Prepared Food and Beverage Tax Return Charlotte Mecklenburg Charmeck Form

What is the prepared food and beverage tax return in Charlotte Mecklenburg?

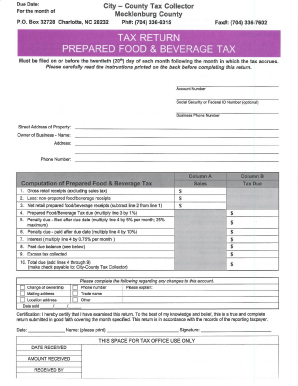

The prepared food and beverage tax return in Charlotte, Mecklenburg County, is a specific tax form that businesses must complete to report and remit the local food and beverage tax. This tax applies to sales of prepared food and beverages sold for immediate consumption. The return includes details such as total sales, tax collected, and any applicable deductions. Understanding this form is essential for compliance with local tax regulations.

Steps to complete the prepared food and beverage tax return in Charlotte Mecklenburg

Completing the prepared food and beverage tax return involves several key steps:

- Gather all sales records related to prepared food and beverages for the reporting period.

- Calculate the total sales amount and the corresponding tax collected based on the current tax rate.

- Fill out the tax return form accurately, ensuring all required information is included.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form by the designated deadline, either online or through traditional mail.

How to obtain the prepared food and beverage tax return in Charlotte Mecklenburg

Businesses can obtain the prepared food and beverage tax return from the Mecklenburg County website or the local tax office. The form is typically available as a downloadable PDF, which can be printed and filled out manually or completed digitally. It is important to ensure you are using the most current version of the form to comply with local regulations.

Legal use of the prepared food and beverage tax return in Charlotte Mecklenburg

The legal use of the prepared food and beverage tax return is governed by local tax laws. This form must be completed and submitted in accordance with Mecklenburg County regulations to ensure that the tax is properly reported and remitted. Failure to use the form correctly can result in penalties, including fines or additional taxes owed.

Filing deadlines and important dates for the prepared food and beverage tax return

Filing deadlines for the prepared food and beverage tax return are typically set by the Mecklenburg County tax office. Businesses should be aware of these deadlines to avoid late fees. It is advisable to mark important dates on a calendar and set reminders to ensure timely submission of the tax return.

Penalties for non-compliance with the prepared food and beverage tax return

Non-compliance with the prepared food and beverage tax return can lead to various penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to stay informed about their tax obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete prepared food and beverage tax return charlotte mecklenburg charmeck

Effortlessly Prepare Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck on Any Device

Digital document management has become increasingly favored among organizations and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the desired form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to edit and electronically sign Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck with minimal effort

- Locate Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prepared food and beverage tax return charlotte mecklenburg charmeck

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current rate of the food and beverage tax in Charlotte?

The food and beverage tax in Charlotte is currently set at 2.5%. This tax applies to prepared food and beverages sold within the city limits, which is crucial for both residents and businesses to understand. Keeping track of how much is the food and beverage tax in Charlotte will help you stay compliant and budget accordingly.

-

How does the food and beverage tax in Charlotte affect local businesses?

Local businesses in Charlotte are required to add the food and beverage tax to their sales, directly impacting their pricing strategies. Understanding how much is the food and beverage tax in Charlotte is essential for businesses to accurately calculate their total expenses and ensure competitive pricing. This knowledge can also help in effective financial planning and reporting.

-

Are there any exemptions to the food and beverage tax in Charlotte?

Certain exemptions exist for the food and beverage tax in Charlotte, such as for groceries and specific nonprofit organizations. It is important for both consumers and businesses to know how much is the food and beverage tax in Charlotte, as it can influence purchasing decisions and operational costs. Consulting local regulations can provide more clarity on these exemptions.

-

How can businesses manage the food and beverage tax in Charlotte efficiently?

To efficiently manage the food and beverage tax in Charlotte, businesses can utilize point-of-sale systems that automatically calculate taxes on transactions. This helps ensure that they are correctly applying the 2.5% tax to sales. Staying informed on how much is the food and beverage tax in Charlotte allows businesses to remain compliant and avoid potential penalties from tax authorities.

-

What resources are available for learning more about the food and beverage tax in Charlotte?

Various resources such as the City of Charlotte's official website, local business associations, and tax workshops can offer valuable information about the food and beverage tax in Charlotte. These platforms can help clarify how much is the food and beverage tax in Charlotte and provide insights on compliance. Regular updates and local regulations ensure you have the latest information at your disposal.

-

How is the food and beverage tax in Charlotte used by the city?

The revenue generated from the food and beverage tax in Charlotte is typically allocated to public services such as transportation, infrastructure, and city development projects. Knowing how much is the food and beverage tax in Charlotte helps residents understand the contributions they make to their community. This awareness can foster greater community engagement and support for local initiatives.

-

What should consumers know about the food and beverage tax in Charlotte?

Consumers should be aware that when dining or buying prepared foods in Charlotte, an additional charge will be incurred due to the food and beverage tax in Charlotte, which is 2.5%. Understanding this cost is essential for budgeting when going out for meals or special events. Being informed enables better financial planning for eating out.

Get more for Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck

- Pre incident survey forms

- Programs abroad course evaluation p a c e form oip server1 lsu

- Elevator maintenance log usi condo usi insurance services form

- Personal use drone flight permission form

- A49 form

- Uniform request form latest amazon web services

- Awana parent handbook first baptist church cary files caryfbc form

- Residential sewer as built drawing the city of portland oregon form

Find out other Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile