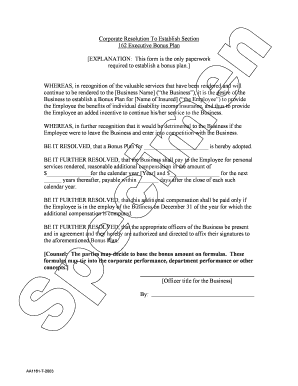

Corporate Resolution to Establish Section 162 Executive Bonus Plan Form

What is the Corporate Resolution to Establish Section 162 Executive Bonus Plan

The Corporate Resolution to Establish Section 162 Executive Bonus Plan is a formal document that outlines a company's decision to implement an executive bonus plan under Section 162 of the Internal Revenue Code. This plan allows businesses to provide tax-deductible bonuses to key executives, thereby incentivizing performance while also benefiting the company financially. The resolution serves as a record of the board's approval and outlines the terms and conditions of the bonus plan, ensuring compliance with applicable tax regulations.

Key Elements of the Corporate Resolution to Establish Section 162 Executive Bonus Plan

Several key elements must be included in the Corporate Resolution to ensure its effectiveness and compliance:

- Identification of the Company: Clearly state the name and legal structure of the business.

- Executive Details: List the executives eligible for the bonus plan, including their roles and responsibilities.

- Bonus Structure: Define the criteria for bonus eligibility, calculation methods, and payment schedules.

- Compliance Statement: Include a statement affirming adherence to Section 162 requirements and relevant IRS guidelines.

- Approval Signatures: Ensure that the resolution is signed by the appropriate corporate officers, typically the board of directors.

Steps to Complete the Corporate Resolution to Establish Section 162 Executive Bonus Plan

Completing the Corporate Resolution involves several important steps:

- Draft the Resolution: Create a draft that includes all required elements, ensuring clarity and precision.

- Review by Legal Counsel: Have the draft reviewed by legal counsel to ensure compliance with state and federal laws.

- Board Approval: Present the resolution to the board of directors for discussion and approval during a formal meeting.

- Document the Decision: Record the approval in the meeting minutes and ensure all board members sign the resolution.

- Distribute Copies: Provide copies of the signed resolution to all relevant parties, including the finance department and executives involved.

Legal Use of the Corporate Resolution to Establish Section 162 Executive Bonus Plan

The legal use of the Corporate Resolution is critical for ensuring that the bonus plan is recognized as valid by the IRS and other regulatory bodies. The resolution must comply with Section 162 requirements, which stipulate that the bonuses must be reasonable and tied to the performance of the executives. Proper documentation and adherence to the established criteria help protect the business from potential tax liabilities and audits.

Examples of Using the Corporate Resolution to Establish Section 162 Executive Bonus Plan

Practical examples of the Corporate Resolution can illustrate its application in real-world scenarios:

- Performance-Based Bonuses: A company may implement a resolution to award bonuses based on achieving specific revenue targets, thereby motivating executives to drive sales.

- Retention Bonuses: In competitive industries, a resolution may be created to offer retention bonuses to key executives to maintain talent during critical periods.

- Annual Review Bonuses: A resolution can outline a plan for annual bonuses based on overall company performance and individual contributions.

IRS Guidelines for Section 162 Executive Bonus Plans

The Internal Revenue Service provides specific guidelines regarding Section 162 Executive Bonus Plans, which must be followed to ensure compliance. Bonuses must be reasonable in amount and directly linked to the services rendered by the executives. Additionally, the company must maintain proper documentation to substantiate the business purpose of the bonuses and their connection to performance metrics. Failure to comply with these guidelines may result in disallowance of the tax deduction for the bonuses paid.

Quick guide on how to complete corporate resolution to establish section 162 executive bonus plan

Finish Corporate Resolution To Establish Section 162 Executive Bonus Plan seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Corporate Resolution To Establish Section 162 Executive Bonus Plan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign Corporate Resolution To Establish Section 162 Executive Bonus Plan effortlessly

- Find Corporate Resolution To Establish Section 162 Executive Bonus Plan and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign option, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Corporate Resolution To Establish Section 162 Executive Bonus Plan and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporate resolution to establish section 162 executive bonus plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an executive resolution example and how can it be used?

An executive resolution example is a formal document that outlines decisions made by executive officers within an organization. It is used to document resolutions related to business actions and to provide a clear record for stakeholders. Using airSlate SignNow, you can easily create and eSign an executive resolution example to streamline your decision-making process.

-

How can airSlate SignNow help in creating an executive resolution example?

airSlate SignNow offers templates that simplify the creation of an executive resolution example. With our user-friendly interface, you can customize the document according to your organization's needs and quickly get it signed electronically. This enhances efficiency and ensures compliance with company policies.

-

What are the pricing options for using airSlate SignNow for executive resolutions?

airSlate SignNow provides various pricing plans to suit different business needs, starting with affordable rates for individuals and small teams. The plans include features that allow for the creation and management of executive resolution examples among other document types. You can explore our pricing page to find the best fit for your organization.

-

What features does airSlate SignNow offer for executive resolution examples?

airSlate SignNow includes features such as customizable templates, document tracking, and secure electronic signatures, all of which enhance the creation of executive resolution examples. Additionally, our platform allows for collaboration between team members, ensuring that all necessary voices are heard in the resolution process.

-

What are the benefits of using an executive resolution example from airSlate SignNow?

Using an executive resolution example from airSlate SignNow helps ensure that your organization's decisions are documented in a structured manner. It saves time through efficient eSigning processes and mitigates the risk of errors or misunderstandings. This leads to improved transparency and accountability within your business.

-

Can airSlate SignNow integrate with other software for managing executive resolution examples?

Yes, airSlate SignNow offers integrations with various business applications like CRM systems, document management tools, and productivity platforms. This allows you to streamline workflows associated with your executive resolution examples across different software, enhancing productivity and efficiency.

-

How secure is the process of signing an executive resolution example with airSlate SignNow?

The process of signing an executive resolution example with airSlate SignNow is highly secure. We utilize encryption, multi-factor authentication, and comply with industry standards to protect your sensitive information. You can trust that your documents and signatures are safeguarded throughout the signing process.

Get more for Corporate Resolution To Establish Section 162 Executive Bonus Plan

Find out other Corporate Resolution To Establish Section 162 Executive Bonus Plan

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU