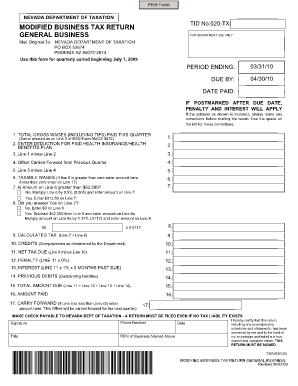

Tid No 020 Tx Form

What is the Tid No 020 Tx

The Tid No 020 Tx form is a specific document used within the United States for various administrative purposes. This form is often required for tax-related situations, particularly for individuals or businesses needing to report specific information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is essential for compliance and proper documentation.

How to use the Tid No 020 Tx

Using the Tid No 020 Tx form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal or business details required on the form. Next, fill out the form carefully, ensuring all fields are completed as per the guidelines. Once completed, review the form for accuracy before submitting it to the appropriate agency or department.

Steps to complete the Tid No 020 Tx

Completing the Tid No 020 Tx form requires attention to detail. Follow these steps:

- Gather required documentation, such as identification numbers and financial records.

- Access the form through official channels, ensuring you have the latest version.

- Fill in all necessary fields, double-checking for accuracy.

- Sign and date the form where required.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Tid No 020 Tx

The Tid No 020 Tx form must be used in accordance with applicable laws and regulations. This includes ensuring that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Additionally, it is important to keep a copy of the submitted form for personal records, as this can serve as proof of compliance if needed in the future.

Filing Deadlines / Important Dates

Filing deadlines for the Tid No 020 Tx form can vary based on specific circumstances, such as the type of taxpayer or the nature of the information being reported. It is crucial to be aware of these deadlines to avoid penalties. Typically, deadlines align with the annual tax filing season, but specific dates should be confirmed through official IRS announcements or guidelines.

Who Issues the Form

The Tid No 020 Tx form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. Understanding the issuing body is important for obtaining the correct version of the form and ensuring compliance with all required regulations. It is advisable to consult official resources or the IRS website for the most accurate and up-to-date information regarding the form.

Quick guide on how to complete tid no 020 tx

Finish Tid No 020 Tx effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a great eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the functionalities necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Handle Tid No 020 Tx on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Tid No 020 Tx effortlessly

- Locate Tid No 020 Tx and select Get Form to begin.

- Take advantage of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Tid No 020 Tx and guarantee seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tid no 020 tx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tid no 020 tx and how does it relate to airSlate SignNow?

Tid no 020 tx refers to a specific transaction ID within our platform that helps users track document processes. With airSlate SignNow, each sent document is assigned a unique tid no 020 tx, making it easier to manage and reference important transactions.

-

How much does it cost to use airSlate SignNow with a tid no 020 tx?

airSlate SignNow offers competitive pricing plans that cater to different business needs, starting with a free trial. The cost associated with features using a tid no 020 tx is outlined clearly in our pricing section, ensuring you choose the right plan without any hidden fees.

-

What features are included with my tid no 020 tx in airSlate SignNow?

When utilizing a tid no 020 tx in airSlate SignNow, users benefit from features like document templates, real-time tracking, and customizable workflows. These features streamline the signing process, providing a comprehensive eSignature solution.

-

Can I integrate airSlate SignNow with other applications when using tid no 020 tx?

Yes, airSlate SignNow supports integrations with numerous applications such as Google Drive, Salesforce, and Dropbox. This integrates seamlessly with your processes, enabling you to effectively manage transactions marked with tid no 020 tx across platforms.

-

What are the benefits of using airSlate SignNow for documents with a tid no 020 tx?

Using airSlate SignNow to handle documents associated with a tid no 020 tx offers enhanced efficiency and reduced turnaround times. The platform’s user-friendly interface ensures that all parties can swiftly complete their tasks, improving overall productivity.

-

Is there customer support available for issues related to tid no 020 tx?

Absolutely! airSlate SignNow provides dedicated customer support for all users, including assistance with any queries related to tid no 020 tx. Our team is available through various channels to ensure you receive timely help and support.

-

How do I track my document status associated with tid no 020 tx?

Tracking your document status with a tid no 020 tx is simple with airSlate SignNow. Users can log into their account and access the dashboard, where you can view the status, history, and related actions for each transaction.

Get more for Tid No 020 Tx

- Mvp prior authorization form pdf

- Dressing prescription request form lothian joint formulary

- St 104v tax exempt form idaho

- Miraca life sciences slide release form

- Challenge jurisdiction template form

- Florida sales tax form 100065962

- Continuing postjudgment earnings garnishment summons form

- Personally appeared and on their oath did swear or affirm to the accuracy of the following facts form

Find out other Tid No 020 Tx

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors