Employee Earnings Record Template Form

What is the Employee Earnings Record Template

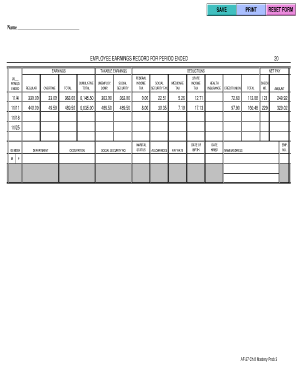

The employee earnings record template is a crucial document that outlines an employee's earnings over a specific period. This template typically includes details such as gross pay, deductions, and net pay, providing a comprehensive overview of an employee's financial compensation. It serves not only as a record for the employee but also as an essential tool for employers to maintain accurate payroll records. The template can be used for various purposes, including tax reporting and verifying income for loans or other financial applications.

How to use the Employee Earnings Record Template

Using the employee earnings record template involves several straightforward steps. First, gather all necessary information, such as the employee's name, Social Security number, and pay period dates. Next, input the gross earnings, including regular pay and any overtime or bonuses. After that, list any deductions, such as taxes, health insurance, and retirement contributions. Finally, calculate the net pay by subtracting the total deductions from the gross earnings. Ensure that the completed record is accurate and securely stored for future reference.

Steps to complete the Employee Earnings Record Template

Completing the employee earnings record template requires careful attention to detail. Follow these steps for accuracy:

- Gather employee information: Collect the employee's full name, Social Security number, and pay period details.

- Enter gross earnings: Include all forms of compensation, such as salary, overtime, and bonuses.

- List deductions: Document all deductions, including federal and state taxes, health benefits, and retirement contributions.

- Calculate net pay: Subtract total deductions from gross earnings to determine the net pay.

- Review for accuracy: Double-check all entries to ensure correctness before finalizing the document.

Legal use of the Employee Earnings Record Template

The legal use of the employee earnings record template is essential for both employers and employees. This document can serve as evidence of income during audits or legal proceedings. It is important to ensure that the template complies with federal and state regulations regarding payroll documentation. Additionally, maintaining accurate records can help protect against potential disputes related to wages and employment status. Employers should also be aware of any specific legal requirements that may apply in their state.

Key elements of the Employee Earnings Record Template

Several key elements should be included in the employee earnings record template to ensure it is comprehensive and useful:

- Employee details: Full name, Social Security number, and job title.

- Pay period: Start and end dates of the pay period covered by the record.

- Gross earnings: Total earnings before any deductions.

- Deductions: Detailed list of all deductions, including taxes and benefits.

- Net pay: Final amount received by the employee after deductions.

Examples of using the Employee Earnings Record Template

The employee earnings record template can be utilized in various scenarios. For instance, an employee may need to present this document when applying for a mortgage to verify income. Employers may also use it during tax season to prepare W-2 forms accurately. Additionally, it can serve as a reference during performance reviews or salary negotiations, providing a clear picture of an employee's compensation history.

Quick guide on how to complete employee earnings record template

Complete Employee Earnings Record Template seamlessly on any device

Managing documents online has become increasingly prevalent among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Employee Earnings Record Template on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Employee Earnings Record Template with ease

- Locate Employee Earnings Record Template and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers exclusively for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Employee Earnings Record Template and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee earnings record template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an employee earnings record?

An employee earnings record is a summary of an employee's earnings for a specific period, including wages, bonuses, and deductions. This document is crucial for both employees and employers for tax reporting and financial management. With airSlate SignNow, you can easily create and manage these records digitally.

-

How does airSlate SignNow help with employee earnings records?

airSlate SignNow allows businesses to generate, send, and eSign employee earnings records seamlessly. The platform's intuitive interface makes it simple to compile and share these documents securely. Additionally, its eSigning feature ensures that all records are legally compliant and easy to manage.

-

Is there a cost associated with creating an employee earnings record using airSlate SignNow?

While airSlate SignNow offers various pricing plans, creating an employee earnings record can be done within these plans at no extra cost. Businesses can choose a plan that suits their needs and budget, making it a cost-effective solution for document management. Explore our pricing page for more details.

-

Can I integrate airSlate SignNow with other HR software for employee earnings records?

Yes, airSlate SignNow supports integrations with multiple HR and payroll systems, allowing for streamlined management of employee earnings records. This integration helps automate the process of generating these records, saving time and reducing errors. Review our integrations page for more information.

-

What are the security features of airSlate SignNow when handling employee earnings records?

airSlate SignNow prioritizes security, implementing encryption and secure authentication methods to protect sensitive employee earnings records. Users can control document access and track changes, ensuring compliance with data protection regulations. Trust in our security measures for your business documents.

-

Can employees access their own earnings records through airSlate SignNow?

Yes, employees can access their own earnings records through airSlate SignNow. The platform allows for easy sharing and permissions management, enabling employees to review their records anytime. This transparency fosters trust and keeps everyone informed about their earnings.

-

What are the advantages of digital employee earnings records over paper ones?

Digital employee earnings records offer numerous advantages, such as enhanced accessibility, reduced risk of loss, and the ability to edit and update records easily. Using airSlate SignNow, businesses can streamline their processes and promote eco-friendly practices by reducing paper usage. These benefits contribute to more efficient financial management.

Get more for Employee Earnings Record Template

Find out other Employee Earnings Record Template

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement