EX75 Notice of Intention to Claim Drawback Use This Form to Tell Us of an Intention to Claim Drawback Hmrc Gov

Understanding the EX75 Notice of Intention to Claim Drawback

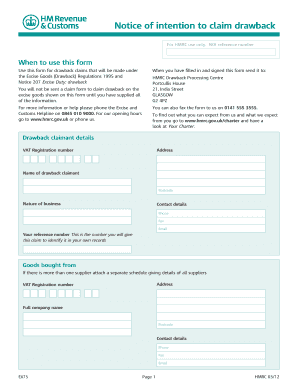

The EX75 Notice of Intention to Claim Drawback is a formal document used to notify relevant authorities of an intention to claim a drawback. This form is essential for individuals or entities seeking to recover duties paid on imported goods that are subsequently exported or destroyed. Understanding its purpose is crucial for compliance and to ensure that claims are processed efficiently.

Steps to Complete the EX75 Notice of Intention to Claim Drawback

Completing the EX75 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including details about the goods and the original duty paid.

- Fill out all required sections of the form, ensuring that all information is accurate and complete.

- Sign the form to validate your claim, as an unsigned form may be rejected.

- Submit the form according to the specified submission methods, which may include online, by mail, or in person.

Legal Use of the EX75 Notice of Intention to Claim Drawback

The EX75 form is legally binding when completed correctly. It is essential to adhere to all regulatory requirements to ensure that the claim is valid. This includes providing accurate information and following the guidelines set forth by the relevant authorities. Failure to comply with these legal standards may result in penalties or rejection of the claim.

Key Elements of the EX75 Notice of Intention to Claim Drawback

When filling out the EX75 form, certain key elements must be included:

- Claimant's name and contact information.

- Description of the goods involved in the drawback claim.

- Details of the original duty paid.

- Signature of the claimant or authorized representative.

Required Documents for the EX75 Notice of Intention to Claim Drawback

To support your claim, you may need to provide additional documentation along with the EX75 form. Commonly required documents include:

- Proof of payment of duties.

- Invoices related to the goods.

- Export documentation showing the goods were exported or destroyed.

Form Submission Methods for the EX75 Notice of Intention to Claim Drawback

The EX75 form can typically be submitted through various methods. These may include:

- Online submission through the designated government portal.

- Mailing the completed form to the appropriate office.

- In-person submission at specified locations.

Filing Deadlines for the EX75 Notice of Intention to Claim Drawback

It is important to be aware of filing deadlines associated with the EX75 form. Claims must be submitted within a specific timeframe following the export or destruction of the goods. Missing these deadlines can result in the inability to recover duties, so keeping track of dates is essential.

Quick guide on how to complete ex75 notice of intention to claim drawback use this form to tell us of an intention to claim drawback hmrc gov

Complete EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov with ease

- Locate EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov and then click Get Form to start.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow presents specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or errors requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex75 notice of intention to claim drawback use this form to tell us of an intention to claim drawback hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EX75 Notice Of Intention To Claim Drawback?

The EX75 Notice Of Intention To Claim Drawback is a form used to inform HMRC of your intention to claim a drawback on specific goods. This document is essential for businesses looking to recover duties paid on imported goods. Make sure to accurately fill out the EX75 to ensure a smooth claims process with HMRC.

-

How can airSlate SignNow help me with the EX75 form?

airSlate SignNow provides an easy-to-use platform for creating, signing, and managing your EX75 Notice Of Intention To Claim Drawback documents. You can quickly template this form and share it with relevant stakeholders for efficient processing. Our solution streamlines the entire workflow, making compliance with HMRC simpler.

-

Is there a cost associated with using airSlate SignNow for EX75 forms?

Yes, airSlate SignNow offers various pricing plans based on your business needs. We provide affordable options that allow unlimited eSigning and document tracking, which is perfect for managing the EX75 Notice Of Intention To Claim Drawback. Visit our pricing page for more details to choose the best plan for you.

-

What features does airSlate SignNow offer for the EX75 form?

AirSlate SignNow offers several features tailored for the EX75 Notice Of Intention To Claim Drawback, including customized templates, secure eSigning, and document storage. You can also track the status of your forms and receive notifications upon completion. These features enhance the efficiency and security of your transactions with HMRC.

-

How can I integrate airSlate SignNow with other systems for using the EX75 form?

airSlate SignNow easily integrates with various applications such as CRM systems, cloud storage, and project management tools. This allows for seamless document management when using the EX75 Notice Of Intention To Claim Drawback. Check our integration page for a complete list of compatible platforms.

-

What benefits does using airSlate SignNow provide for handling the EX75 form?

Using airSlate SignNow simplifies the process of managing the EX75 Notice Of Intention To Claim Drawback. Benefits include reduced paper usage, improved workflow efficiency, and greater compliance with HMRC regulations. Additionally, the platform enhances collaboration among team members involved in the claims process.

-

Can I access the EX75 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to access the EX75 Notice Of Intention To Claim Drawback from your smartphone or tablet. This flexibility ensures that you can manage your documents anytime and anywhere, keeping your business processes agile and efficient.

Get more for EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov

Find out other EX75 Notice Of Intention To Claim Drawback Use This Form To Tell Us Of An Intention To Claim Drawback Hmrc Gov

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document