Fidelity Solo 401k Contribution Form

What is the Fidelity Solo 401k Contribution Form

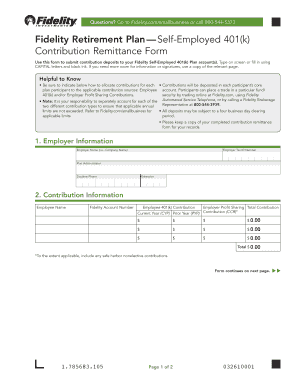

The Fidelity Solo 401k Contribution Form is a crucial document for self-employed individuals or business owners who wish to contribute to their retirement savings through a Solo 401k plan. This form allows participants to specify their contribution amounts, which can include both employee salary deferrals and employer profit-sharing contributions. The form is designed to comply with IRS regulations, ensuring that contributions are made within the legal limits set for retirement accounts.

How to use the Fidelity Solo 401k Contribution Form

Using the Fidelity Solo 401k Contribution Form involves several straightforward steps. First, gather all necessary financial information, including your income and previous contributions. Next, accurately fill out the form with your desired contribution amounts. It is essential to ensure that the contributions do not exceed the annual limits established by the IRS. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Fidelity Solo 401k Contribution Form

Completing the Fidelity Solo 401k Contribution Form requires careful attention to detail. Follow these steps:

- Download the form from the Fidelity website or access it through your account.

- Input your personal details, including your name, address, and Social Security number.

- Specify the contribution amounts for both employee and employer contributions.

- Review the form for accuracy, ensuring compliance with IRS contribution limits.

- Sign and date the form to validate your submission.

Legal use of the Fidelity Solo 401k Contribution Form

The legal use of the Fidelity Solo 401k Contribution Form is governed by IRS regulations. To ensure that your contributions are valid, it is important to adhere to the contribution limits and guidelines set forth by the IRS. Additionally, using a trusted electronic signature solution, like signNow, can help ensure that your form is legally binding and compliant with eSignature laws, such as the ESIGN Act and UETA.

Key elements of the Fidelity Solo 401k Contribution Form

Several key elements are essential for the Fidelity Solo 401k Contribution Form to be complete and valid:

- Personal Information: Your full name, address, and Social Security number.

- Contribution Amounts: Detailed amounts for employee and employer contributions.

- Signature: Your signature is required to authenticate the form.

- Date: The date of submission must be included to establish the timeline of contributions.

Form Submission Methods (Online / Mail / In-Person)

The Fidelity Solo 401k Contribution Form can be submitted through various methods to accommodate user preferences. Options include:

- Online Submission: Many users prefer to submit the form electronically through their Fidelity account, which allows for quick processing.

- Mail: The form can be printed and mailed to the designated Fidelity address for processing.

- In-Person: Some users may choose to visit a Fidelity branch to submit the form directly.

Quick guide on how to complete fidelity solo 401k contribution form 40815199

Complete Fidelity Solo 401k Contribution Form effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fidelity Solo 401k Contribution Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Fidelity Solo 401k Contribution Form seamlessly

- Obtain Fidelity Solo 401k Contribution Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Fidelity Solo 401k Contribution Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity solo 401k contribution form 40815199

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k contribution form template?

A 401k contribution form template is a pre-designed document that employees use to allocate a portion of their salary towards retirement savings. This template helps streamline the process of setting up and managing employee contributions to their 401k plans. By using a standardized form, businesses can ensure compliance and reduce administrative errors.

-

How can I create a 401k contribution form template with airSlate SignNow?

Creating a 401k contribution form template with airSlate SignNow is simple and efficient. You can start by customizing one of our existing templates or create a new one from scratch using our user-friendly interface. Once your form is ready, you can easily share it with employees for electronic signatures.

-

What are the benefits of using a 401k contribution form template?

Using a 401k contribution form template offers numerous benefits including time-saving, accuracy, and ease of use. It simplifies the data entry process and minimizes the risk of errors typically associated with handwritten forms. Additionally, it ensures that all necessary information is captured correctly, helping businesses manage their retirement plans more effectively.

-

Is the 401k contribution form template customizable?

Yes, the 401k contribution form template is fully customizable within airSlate SignNow. You can modify fields, add your company's branding, and include specific instructions tailored to your employees' needs. This flexibility allows you to create a form that best fits your organization's requirements.

-

Are there any costs associated with the 401k contribution form template?

While airSlate SignNow offers a range of pricing plans, the use of the 401k contribution form template comes at no additional cost. Once you subscribe to one of our plans, you can access and utilize the template as part of your document management and eSigning solutions. This makes it a cost-effective choice for businesses.

-

Can the 401k contribution form template be integrated with other tools?

Absolutely! The 401k contribution form template from airSlate SignNow can be seamlessly integrated with various third-party applications like payroll software and HR management systems. This integration helps automate data transfer and enhances workflow efficiency within your organization.

-

How does airSlate SignNow ensure the security of my 401k contribution form template?

airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect your documents. Your 401k contribution form template is safeguarded through secure cloud storage and multi-factor authentication, ensuring that sensitive employee information remains confidential and secure.

Get more for Fidelity Solo 401k Contribution Form

Find out other Fidelity Solo 401k Contribution Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document