Tn Form Inh 300

What is the Tn Form Inh 300

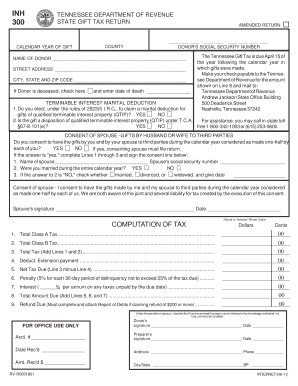

The Tn Form Inh 300 is a specific document utilized in the state of Tennessee, primarily for tax purposes. This form is essential for individuals and businesses to report certain financial information to the state. It plays a crucial role in ensuring compliance with state tax regulations and is often required during tax filing periods. Understanding the purpose and requirements of this form is vital for accurate reporting and avoiding potential penalties.

How to obtain the Tn Form Inh 300

To obtain the Tn Form Inh 300, individuals can visit the official Tennessee Department of Revenue website. The form is typically available for download in a PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or government buildings. Ensuring that you have the most current version of the form is important, as tax regulations may change.

Steps to complete the Tn Form Inh 300

Completing the Tn Form Inh 300 involves several important steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Fill in the required personal information, such as your name, address, and Social Security number.

- Report your income and any deductions or credits applicable to your situation.

- Review the completed form for accuracy to avoid errors that could lead to delays or penalties.

- Sign and date the form before submission.

Legal use of the Tn Form Inh 300

The legal use of the Tn Form Inh 300 is governed by Tennessee state tax laws. It is essential for ensuring that individuals and businesses report their income accurately and comply with state regulations. Failure to use this form correctly can result in penalties, including fines or additional taxes owed. Understanding the legal implications of this form is crucial for maintaining compliance and protecting oneself from potential legal issues.

Form Submission Methods

The Tn Form Inh 300 can be submitted through various methods, ensuring convenience for users. The available submission methods include:

- Online submission through the Tennessee Department of Revenue's e-filing system.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices for those who prefer face-to-face assistance.

Penalties for Non-Compliance

Non-compliance with the requirements of the Tn Form Inh 300 can lead to significant penalties. These may include:

- Fines imposed by the state for late or inaccurate submissions.

- Interest charges on any unpaid taxes resulting from incorrect reporting.

- Potential legal action for severe cases of tax evasion or fraud.

Being aware of these penalties emphasizes the importance of completing and submitting the form accurately and on time.

Quick guide on how to complete tn form inh 300

Complete Tn Form Inh 300 with ease on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Tn Form Inh 300 across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to edit and eSign Tn Form Inh 300 effortlessly

- Obtain Tn Form Inh 300 and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Tn Form Inh 300 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn form inh 300

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tn Form Inh 300 and how do I use it?

The Tn Form Inh 300 is a document used in Tennessee for tax reporting purposes. To use it effectively, you can upload it to airSlate SignNow, where you can easily eSign, edit, and share the form with relevant parties, streamlining your workflow.

-

How does airSlate SignNow simplify the Tn Form Inh 300 signing process?

airSlate SignNow simplifies the signing process for the Tn Form Inh 300 by providing an intuitive interface where users can easily add signatures, initial fields, and other necessary information. You can access the document from anywhere and on any device, allowing for quick completions and submissions.

-

What are the pricing options for using airSlate SignNow with the Tn Form Inh 300?

airSlate SignNow offers various pricing plans to suit different business needs, including options for individuals and teams. You can leverage these affordable plans to manage your Tn Form Inh 300 documents efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other applications when handling the Tn Form Inh 300?

Yes, airSlate SignNow offers seamless integrations with many popular applications like Google Drive, Dropbox, and Salesforce. This allows you to manage and store your Tn Form Inh 300 alongside other important documents in one convenient place.

-

What are the benefits of using airSlate SignNow for the Tn Form Inh 300?

Using airSlate SignNow for the Tn Form Inh 300 provides several benefits including enhanced security, ease of use, and improved document management. You can quickly eSign the form, track its status, and ensure it is securely stored for future reference.

-

Is airSlate SignNow secure for managing the Tn Form Inh 300?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your documents, including the Tn Form Inh 300. With features like two-factor authentication and secure cloud storage, your information remains safe and confidential.

-

Can I access the Tn Form Inh 300 on multiple devices with airSlate SignNow?

Yes, airSlate SignNow is accessible on multiple devices, including desktops, tablets, and smartphones. This flexibility allows you to work on the Tn Form Inh 300 from anywhere, making it easy to eSign and send the document on the go.

Get more for Tn Form Inh 300

- Metro wholesale price list pdf form

- Vra packet for tobyhanna army depot form

- Bank al habib survey form

- Yazoo kees parts lookup form

- Aviso de audiencia para renovar judicial council forms

- Pld pi 001 complaintpersonal injury propertydamage wrongful death form

- Articles of incorporation idaho secretary of state form

- Employment application california lnss birthday goventura form

Find out other Tn Form Inh 300

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later