Payoff Statement Form

What is the payoff statement?

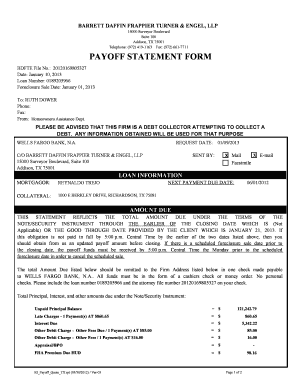

A payoff statement is a document that outlines the total amount required to pay off a loan, typically a mortgage, at a specific point in time. It includes details such as the outstanding principal, accrued interest, and any applicable fees or penalties. This statement is essential for borrowers who wish to settle their debts, as it provides a clear understanding of the financial obligations remaining. The payoff statement is often requested by the borrower from the lender and serves as an official record of the loan balance.

How to obtain the payoff statement

To obtain a payoff statement, borrowers typically need to contact their lender directly. This can often be done through the lender's customer service line or online account management system. When requesting the statement, it is important to provide relevant information, such as the loan number and identification details. Some lenders may require a formal written request or a specific form to be completed. It is advisable to request the statement well in advance of the intended payoff date to ensure that all necessary information is accurately reflected.

Key elements of the payoff statement

A comprehensive payoff statement includes several key elements that are crucial for understanding the total amount owed. These elements typically include:

- Outstanding principal: The remaining balance on the loan.

- Accrued interest: The interest that has accumulated since the last payment.

- Fees and penalties: Any additional charges that may apply, such as prepayment penalties.

- Payoff date: The specific date by which the payoff amount is valid, as interest may continue to accrue after this date.

- Lender contact information: Details for reaching the lender for any follow-up questions.

Steps to complete the payoff statement

Completing a payoff statement involves several straightforward steps. First, gather all necessary loan information, including the loan number and account details. Next, contact the lender to request the payoff statement, ensuring to specify the desired payoff date. Once received, review the statement carefully to verify the accuracy of the amounts listed. If any discrepancies are found, reach out to the lender for clarification. Finally, if the payoff statement is satisfactory, arrange for the payment to be made by the specified date to settle the loan.

Legal use of the payoff statement

The payoff statement serves as a legally binding document that outlines the terms under which a loan can be paid off. It is important for borrowers to ensure that the statement is accurate and reflects all necessary details, as it may be required in legal proceedings or disputes. Additionally, the statement must comply with relevant laws and regulations governing loan agreements. Retaining a copy of the payoff statement after payment is crucial, as it acts as proof of loan settlement and can be used to resolve any future issues related to the loan.

Examples of using the payoff statement

Payoff statements are commonly used in various scenarios, such as:

- Refinancing: When a borrower wishes to refinance their mortgage, they will need a payoff statement to determine the exact amount required to pay off the existing loan.

- Property sale: In the event of selling a property, the seller must provide a payoff statement to the closing agent to ensure that the mortgage is settled during the sale process.

- Debt settlement: Borrowers negotiating with creditors may use a payoff statement to understand their obligations and negotiate a settlement amount.

Quick guide on how to complete loan payoff letter template

Easy Preparation of loan payoff letter template on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents quickly and without delays. Manage payoff statement on any device using the airSlate SignNow apps for Android or iOS and simplify any document-focused task today.

How to Edit and Electronically Sign payoff statement template Effortlessly

- Obtain payoff statement example and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive data using the tools that airSlate SignNow provides for that specific purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign mortgage payoff statement example and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to loan payoff document

Create this form in 5 minutes!

How to create an eSignature for the loan payoff letter example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask mortgage payoff letter

-

What is a payoff statement?

A payoff statement is a document that details the total amount required to pay off a loan or mortgage. It includes important information such as the principal balance, interest rates, and any applicable fees. Understanding a payoff statement is crucial for borrowers looking to settle their debts efficiently.

-

How can airSlate SignNow help with obtaining a payoff statement?

airSlate SignNow simplifies the process of obtaining a payoff statement by allowing users to electronically sign and send necessary documents to their lenders. This streamlines communication and accelerates the response time for receiving the payoff statement. With our solution, you can manage your documents seamlessly.

-

Is there a cost associated with using airSlate SignNow to get a payoff statement?

Yes, while airSlate SignNow offers a cost-effective solution for managing documents, there may be fees associated with your subscription. We provide various pricing plans that cater to different business needs, ensuring that you only pay for the features essential for processing documents like payoff statements.

-

What features does airSlate SignNow offer that can assist with payoff statements?

airSlate SignNow offers features such as reusable templates, in-document signing, and automatic reminders which facilitate the management of payoff statements. These tools ensure that you have a streamlined approach to getting documents signed quickly and efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other platforms to manage payoff statements?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing you to connect your existing tools with our electronic signature solution. This integration capability makes it easy to manage and retrieve payoff statements alongside other business processes, enhancing overall productivity.

-

What are the security measures taken by airSlate SignNow for handling payoff statements?

airSlate SignNow takes data security seriously, ensuring that all documents, including payoff statements, are protected with top-notch encryption and compliance with legal standards. Our platform is designed to keep your information safe while providing a user-friendly eSigning experience.

-

How quickly can I receive my payoff statement after using airSlate SignNow?

Using airSlate SignNow can signNowly speed up the process of receiving your payoff statement. Once you send the required documents to your lender through our platform, you can expect quicker turnaround times for responses. This efficiency allows you to get your payoff statement without unnecessary delays.

Get more for what is a payoff statement

- The furnishing of forms does not constitute an empireblue

- Athena award nomination form wcofwc

- Wedding for hairdresser contract template form

- Wedding for photographers contract template form

- Wedding for wedding planner contract template form

- Wedding hair contract template form

- Wedding hair and makeup contract template form

- Wedding hair stylist contract template form

Find out other what does a payoff statement look like

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now