessments?

Absolutely! airSlate SignNow offers integrations with various business tools and applications, enhancing workflow for TAX EXEMPT RETURN Assessments in Hartford. This connectivity allows for better data management and streamlined processes.

-

How does airSlate SignNow ensure the security of TAX EXEMPT RETURN Assessment documents?

airSlate SignNow employs industry-standard security measures, including encryption and secure server protocols, to protect your TAX EXEMPT RETURN Assessment documents in Hartford. This ensures that sensitive information remains confidential and safe from unauthorized access.

Get more for TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford

- Cal pers bsd 241 form

- Great west life insurance beneficiary change form

- Guest preference form 403639044

- Gratitude questionnaire form

- Va form 10 0539 100473854

- Ftb 1131 cod franchise tax board privacy notice ca gov form

- California 540 2ez forms amp instructions personal income tax booklet california 540 2ez forms amp instructions personal income

- Virginia form 502 766807049

Find out other TAX EXEMPT RETURN Assessment Hartford Hartfordassessor Hartford

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template