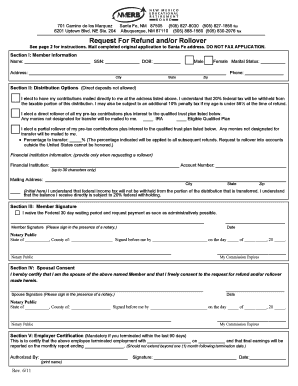

Nmerb Refund Form

What is the Nmerb Refund

The Nmerb refund refers to the process through which individuals can reclaim overpaid fees or taxes associated with their nursing education and licensing in the United States. This refund is specifically designed for candidates who have paid for examination or application fees that are no longer applicable due to various reasons, such as changes in eligibility or program requirements. Understanding the Nmerb refund is crucial for ensuring that individuals receive the financial relief they are entitled to, especially in the context of educational expenses.

How to Obtain the Nmerb Refund

To obtain the Nmerb refund, individuals must follow a structured process. First, they should gather all relevant documentation, including proof of payment and any correspondence related to their application or examination. Next, applicants need to fill out the appropriate Nmerb refund form, ensuring that all details are accurate and complete. Submitting the form can typically be done online, by mail, or in person, depending on the specific guidelines provided by the Nmerb. It is essential to keep a copy of the submitted form for personal records.

Steps to Complete the Nmerb Refund

Completing the Nmerb refund involves several key steps:

- Gather all necessary documentation, including receipts and identification.

- Access the official Nmerb refund form from the Nmerb website.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form through the designated method (online, mail, or in person).

- Keep a copy of the submitted form and any confirmation received for future reference.

Legal Use of the Nmerb Refund

The legal use of the Nmerb refund is governed by specific regulations that ensure the process is compliant with state and federal laws. It is important for applicants to understand that the refund must be claimed within a designated timeframe, and any misuse of the refund process can result in penalties. By adhering to the guidelines set forth by the Nmerb, individuals can ensure that their claims are processed legally and efficiently.

Key Elements of the Nmerb Refund

Several key elements are essential for a successful Nmerb refund application:

- Eligibility Criteria: Applicants must meet specific criteria to qualify for the refund.

- Required Documentation: Submission of appropriate documents is necessary to support the refund request.

- Submission Method: Understanding the correct method for submitting the refund form is crucial.

- Timeliness: Claims must be submitted within the stipulated deadlines to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Nmerb refund are critical to ensure that applicants do not miss their opportunity to reclaim funds. Typically, these deadlines are set annually and can vary based on the specific circumstances of the refund request. It is advisable for applicants to regularly check the Nmerb website or contact their office for the most current information regarding important dates related to the refund process.

Quick guide on how to complete nmerb refund

Complete Nmerb Refund effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Nmerb Refund on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and eSign Nmerb Refund without any hassle

- Obtain Nmerb Refund and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign Nmerb Refund and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nmerb refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are nmerb forms, and how can they benefit my business?

Nmerb forms are essential documents used for various administrative tasks. Utilizing airSlate SignNow to manage these forms can streamline your workflow, improve compliance, and reduce processing times. By digitizing nmerb forms, businesses can enhance efficiency and accuracy in their document handling.

-

How does airSlate SignNow integrate with nmerb forms?

airSlate SignNow allows users to easily upload and manage nmerb forms within its platform. By offering integrations with various applications, it ensures that your nmerb forms sync seamlessly with your existing workflows, maintaining data consistency and security across all systems.

-

What features does airSlate SignNow offer for managing nmerb forms?

AirSlate SignNow provides features like document templates, eSignature capabilities, and automated workflows specifically designed for nmerb forms. These tools not only simplify the signing process but also help track document status, making it easier for businesses to manage their paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for nmerb forms?

Yes, there is a cost associated with using airSlate SignNow, which is designed to be budget-friendly for all business sizes. Pricing plans vary based on features and usage, allowing companies to choose the right plan that fits their needs for managing nmerb forms effectively.

-

Can I customize my nmerb forms with airSlate SignNow?

Absolutely! airSlate SignNow offers customizable templates that allow you to modify your nmerb forms to suit your specific requirements. This flexibility ensures that your documents meet both regulatory standards and your business's branding needs.

-

How secure is airSlate SignNow when handling nmerb forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive nmerb forms. The platform employs advanced encryption and compliance measures to protect your data, ensuring that your documents remain confidential and secure throughout the signing process.

-

What types of businesses can benefit from airSlate SignNow's nmerb forms solution?

Businesses of any size and industry can benefit from airSlate SignNow's nmerb forms solution. Whether you're a small startup or a large enterprise, the ability to efficiently manage and eSign nmerb forms can improve your operational efficiency and client satisfaction.

Get more for Nmerb Refund

- Rental bond lodgement form pdf

- Dp3 shipment inconvenience claim form

- Laboratory safety quiz questions and answers pdf form

- Certification of notification of complementary dispute resolution form

- Form 3502 400046349

- Financing change statement reg 3323 service alberta servicealberta gov ab form

- Seizure health care plan doc form

- Unit 7 the lorax form

Find out other Nmerb Refund

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form