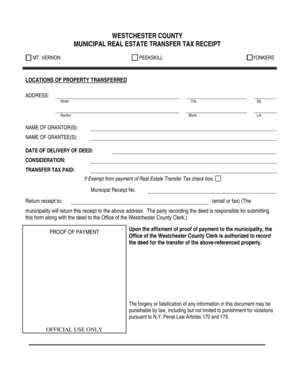

Transfer Tax Form

What is the transfer tax?

The transfer tax is a levy imposed by state or local governments on the transfer of real estate or property ownership. This tax is typically calculated as a percentage of the property's sale price or assessed value. The specifics of the transfer tax can vary significantly from one jurisdiction to another, with some areas imposing a flat rate while others may have tiered rates based on the property's value. Understanding the transfer tax is crucial for both buyers and sellers, as it directly impacts the overall cost of a real estate transaction.

Steps to complete the transfer tax

Completing the transfer tax form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as the property address, sale price, and details about the buyer and seller. Next, fill out the transfer tax form with the required data, ensuring all information is accurate. Once completed, review the form for any errors before submission. Depending on your jurisdiction, you may need to submit the form along with payment of the transfer tax to the appropriate government office. It is advisable to keep a copy of the submitted form for your records.

State-specific rules for the transfer tax

Each state in the U.S. has its own rules and regulations regarding the transfer tax, including rates, exemptions, and filing procedures. Some states may offer exemptions for certain types of transactions, such as transfers between family members or non-profit organizations. It is essential to research the specific regulations in your state to ensure compliance and to understand any potential savings. Consulting with a local real estate professional or tax advisor can provide valuable insights into state-specific transfer tax laws.

Filing deadlines / important dates

Filing deadlines for the transfer tax can vary by state and locality. Generally, the transfer tax form must be filed within a specific timeframe following the property transfer, often within thirty days. Missing the deadline may result in penalties or additional fees. It is important to be aware of these deadlines to avoid complications. Keeping a calendar of important dates related to your property transaction can help ensure timely filing and payment of the transfer tax.

Required documents

When completing the transfer tax form, several documents may be required to support your submission. These typically include the sales contract, proof of payment, and any relevant identification for the buyer and seller. In some cases, additional documentation may be needed to verify exemptions or special circumstances. Ensuring that you have all necessary documents prepared in advance can streamline the filing process and help avoid delays.

Penalties for non-compliance

Failure to comply with transfer tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Each jurisdiction has its own enforcement mechanisms, which can vary in severity. It is crucial to understand the implications of non-compliance and to take steps to ensure that all transfer tax obligations are met promptly. Seeking advice from a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete transfer tax

Manage Transfer Tax effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without holdups. Access Transfer Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to adjust and eSign Transfer Tax effortlessly

- Locate Transfer Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Transfer Tax while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is transfer tax, and how does it relate to eSigning documents?

Transfer tax is a tax imposed on the transfer of property or rights from one entity to another. When using airSlate SignNow for eSigning documents related to property transfers, it's important to understand how these taxes may apply to your agreements. Utilizing our platform can streamline the signing process, helping ensure you comply with transfer tax regulations efficiently.

-

How can airSlate SignNow help in reducing transfer tax implications?

While airSlate SignNow itself does not directly reduce transfer tax, it simplifies the documentation process for property transfers, allowing you to manage your transactions more efficiently. By ensuring all required documents are signed quickly and accurately, you can potentially avoid penalties related to transfer tax discrepancies. This efficiency may lead to time and cost savings in the long run.

-

What are the pricing plans for airSlate SignNow, and do they include features for managing transfer tax?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Each plan includes essential features for document management, eSigning, and workflow automation, which can aid in handling documents subject to transfer tax. By choosing the right plan, you can streamline your processes and ensure compliance with transfer tax requirements.

-

Does airSlate SignNow integrate with accounting software to help track transfer tax?

Yes, airSlate SignNow integrates with various accounting and financial management platforms. These integrations can help you track pertinent information related to transfer tax and ensure that all relevant documentation is in sync. By connecting to your accounting system, you can streamline your operations while keeping transfer tax considerations in mind.

-

What features of airSlate SignNow make it suitable for companies dealing with transfer tax?

airSlate SignNow offers robust features like secure eSigning, document templates, and real-time tracking that are beneficial for handling documents associated with transfer tax. These tools help businesses ensure compliance and maintain accurate records during property transactions. With customizable workflows, managing transfer tax-related documents becomes simpler and more efficient.

-

Are there any compliance features within airSlate SignNow that address transfer tax documentation?

Yes, airSlate SignNow provides compliance features including audit trails and secure document storage, essential for maintaining records relating to transfer tax. These features ensure that your documents comply with legal standards and can serve as proof in case of a tax audit. Using airSlate SignNow helps mitigate risks associated with transfer tax compliance.

-

How does airSlate SignNow enhance the signing experience for documents involving transfer tax?

airSlate SignNow enhances the signing experience by providing an intuitive platform that allows signers to complete documents involving transfer tax quickly and securely. Our user-friendly interface reduces the time taken to sign documents, which is crucial when dealing with financial transactions subject to transfer tax. Ensuring quick sign-offs can help facilitate timely tax payments.

Get more for Transfer Tax

- Borang pelarasan pcg form

- Juice plus app form

- Cougar home safety assessment form

- Portability request form aurora housing authority colorado aurorahousing

- Gingerbread girl story printable form

- Standard form of agreement between owner and contractor for a small project

- General nutrition counseling referral form pdf yale new haven ynhh

- Bp pulse form

Find out other Transfer Tax

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice