Rule 114B and Form 60 Filing for Income Tax IndiaFilings

Understanding Rule 114B and Form 60 for Income Tax

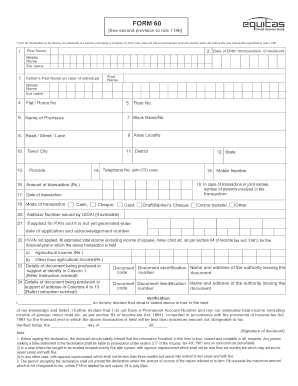

Rule 114B and Form 60 play a crucial role in the income tax framework in India, particularly for individuals who do not have a Permanent Account Number (PAN). This rule mandates that certain transactions must be reported to the tax authorities, ensuring transparency and compliance. Form 60 serves as a declaration for individuals to provide their personal details and confirm their identity when engaging in specified financial activities without a PAN. This helps the government track income and prevent tax evasion.

Steps to Complete Rule 114B and Form 60

Completing Rule 114B and Form 60 involves several straightforward steps:

- Gather necessary personal information, including your name, address, and contact details.

- Identify the specific financial transaction that requires the submission of Form 60.

- Fill out Form 60 accurately, ensuring all fields are completed as per the guidelines.

- Submit the form to the relevant financial institution or authority as required.

It is essential to double-check the information provided to avoid any discrepancies that could lead to compliance issues.

Legal Use of Rule 114B and Form 60

The legal framework surrounding Rule 114B and Form 60 ensures that these documents are recognized by tax authorities in India. When properly filled and submitted, they serve as a valid declaration of identity for individuals without a PAN. This legal recognition helps facilitate various financial transactions, including opening bank accounts and making large purchases, while adhering to tax regulations. Compliance with this rule is vital for avoiding penalties associated with non-disclosure of income.

Required Documents for Form 60 Submission

When submitting Form 60, individuals must provide specific supporting documents to validate their identity. Commonly required documents include:

- A government-issued photo ID, such as a passport or driver's license.

- Proof of address, which can be a utility bill or rental agreement.

- Any additional documents as specified by the financial institution or authority.

Providing accurate documentation is essential for the acceptance of Form 60 and to ensure compliance with Rule 114B.

Filing Deadlines for Rule 114B and Form 60

Filing deadlines for Rule 114B and Form 60 can vary based on the nature of the financial transaction. It is important to be aware of these deadlines to avoid penalties. Generally, individuals should submit Form 60 at the time of the transaction or when requested by the financial institution. Keeping track of these deadlines helps ensure compliance with income tax regulations and prevents unnecessary complications.

Examples of Using Rule 114B and Form 60

Rule 114B and Form 60 are applicable in various scenarios, such as:

- Opening a bank account without a PAN.

- Purchasing high-value assets, like real estate or vehicles, where PAN is typically required.

- Engaging in financial transactions that exceed specified monetary limits.

These examples illustrate the practical application of Form 60 in everyday financial activities, ensuring compliance with tax regulations while facilitating essential transactions.

Quick guide on how to complete rule 114b and form 60 filing for income tax indiafilings

Complete Rule 114B And Form 60 Filing For Income Tax IndiaFilings effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Rule 114B And Form 60 Filing For Income Tax IndiaFilings on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Rule 114B And Form 60 Filing For Income Tax IndiaFilings without hassle

- Obtain Rule 114B And Form 60 Filing For Income Tax IndiaFilings and select Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign Rule 114B And Form 60 Filing For Income Tax IndiaFilings and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rule 114b and form 60 filing for income tax indiafilings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rule 114B and how does it relate to Form 60 filing for income tax?

Rule 114B outlines the circumstances under which individuals must provide their permanent account number (PAN) while filing tax-related documents. Form 60 is used when a PAN is not available, and understanding this rule is crucial for compliance with tax regulations in India. By utilizing 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings,' you can ensure proper filing and stay compliant.

-

What features does airSlate SignNow offer for Rule 114B and Form 60 filing?

airSlate SignNow offers an intuitive platform that allows users to efficiently prepare, sign, and manage documents like Form 60 required for income tax filings. With eSigning capabilities, document tracking, and template options, airSlate SignNow facilitates seamless 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings'.

-

Is there a cost associated with using airSlate SignNow for tax document filing?

Yes, airSlate SignNow provides various pricing plans designed to accommodate different needs, ensuring users can find an option that fits their budget. These plans are tailored to support 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings', making compliance affordable for all users.

-

How can airSlate SignNow simplify the process of filing Form 60?

airSlate SignNow simplifies the filing of Form 60 by allowing users to upload the form, fill it out electronically, and eSign it without the need for paper documentation. This digital process ensures faster compliance with the requirements of 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings' while reducing errors and increasing efficiency.

-

Can I integrate airSlate SignNow with other applications for tax filing?

Yes, airSlate SignNow offers integration capabilities with numerous applications, enhancing your tax filing process. For 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings', you can connect with accounting software and CRMs to streamline workflows and maintain organized records.

-

What are the benefits of using airSlate SignNow for compliance?

Using airSlate SignNow for compliance with 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings' provides several benefits, including improved accuracy, reduced paper use, and enhanced security. Users can also enjoy quick turnaround times while ensuring all necessary documents are properly completed and submitted.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to needs of businesses of various sizes, making it an effective tool for anyone needing to handle 'Rule 114B And Form 60 Filing For Income Tax IndiaFilings'. Whether you're a small business or a large corporation, airSlate SignNow can support your document management requirements.

Get more for Rule 114B And Form 60 Filing For Income Tax IndiaFilings

- Nj retired law enforcement officer firearms training record form

- 01 339 sales and use tax resale certificate texas state university gato docs its txstate form

- Employer south georgia medical center sgmc form

- Form 315

- Omnibus licence form

- Sv form

- Wound care orders example form

- Recruitment agency employment contract template form

Find out other Rule 114B And Form 60 Filing For Income Tax IndiaFilings

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation