Form 48845

What is the Form 48845

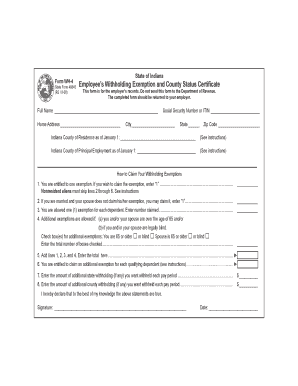

The Form 48845 is an official document utilized for specific purposes within the United States, typically associated with tax-related matters or compliance requirements. It serves as a means for individuals or businesses to provide necessary information to the relevant authorities. Understanding the purpose of this form is crucial for ensuring proper completion and submission.

How to use the Form 48845

Using Form 48845 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation that supports the information you will enter. Next, carefully fill out each section of the form, ensuring clarity and accuracy. Once completed, review the form for any errors before submission to avoid delays or complications.

Steps to complete the Form 48845

Completing Form 48845 requires attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the form from the appropriate source.

- Read the instructions thoroughly to understand what information is required.

- Fill in your personal or business information as requested.

- Provide any supporting documentation if necessary.

- Review the completed form for accuracy.

- Submit the form as directed, either electronically or by mail.

Legal use of the Form 48845

Form 48845 must be used in accordance with U.S. regulations to ensure its legal validity. This includes adhering to specific guidelines regarding the information provided and the manner of submission. When completed correctly, the form can serve as a legally binding document that fulfills its intended purpose.

Key elements of the Form 48845

Understanding the key elements of Form 48845 is essential for proper completion. Important components typically include:

- Identification information of the individual or entity submitting the form.

- Details relevant to the specific purpose of the form.

- Signature fields, which may require electronic or handwritten signatures.

- Submission instructions, outlining how and where to send the completed form.

Filing Deadlines / Important Dates

Timeliness is critical when submitting Form 48845. Be aware of any filing deadlines associated with the form to avoid penalties. Important dates may vary depending on the specific use of the form, so it is advisable to check the relevant guidelines or consult with a tax professional for the most accurate information.

Quick guide on how to complete form 48845

Accomplish Form 48845 seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Form 48845 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign Form 48845 effortlessly

- Find Form 48845 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 48845 and ensure excellent communication at any stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 48845

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 48845 and why is it important?

Form 48845 is a crucial document used in specific transactions and processes. Understanding this form is essential for ensuring compliance and leveraging its benefits effectively in your operations. By utilizing airSlate SignNow, you can streamline the completion and signing of Form 48845, making your workflow more efficient.

-

How does airSlate SignNow help with filling out Form 48845?

With airSlate SignNow, you can easily fill out Form 48845 using our user-friendly platform. The form can be customized with fields that can be automatically filled, ensuring accuracy and saving time for all parties involved. Our tool simplifies the process of creating and completing Form 48845, making it accessible for anyone.

-

What are the pricing plans for using airSlate SignNow for Form 48845?

airSlate SignNow offers a range of pricing plans designed to cater to different business needs. Whether you're looking for basic features for individual use or advanced capabilities for team management, there is a plan suitable for your requirement. By investing in airSlate SignNow, you ensure a cost-effective solution for managing Form 48845 and other documents.

-

Can airSlate SignNow integrate with other software for managing Form 48845?

Yes, airSlate SignNow integrates seamlessly with various software applications to streamline your document management processes. By connecting with tools already in use, you can enhance how you handle Form 48845 alongside your other workflows. This integration boosts productivity and ensures all necessary data is available when using Form 48845.

-

What are the benefits of using airSlate SignNow for Form 48845?

Using airSlate SignNow for Form 48845 brings numerous benefits such as enhanced efficiency, reduced paperwork, and improved turnaround times. Our platform allows for secure electronic signatures making the submission of Form 48845 easier and more reliable. This means you'll spend less time on administrative tasks and more on what matters most.

-

Is airSlate SignNow secure for managing Form 48845?

Absolutely, airSlate SignNow prioritizes security when handling Form 48845 and other documents. Our platform employs advanced encryption and security protocols to protect your data during transmission and storage. This ensures that your Form 48845 and sensitive information remain safe from unauthorized access.

-

Can I track the status of Form 48845 sent through airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of Form 48845 after it is sent. You can receive notifications and updates at each stage of the signing process, improving your oversight and communication. This capability ensures that you are always informed about where your Form 48845 stands.

Get more for Form 48845

- Rule 25 assessment and placement summary form

- Backflow test form 29428910

- Var form 900 fl bbb edits 6 5 14

- Va form 10 0381

- Form interrogatories nj

- State of california gavin newsom governordepartme form

- Client numberclinic use form

- New standard employment contract department of labor and employment form

Find out other Form 48845

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe