Employee Withholding Allowance Certificate Form

What is the Employee Withholding Allowance Certificate

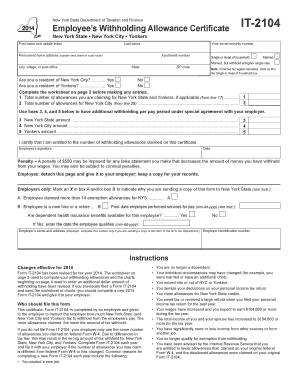

The Employee Withholding Allowance Certificate, commonly referred to as the EDD employee's withholding allowance certificate, is a crucial document used by employees to determine the amount of federal income tax withheld from their paychecks. This form allows employees to claim allowances based on their personal circumstances, such as marital status and dependents, which can significantly affect their tax liability. By accurately completing this certificate, employees can ensure that they are not over- or under-withheld on their taxes throughout the year.

How to use the Employee Withholding Allowance Certificate

Using the Employee Withholding Allowance Certificate involves several steps that ensure proper completion and submission. First, employees should obtain the form from their employer or download it from official resources. Next, they need to fill out the required sections, including personal information and the number of allowances they wish to claim. Once completed, the certificate must be submitted to the employer’s payroll department to adjust the withholding amounts accordingly. It is essential to keep a copy for personal records and to review the form periodically, especially after significant life changes.

Steps to complete the Employee Withholding Allowance Certificate

Completing the Employee Withholding Allowance Certificate requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the EDD employee's withholding allowance certificate from your employer or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you are eligible to claim based on your personal and financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed certificate to your employer’s payroll department for processing.

Legal use of the Employee Withholding Allowance Certificate

The legal use of the Employee Withholding Allowance Certificate is governed by federal tax laws. This form must be filled out truthfully and accurately, as providing false information can lead to penalties from the IRS. Employers are required to honor the allowances claimed on the certificate, which directly influences the amount withheld from an employee's paycheck. It is important to understand that any changes in personal circumstances, such as marriage or having children, should prompt a review and possible revision of the certificate to remain compliant with tax obligations.

Key elements of the Employee Withholding Allowance Certificate

Several key elements are essential for the proper completion of the Employee Withholding Allowance Certificate. These include:

- Personal Information: Name, address, and Social Security number.

- Allowances Claimed: The number of allowances based on personal and financial situations.

- Signature: A signature is required to validate the information provided.

- Date: The date of completion must be included to establish the form's validity.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Employee Withholding Allowance Certificate. These guidelines outline eligibility criteria for claiming allowances, the importance of accuracy, and the implications of incorrect information. Employees are encouraged to refer to the IRS website or consult a tax professional for the latest regulations and updates related to withholding allowances. Staying informed ensures compliance and helps avoid potential issues with tax filings.

Quick guide on how to complete employee withholding allowance certificate

Complete Employee Withholding Allowance Certificate effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without any hold-ups. Manage Employee Withholding Allowance Certificate on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Employee Withholding Allowance Certificate easily

- Locate Employee Withholding Allowance Certificate and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that function.

- Create your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Employee Withholding Allowance Certificate to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EDD employee's withholding allowance certificate?

The EDD employee's withholding allowance certificate is a form used to determine the amount of state income tax to withhold from an employee's paycheck. This certificate allows you to specify the number of allowances you are claiming, which directly affects your tax deductions. Utilizing airSlate SignNow can simplify the process of completing and submitting this important document.

-

How does airSlate SignNow support the EDD employee's withholding allowance certificate?

airSlate SignNow offers an efficient platform for filling out and eSigning the EDD employee's withholding allowance certificate. With its user-friendly interface, you can easily input your information, electronically sign the document, and quickly share it with your employer. This streamlines the process and reduces the chance of errors.

-

What features does airSlate SignNow offer for managing the EDD employee's withholding allowance certificate?

airSlate SignNow provides a variety of features to enhance your experience with the EDD employee's withholding allowance certificate. Features include customizable templates, secure electronic signatures, and document tracking capabilities. These tools help ensure that your EDD forms are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the EDD employee's withholding allowance certificate?

While airSlate SignNow offers a range of pricing plans, using the platform for the EDD employee's withholding allowance certificate can be very cost-effective. The subscription includes comprehensive features for managing all of your document needs. Check the website for specific pricing options tailored to your business requirements.

-

Can I integrate airSlate SignNow with other software for handling the EDD employee's withholding allowance certificate?

Yes, airSlate SignNow provides integration capabilities with various software solutions that facilitate the management of the EDD employee's withholding allowance certificate. This means you can seamlessly connect it with your HR platforms, accounting systems, and other essential tools. These integrations streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the EDD employee's withholding allowance certificate?

Using airSlate SignNow for your EDD employee's withholding allowance certificate provides several benefits, including greater efficiency, enhanced security, and reduced processing time. The electronic signature feature eliminates the need for printing and scanning, while document tracking ensures you can monitor the status of your forms. This saves time and keeps your payroll process on track.

-

How can I ensure the security of my EDD employee's withholding allowance certificate when using airSlate SignNow?

airSlate SignNow prioritizes security by utilizing advanced encryption and authentication methods for all documents, including the EDD employee's withholding allowance certificate. This ensures that your sensitive information remains safe throughout the signing process. You can trust that your data is protected, providing peace of mind for both you and your employer.

Get more for Employee Withholding Allowance Certificate

- Form 10 ba

- San bernardino family court services form

- Cant open a form docs editors help google support

- Notice of repossession of a motor vehicle or dmv ny gov form

- Formulario de registro de usuarios sidunea form sip ooi operadores de comercio exterior sidunea aduana gob

- Nlc offer later form

- Development departmentstuart fl form

- City of ormond beach fl official websiteofficial website form

Find out other Employee Withholding Allowance Certificate

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online