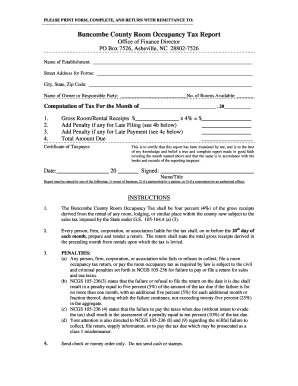

Buncombe County Room Occupancy Tax Report Buncombecounty Form

Understanding the Buncombe County Room Occupancy Tax Report

The Buncombe County Room Occupancy Tax Report is a crucial document for businesses operating in the hospitality sector. It is designed to collect taxes from short-term rentals and accommodations, ensuring compliance with local tax regulations. This report typically includes details about the rental income generated and the applicable tax rates. Understanding this form is essential for accurate reporting and avoiding penalties.

Steps to Complete the Buncombe County Room Occupancy Tax Report

Completing the Buncombe County Room Occupancy Tax Report involves several key steps to ensure accuracy and compliance. Start by gathering all relevant financial records, including rental income and occupancy rates. Next, fill out the report with the required information, ensuring that all figures are accurate. After completing the form, review it for any errors before submission. Finally, submit the report by the designated deadline to avoid any late fees or penalties.

Legal Use of the Buncombe County Room Occupancy Tax Report

The Buncombe County Room Occupancy Tax Report serves as a legal document that must be filled out accurately to comply with local tax laws. It is essential for businesses to understand the legal implications of this report, as inaccuracies can lead to audits and potential fines. By adhering to the guidelines set forth by the local government, businesses can ensure their operations remain compliant and avoid any legal issues.

Required Documents for the Buncombe County Room Occupancy Tax Report

To successfully complete the Buncombe County Room Occupancy Tax Report, certain documents are necessary. These typically include financial statements that detail rental income, occupancy rates, and any other relevant financial data. Additionally, businesses may need to provide proof of their business license and any other permits related to short-term rentals. Having these documents ready will facilitate a smoother reporting process.

Filing Deadlines for the Buncombe County Room Occupancy Tax Report

Filing deadlines for the Buncombe County Room Occupancy Tax Report are critical to ensure compliance and avoid penalties. Generally, reports must be submitted quarterly, with specific due dates outlined by the local tax authority. It is essential for businesses to mark these dates on their calendars and prepare their reports in advance to meet the deadlines consistently.

Penalties for Non-Compliance with the Buncombe County Room Occupancy Tax Report

Failure to comply with the requirements of the Buncombe County Room Occupancy Tax Report can result in significant penalties. These may include fines based on the amount of tax owed, interest on late payments, and potential legal action for repeated non-compliance. Understanding these consequences can motivate businesses to prioritize timely and accurate reporting.

Quick guide on how to complete buncombe county room occupancy tax report buncombecounty

Effortlessly Prepare Buncombe County Room Occupancy Tax Report Buncombecounty on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Buncombe County Room Occupancy Tax Report Buncombecounty on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Buncombe County Room Occupancy Tax Report Buncombecounty with Ease

- Obtain Buncombe County Room Occupancy Tax Report Buncombecounty and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Buncombe County Room Occupancy Tax Report Buncombecounty to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the buncombe county room occupancy tax report buncombecounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is billpay umd and how does it work?

Billpay umd is a streamlined digital payment solution that allows users to manage and process bills efficiently. With airSlate SignNow, you can easily send, receive, and eSign documents related to bill payments. It simplifies the payment process, ensuring that all transactions are secure and well-documented.

-

What features does airSlate SignNow offer for billpay umd?

airSlate SignNow offers several features tailored for billpay umd, including customizable templates, secure eSignatures, and automated workflows. These tools help users streamline their billing processes and reduce errors, enhancing overall efficiency. Additionally, the platform provides real-time tracking and notifications for document status.

-

How much does the billpay umd service cost?

The pricing for billpay umd varies based on the chosen subscription plan of airSlate SignNow. Plans often include a range of features suitable for different business sizes and needs, allowing users to select one that meets their budget. It's recommended to explore the specific pricing details on the airSlate SignNow website for the latest offers.

-

Is billpay umd secure for processing payments?

Yes, billpay umd is designed with security in mind. airSlate SignNow employs advanced encryption and data protection measures to ensure that all payment information is safe and confidential. Users can trust that their sensitive financial data is handled with the highest level of security.

-

Can I integrate billpay umd with my existing software?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing users to incorporate billpay umd into their existing workflows seamlessly. This includes compatibility with accounting software, CRM systems, and other productivity tools to enhance efficiency.

-

What benefits can I expect from using billpay umd?

Using billpay umd can signNowly improve your billing process by reducing administrative burdens and enhancing accuracy. The convenience of electronic signatures and document tracking ensures a quicker turnaround, leading to better cash flow management. Overall, it empowers businesses to focus more on their core operations.

-

Is there customer support available for billpay umd users?

Yes, airSlate SignNow provides robust customer support for billpay umd users. You can access various resources including live chat, email support, and an extensive knowledge base. This ensures that you have the assistance you need to utilize the service effectively.

Get more for Buncombe County Room Occupancy Tax Report Buncombecounty

- Charter township of caledonia mechanical permit caledoniatownship form

- Adult foster care license limited state of michigan michigan form

- Homeowner contractor form

- Gift letter fha form

- Provider information update form

- Bratenahl police department application form

- Medical doctor wilkes honors college form

- Instructions for employment eligibility verification department of homeland security u form

Find out other Buncombe County Room Occupancy Tax Report Buncombecounty

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy