Life Insurance Application Form

What is the life insurance application?

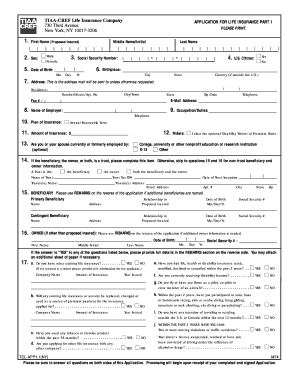

The life insurance application is a formal document that individuals complete to apply for life insurance coverage. This application gathers essential information about the applicant's health, lifestyle, and financial situation. It serves as the basis for the insurance company to assess risk and determine eligibility for coverage. The application typically includes personal details such as age, occupation, and medical history, which are crucial for underwriting decisions.

Steps to complete the life insurance application

Completing the life insurance application involves several key steps to ensure accuracy and compliance. First, gather necessary documents, including identification and health records. Next, fill out the application form with precise information, paying close attention to health questions. Afterward, review the application thoroughly for any errors or omissions. Once satisfied, submit the application electronically or via mail, depending on the insurance provider's requirements. Lastly, keep a copy of the submitted application for your records.

Legal use of the life insurance application

The legal use of a life insurance application is governed by various regulations that ensure the document's validity. To be legally binding, the application must be signed by the applicant, and in some cases, witnessed. Additionally, the application process must comply with state laws regarding insurance contracts. Ensuring that the application is filled out truthfully is crucial, as any misrepresentation can lead to denial of claims or cancellation of the policy.

Key elements of the life insurance application

Several key elements are essential in a life insurance application. These include personal information, such as the applicant's name, date of birth, and contact details. Health-related questions are also critical, covering medical history, current medications, and lifestyle choices like smoking or alcohol use. Financial information may be requested to assess the applicant's needs and determine coverage amounts. Lastly, the application will typically require the applicant's signature to validate the information provided.

How to obtain the life insurance application

The life insurance application can be obtained through various channels. Most insurance companies provide the application on their official websites, allowing applicants to download or fill it out online. Additionally, individuals can request a paper application by contacting the insurance provider directly or visiting a local agent's office. It is advisable to review multiple insurers to compare coverage options and application processes before proceeding.

Form submission methods

Submitting the life insurance application can be done through several methods. Applicants can choose to submit their forms online, which is often the quickest and most efficient option. Alternatively, applications can be mailed to the insurance company, ensuring that all necessary documents are included. Some applicants may prefer to submit their applications in person at a local insurance office, allowing for immediate assistance and clarification of any questions.

Quick guide on how to complete life insurance application

Easily Prepare Life Insurance Application on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly, without delays. Manage Life Insurance Application on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Most Efficient Way to Modify and Electronically Sign Life Insurance Application Effortlessly

- Find Life Insurance Application and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it onto your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Life Insurance Application to guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is TIAA CREF life insurance?

TIAA CREF life insurance is a type of coverage offered by TIAA, designed to provide financial security for your loved ones in the event of your passing. It includes various options such as term and whole life insurance, tailored to meet different needs and budgets. With TIAA CREF life insurance, you can ensure peace of mind knowing that your family is financially protected.

-

What are the benefits of TIAA CREF life insurance?

One of the key benefits of TIAA CREF life insurance is the ability to customize your policy to your specific needs. It offers tax advantages, the potential for cash value accumulation, and different riders to enhance your coverage. This flexible approach enables you to choose the right level of protection for your individual circumstances.

-

How does TIAA CREF life insurance pricing work?

The pricing of TIAA CREF life insurance varies based on several factors, including your age, health status, and the type of policy you select. Generally, term life insurance offers lower premiums compared to whole life insurance. By evaluating your specific needs, you can find a policy that fits your budget while providing adequate coverage.

-

What types of TIAA CREF life insurance are available?

TIAA CREF offers several types of life insurance, including term life, whole life, and universal life insurance. Each type caters to different financial goals and levels of commitment. Understanding these options helps you make an informed decision about the best policy for your needs.

-

Can I integrate TIAA CREF life insurance with other financial products?

Yes, TIAA CREF life insurance can be integrated with a variety of financial products, such as retirement accounts and investment plans. This integration allows for a comprehensive financial strategy that provides both life insurance coverage and long-term savings. By working with a financial advisor, you can align your TIAA CREF life insurance with your overall financial goals.

-

How do I apply for TIAA CREF life insurance?

Applying for TIAA CREF life insurance is a straightforward process that can often be completed online. You'll need to provide personal information, answer health-related questions, and select the type of policy that suits your needs. Once your application is submitted, TIAA will review it and provide you with the next steps.

-

What factors affect the approval of TIAA CREF life insurance?

Approval for TIAA CREF life insurance typically depends on factors such as your age, health history, lifestyle choices, and the type of coverage requested. A thorough health assessment may be required, which could include a medical exam. Being transparent about your health conditions is crucial for a smooth application process.

Get more for Life Insurance Application

- Bentigte informationen von allen passagieren auf flgen in die usa

- Mayo clinic release of information form

- Motion to set aside an ex parte order form

- Local xxiv pdf form

- Immunization forms order request

- Initial license application for family care homes form

- Sh7005pago del impuesto cedular a los ingresos por form

- Authorization to release information on financial aid

Find out other Life Insurance Application

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free