Clayton County Excess Funds List 2017-2026

What is the Clayton County Excess Funds List

The Clayton County Excess Funds List is a comprehensive record that details surplus funds resulting from tax sales in Clayton County, Georgia. When properties are sold at tax lien sales, any amount exceeding the owed taxes and fees becomes excess funds. This list serves as an essential resource for individuals and entities seeking to claim these funds. It is crucial for property owners and potential claimants to understand that these funds can be reclaimed under specific conditions, making the list a valuable tool for financial recovery.

How to use the Clayton County Excess Funds List

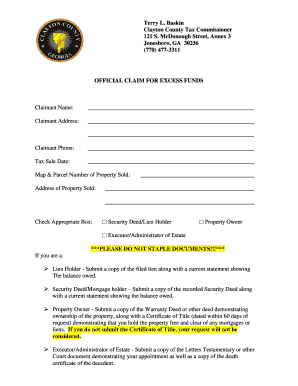

Utilizing the Clayton County Excess Funds List involves several steps to ensure that you can effectively claim any funds owed to you. First, review the list to identify your name or property address, confirming that you are eligible for a claim. Next, gather any necessary documentation, such as proof of ownership or identification, to support your claim. Finally, follow the prescribed procedures for filing your claim with the appropriate county office, ensuring that all forms are completed accurately and submitted on time.

How to obtain the Clayton County Excess Funds List

The Clayton County Excess Funds List can be obtained through the Clayton County government’s official website or by visiting the county office directly. It is often available in a downloadable format, allowing for easy access and review. Additionally, individuals may inquire about the list by contacting the county tax office, where staff can provide guidance on accessing the information and any related processes.

Steps to complete the Clayton County Excess Funds List

Completing the Clayton County Excess Funds List involves a series of methodical steps. Begin by carefully reading through the list to determine if you qualify for any excess funds. Once identified, gather all required documentation, such as identification and proof of ownership. Fill out the necessary claim forms accurately, ensuring that all information matches your documentation. After completing the forms, submit them to the designated county office either in person or via mail, following any specific submission guidelines provided by the county.

Legal use of the Clayton County Excess Funds List

The Clayton County Excess Funds List is legally recognized as a valid resource for claiming surplus funds from tax sales. To ensure compliance with local laws, it is important to follow the established procedures for claiming these funds. This includes adhering to any deadlines and providing accurate documentation. Misrepresentation or failure to comply with the legal requirements can lead to rejection of the claim, making it essential for claimants to understand their rights and responsibilities when using the list.

Key elements of the Clayton County Excess Funds List

Key elements of the Clayton County Excess Funds List include the names of individuals or entities eligible for excess funds, the property addresses associated with those funds, and the amounts available for claim. Additionally, the list may include important dates related to the tax sale and deadlines for filing claims. Understanding these elements is crucial for anyone looking to navigate the claims process effectively and ensure they receive any funds owed to them.

Quick guide on how to complete clayton county excess funds list

Complete Clayton County Excess Funds List smoothly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Clayton County Excess Funds List on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

The easiest way to modify and eSign Clayton County Excess Funds List effortlessly

- Obtain Clayton County Excess Funds List and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Clayton County Excess Funds List and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clayton county excess funds list

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clayton County excess funds list?

The Clayton County excess funds list refers to the available funds that remain after a property foreclosure in Clayton County. These funds can be claimed by the original property owners or their heirs. Understanding this list helps individuals make informed decisions regarding their financial recovery.

-

How can I access the Clayton County excess funds list?

You can access the Clayton County excess funds list through the official Clayton County website or contact the county's finance department. They provide up-to-date information regarding available funds. This list is crucial for individuals looking to reclaim their excess funds after a foreclosure.

-

Does airSlate SignNow help with processing claims from the Clayton County excess funds list?

Yes, airSlate SignNow can streamline the process of submitting claims related to the Clayton County excess funds list. Using our eSigning features, you can easily prepare and send documentation for claims. This simplifies communication with county authorities and accelerates the claim process.

-

What features does airSlate SignNow offer for managing documents regarding the Clayton County excess funds list?

airSlate SignNow offers a variety of features such as template creation, eSigning, and document sharing. These tools are designed to help you effectively manage documents needed for claims on the Clayton County excess funds list. Additionally, you'll benefit from secure storage and easy access to your important documents.

-

Is airSlate SignNow cost-effective for accessing the Clayton County excess funds list?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses looking to access the Clayton County excess funds list. Our pricing plans are designed to fit different budgets. You get robust features that enhance your ability to handle documents efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for better handling of the Clayton County excess funds list?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms. This allows you to create a more efficient workflow when dealing with documents related to the Clayton County excess funds list, ensuring all your tools work together harmoniously.

-

What are the benefits of using airSlate SignNow for claims on the Clayton County excess funds list?

Using airSlate SignNow enhances your ability to manage claims on the Clayton County excess funds list with ease. You benefit from quick eSigning, document tracking, and a user-friendly interface. This promotes faster processing times and reduces the hassle often associated with traditional paperwork.

Get more for Clayton County Excess Funds List

- Doh 3688 form

- 10 sin ming drive singapore 575701 tel 1800 call form

- Motor vehicle administration 6601 ritchie highway form

- Form 701 6 application for oklahoma certificate of title for a vehicle trailer or manufactured home

- Sf 0395 dec 18 form

- Reg 227 application for replacement or transfer of title index ready this form is used in a variety of situations such as but

- Register haji muis online form

- Medibm form central provident fund board mediate

Find out other Clayton County Excess Funds List

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document