1003 Form

What is the Fannie Mae Form 1003?

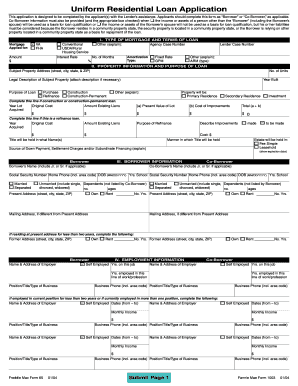

The Fannie Mae Form 1003, also known as the Uniform Residential Loan Application, is a standardized document used by lenders to collect information about a borrower’s financial history and current situation. This form is essential for individuals seeking a mortgage, as it helps lenders evaluate creditworthiness and determine eligibility for loan products. The 1003 form includes sections for personal identification, employment history, income details, assets, liabilities, and property information, ensuring that all relevant data is captured for the loan assessment process.

Steps to Complete the 1003 Form

Completing the Fannie Mae Form 1003 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, such as identification, income statements, and details about your assets and debts. Next, fill out each section of the form meticulously, providing accurate information regarding your employment, income, and financial obligations. It is crucial to review the completed form for any errors or omissions before submission. Once finalized, the form can be submitted to your lender, either electronically or in paper format, depending on their requirements.

Legal Use of the 1003 Form

The legal use of the Fannie Mae Form 1003 is governed by federal regulations and guidelines. This form serves as a binding document in the mortgage application process, meaning that the information provided must be truthful and accurate. Misrepresentation or errors can lead to serious consequences, including loan denial or legal repercussions. Lenders rely on the data in the 1003 form to assess risk and determine loan terms, making it essential for borrowers to understand the importance of compliance with all legal requirements associated with this form.

Key Elements of the 1003 Form

The Fannie Mae Form 1003 comprises several key elements that are crucial for a comprehensive loan application. These elements include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Current and previous employment details, including job titles and duration.

- Income Details: Information about salary, bonuses, and any additional sources of income.

- Assets and Liabilities: A complete list of financial assets, such as bank accounts and investments, alongside outstanding debts.

- Property Information: Details about the property being purchased or refinanced, including its address and estimated value.

How to Obtain the 1003 Form

The Fannie Mae Form 1003 can be obtained through various channels. Most lenders provide the form as part of their mortgage application process, either in physical or digital format. Additionally, the form is available on the Fannie Mae website, where it can be downloaded for personal use. It is advisable to ensure that you are using the most current version of the form, as updates may occur that reflect changes in lending practices or regulations.

Form Submission Methods

Submitting the Fannie Mae Form 1003 can be done through several methods, depending on lender preferences. Common submission methods include:

- Online Submission: Many lenders offer secure online portals for electronic submission, allowing for quick processing.

- Mail: The form can be printed and mailed to the lender's office, though this may result in longer processing times.

- In-Person Submission: Borrowers may also visit their lender's office to submit the form directly, which can provide an opportunity for immediate feedback.

Quick guide on how to complete 1003 form 36032429

Complete 1003 Form effortlessly on any device

Digital document management has gained immense traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage 1003 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

How to modify and eSign 1003 Form with ease

- Obtain 1003 Form and click Get Form to commence.

- Utilize the tools we provide to finish your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your edits.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1003 Form and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1003 form 36032429

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fannie Mae Form 1003 and why is it important?

The Fannie Mae Form 1003, also known as the Uniform Residential Loan Application, is crucial for any mortgage application. It helps lenders gather standardized information about borrowers, which streamlines the mortgage approval process. Understanding the importance of this form is essential for anyone looking to finance a home.

-

How does airSlate SignNow simplify the completion of the Fannie Mae Form 1003?

airSlate SignNow offers an easy-to-use platform that allows users to fill out and eSign the Fannie Mae Form 1003 quickly. The intuitive interface ensures that even those unfamiliar with digital forms can navigate the process effortlessly. This streamlining can enhance the speed and accuracy of loan applications.

-

Is there a cost associated with using airSlate SignNow for the Fannie Mae Form 1003?

Yes, airSlate SignNow provides various pricing models to cater to different business needs. While there are costs involved, the platform is designed to be cost-effective, making the processing of the Fannie Mae Form 1003 affordable for businesses and individuals alike. You can choose a plan that fits your volume of transactions.

-

Can I integrate airSlate SignNow with existing systems for the Fannie Mae Form 1003?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and financial systems. This allows for the smooth transfer of data, making it easier to manage documents like the Fannie Mae Form 1003 without disrupting your current workflow.

-

What security measures does airSlate SignNow have for handling the Fannie Mae Form 1003?

airSlate SignNow employs advanced security protocols, including encryption and multi-factor authentication, to ensure the safety of your documents, including the Fannie Mae Form 1003. You can trust that sensitive information is protected throughout the signing process.

-

Does airSlate SignNow support multiple users for the Fannie Mae Form 1003?

Yes, airSlate SignNow allows multiple users to collaborate on the Fannie Mae Form 1003. This feature is especially beneficial for teams working on mortgage applications, enabling real-time updates and revisions. Collaborative tools make it easier to manage submissions efficiently.

-

What are the benefits of using airSlate SignNow for the Fannie Mae Form 1003?

Using airSlate SignNow for the Fannie Mae Form 1003 offers several benefits, including faster processing times, reduced paperwork, and improved accuracy. The solution is designed to enhance the overall user experience, making it simpler for borrowers and lenders to complete the application effectively.

Get more for 1003 Form

- Dialysis orders sample form

- Civ 805 motion form

- Christmas parade permission slip valley preparatory school form

- Business certificate dba cohassetmaorg form

- Fmla certification of health care provider for family member39s serious form

- Accountant agreement template form

- Accounting consulting agreement template form

- Accounting agreement template form

Find out other 1003 Form

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF