Mi 1040x Form

What is the Mi 1040x

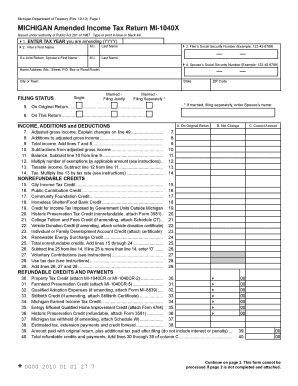

The Mi 1040x form, officially known as the Michigan Individual Income Tax Amended Return, is used by taxpayers in Michigan to amend their previously filed state income tax returns. This form allows individuals to correct errors, claim additional deductions, or report any changes in income that may affect their tax liability. It is essential for ensuring that your tax records are accurate and up to date, which can help avoid potential penalties or issues with the state tax authority.

How to use the Mi 1040x

Using the Mi 1040x involves a few straightforward steps. First, gather all necessary documentation related to your original return, including W-2s, 1099s, and any other relevant financial information. Next, fill out the Mi 1040x form accurately, ensuring that you indicate the changes made and the reasons for these amendments. After completing the form, review it carefully for any errors before submitting it to the Michigan Department of Treasury. It is advisable to keep copies of all documents for your records.

Steps to complete the Mi 1040x

Completing the Mi 1040x requires careful attention to detail. Follow these steps:

- Obtain the Mi 1040x form from the Michigan Department of Treasury website or through authorized tax preparation services.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Provide details of the original return and the changes being made, including any additional income or deductions.

- Calculate your new tax liability based on the amended information.

- Sign and date the form, certifying that the information provided is accurate.

Legal use of the Mi 1040x

The Mi 1040x is legally valid when completed and submitted in accordance with Michigan tax laws. It must be signed by the taxpayer, and any changes made should be well-documented to support the amendments. The form must be filed within the specified time limits set by the Michigan Department of Treasury to ensure compliance. Failure to adhere to these regulations may result in penalties or denial of the amended return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Mi 1040x to avoid penalties. Generally, amended returns must be filed within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later. Keeping track of these dates ensures that you remain compliant with state tax regulations and can correct any errors in a timely manner.

Form Submission Methods

The Mi 1040x can be submitted in several ways. Taxpayers have the option to file the amended return electronically through approved tax software or print the completed form and mail it to the Michigan Department of Treasury. In-person submissions may also be possible at designated tax offices. Each method has its own processing times, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete mi 1040x

Complete Mi 1040x effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage Mi 1040x on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Mi 1040x with ease

- Find Mi 1040x and select Get Form to begin.

- Utilize the resources we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Alter and eSign Mi 1040x and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 1040X form and who needs to file it?

The MI 1040X is an amended individual income tax return used by Michigan residents to correct errors on their original MI 1040 tax forms. If you've made changes to your income, deductions, or credits after filing your first return, you may need to submit the MI 1040X to ensure your tax information is accurate.

-

How do I complete the MI 1040X form?

To complete the MI 1040X form, you'll need to gather your original MI 1040 and any relevant documents reflecting the changes you're making. Follow the instructions provided on the MI 1040X form to ensure you're correctly reporting your adjustments, and don’t forget to provide an explanation for each change.

-

Can I eSign the MI 1040X with airSlate SignNow?

Yes, you can use airSlate SignNow to eSign your MI 1040X form quickly and securely. Our platform provides an easy-to-use interface for adding signatures electronically, streamlining the submission process and ensuring your amendments are filed without delay.

-

What features does airSlate SignNow offer for filing the MI 1040X?

airSlate SignNow offers a range of features ideal for filing your MI 1040X, including customizable templates, secure cloud storage, and real-time collaboration tools. These features help facilitate the completion and signing process, ensuring you can efficiently manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for my MI 1040X?

airSlate SignNow provides cost-effective pricing plans that cater to individual users and businesses alike. You can choose a plan that best fits your needs for filing the MI 1040X while ensuring you have access to all necessary features to simplify the process.

-

What are the benefits of using airSlate SignNow for tax documents like the MI 1040X?

Using airSlate SignNow for tax documents like the MI 1040X simplifies the filing process, reduces the risk of errors, and enhances compliance. The platform ensures your documents are securely stored and easily accessible, making it easier to keep track of your amendments.

-

Does airSlate SignNow integrate with tax software for filing the MI 1040X?

Yes, airSlate SignNow offers integrations with popular tax software programs, making it easier to incorporate your MI 1040X filings into your overall tax management workflow. This connectivity helps streamline the process from preparation to signing and submission.

Get more for Mi 1040x

- Guided reading activity economic systems lesson 1 answer key form

- 6b6 subcontractor waiver and partial release of lien upon progress payment conditional form

- Medex eyeglass reimbursement form

- Iuoe pipeline agreement form

- Release of information searchdisclosure nd

- In the xxx judicial district kansas judicial council kansasjudicialcouncil form

- Cc dc cr 072a petition for expungement of records form

Find out other Mi 1040x

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile