Michigan Form 5082

Understanding the Michigan Form 2271

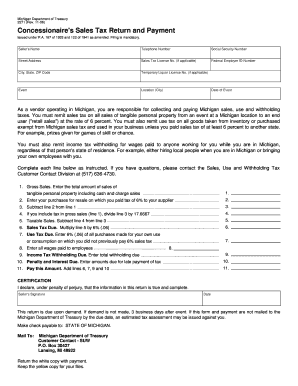

The Michigan Form 2271 is specifically designed for reporting sales tax for concessionaires. This form is essential for businesses that provide goods or services at events, fairs, or other public gatherings. It allows these businesses to report their sales and remit the appropriate sales tax to the state of Michigan. Understanding the purpose and requirements of this form is crucial for compliance and to avoid potential penalties.

Steps to Complete the Michigan Form 2271

Completing the Michigan Form 2271 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. This includes total sales figures and any exemptions that may apply. Next, fill out the form by entering your business information, including your sales tax identification number. Then, calculate the total sales tax owed based on your reported sales. Finally, review the form for accuracy before submitting it to the appropriate state agency.

Legal Use of the Michigan Form 2271

The legal use of the Michigan Form 2271 is governed by state tax laws. It is important to ensure that the form is completed accurately and submitted on time to maintain compliance. Failure to do so could result in penalties or interest charges. The form must be signed and dated by the responsible party, affirming the accuracy of the information provided. Utilizing a reliable eSignature platform can enhance the legal validity of the submission.

Filing Deadlines for the Michigan Form 2271

Filing deadlines for the Michigan Form 2271 are critical to avoid late fees or penalties. Typically, the form must be submitted within a specific time frame following the end of the reporting period. It is advisable to check the Michigan Department of Treasury's guidelines for the exact dates applicable to your business. Staying informed about these deadlines can help ensure timely compliance.

Form Submission Methods for the Michigan Form 2271

The Michigan Form 2271 can be submitted through various methods, including online submission, by mail, or in-person delivery to the appropriate state office. Utilizing online submission can expedite the process and provide immediate confirmation of receipt. When submitting by mail, it is recommended to use certified mail to ensure that the form is received by the deadline. Understanding these options can help streamline your filing process.

Key Elements of the Michigan Form 2271

Key elements of the Michigan Form 2271 include sections for reporting total sales, calculating sales tax owed, and providing business identification information. Each section must be filled out accurately to ensure proper processing. Additionally, the form may require information about any exemptions claimed, which should be documented thoroughly. Familiarity with these elements can facilitate a smoother completion process.

Penalties for Non-Compliance with the Michigan Form 2271

Non-compliance with the Michigan Form 2271 can lead to significant penalties, including fines and interest on unpaid taxes. The state of Michigan takes sales tax reporting seriously, and failure to file or pay on time can result in increased scrutiny and potential audits. It is essential for businesses to understand these risks and take proactive measures to ensure compliance with all filing requirements.

Quick guide on how to complete michigan form 5082

Complete Michigan Form 5082 effortlessly on any device

Online document administration has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Form 5082 on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-based procedure today.

The easiest method to modify and electronically sign Michigan Form 5082 effortlessly

- Find Michigan Form 5082 and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiring form searches, or mistakes requiring new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Michigan Form 5082 and ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 5082

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan form 2271 for 2019 and why do I need it?

The Michigan form 2271 for 2019 is a crucial document used for filing certain tax-related information with the state. It is important to complete this form accurately to ensure compliance and avoid potential penalties. Understanding its purpose can streamline your filing process and save you time.

-

How can airSlate SignNow help me with Michigan form 2271 for 2019?

airSlate SignNow provides a user-friendly platform that simplifies the signing and sending of documents like the Michigan form 2271 for 2019. With its intuitive interface, you can easily prepare and eSign your form, ensuring that you meet your filing deadlines efficiently.

-

Is there a cost associated with using airSlate SignNow for Michigan form 2271 for 2019?

Yes, there is a subscription fee associated with using airSlate SignNow, but it is competitively priced and offers great value for businesses needing to manage documents. The cost can often be offset by the time saved in handling important documents like the Michigan form 2271 for 2019.

-

Can I integrate airSlate SignNow with my existing applications for filing Michigan form 2271 for 2019?

Absolutely! airSlate SignNow offers integrations with various applications you might already be using, making it seamless to handle your documentation, including the Michigan form 2271 for 2019. This helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer for signing Michigan form 2271 for 2019?

airSlate SignNow offers a range of features that are perfect for signing documents like the Michigan form 2271 for 2019, including customizable templates, real-time tracking, and secure cloud storage. These tools enhance the signing experience and ensure your documents are protected.

-

Is my data secure when using airSlate SignNow for Michigan form 2271 for 2019?

Yes, airSlate SignNow takes data security seriously, employing advanced encryption and security protocols to protect your information. When you use airSlate SignNow to handle the Michigan form 2271 for 2019, you can have peace of mind knowing your documents are safeguarded.

-

How do I get started with airSlate SignNow for Michigan form 2271 for 2019?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you’ll have access to a host of features to manage your documents, including the Michigan form 2271 for 2019. Our support team is also available to assist you through the setup process.

Get more for Michigan Form 5082

- Firma ad form

- Wv 2848 west virginia state tax department authorization of form

- Cibc direct deposit form

- Hl restructuring application form

- Cara mengisi formulir kartu kredit bni

- Credit card standing instruction si form rbl bank

- 23 24 parking pass regulations and signature agreement form

- Appleton parking ticket form

Find out other Michigan Form 5082

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation