Ohio County Tax Map Form

What is the Ohio County Tax Map

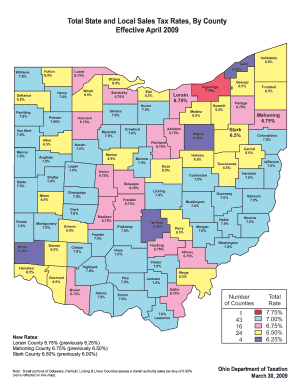

The Ohio County Tax Map is a detailed representation of property boundaries, ownership, and tax assessments within Ohio counties. It serves as a crucial tool for property owners, real estate professionals, and local government agencies. This map provides essential information regarding property dimensions, zoning classifications, and tax rates, which are vital for making informed decisions about land use and property investments.

How to Use the Ohio County Tax Map

Utilizing the Ohio County Tax Map effectively involves several steps. First, access the map through your local county auditor's website or office. Once you have the map, you can search for specific properties by entering the address or parcel number. The map will display relevant details such as property lines, ownership information, and assessed values. Understanding these elements helps users navigate property transactions, tax assessments, and zoning regulations.

Steps to Complete the Ohio County Tax Map

Completing the Ohio County Tax Map typically involves the following steps:

- Gather necessary information, including property addresses and parcel numbers.

- Access the map through the county auditor's official website.

- Input the required data into the search function to locate specific properties.

- Review the displayed information to ensure accuracy and completeness.

- Save or print the map for your records or further use.

Legal Use of the Ohio County Tax Map

The Ohio County Tax Map is legally recognized as a valid document for property assessment and taxation purposes. It can be used in various legal contexts, such as property disputes, tax appeals, and real estate transactions. However, it is essential to ensure that the information is current and accurate, as outdated data may lead to legal complications. Users should consult with legal professionals if they have questions regarding the map's legal implications.

Key Elements of the Ohio County Tax Map

Several key elements make up the Ohio County Tax Map, including:

- Parcel Boundaries: Clearly defined lines indicating property limits.

- Ownership Information: Details about current property owners and historical ownership.

- Tax Assessments: Information on property values and associated tax rates.

- Zoning Classifications: Designations that dictate land use regulations.

How to Obtain the Ohio County Tax Map

To obtain the Ohio County Tax Map, individuals can visit their local county auditor's office or access the map online through the county's official website. Many counties provide digital versions of the tax map, which can be easily viewed and downloaded. For those requiring physical copies, requests can often be made directly at the office, where staff can assist with obtaining the necessary documents.

Quick guide on how to complete ohio sales tax map

Complete ohio sales tax map seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the necessary paperwork and store it securely online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage ohio property map on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign ohio property tax map effortlessly

- Find ohio county tax map and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your choosing. Edit and electronically sign ohio county tax rate map to ensure excellent communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ohio property tax map

Create this form in 5 minutes!

How to create an eSignature for the ohio county tax map

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask ohio sales tax map

-

What is an Ohio property map?

An Ohio property map is a detailed representation of land records and real estate properties in Ohio, showcasing information such as boundaries, ownership details, and parcel numbers. These maps are essential for buyers, sellers, and real estate agents looking to understand property layout and values in the state.

-

How can I access an Ohio property map?

You can access an Ohio property map through various online platforms and county assessor websites. These resources often provide interactive features allowing you to zoom in on specific properties and view related information. Using services like airSlate SignNow can streamline the document processes required for property transactions.

-

Is there a cost associated with obtaining an Ohio property map?

Many county offices provide Ohio property maps for free or at a minimal cost. However, some online platforms might charge for advanced features or detailed reports. It's important to check the specific terms and offerings when accessing a property map.

-

What features should I look for in an Ohio property map?

When selecting an Ohio property map, look for features like user-friendly navigation, up-to-date information, and detailed overlays that show zoning, topography, and ownership records. The ability to integrate with eSignature platforms like airSlate SignNow can enhance your property transaction processes.

-

How can Ohio property maps benefit home buyers?

Ohio property maps allow home buyers to visualize property dimensions, boundaries, and neighboring properties effectively. Understanding these aspects helps in making informed decisions about purchasing a home or investment property. Additionally, the integration of e-signatures can facilitate easier documentation.

-

Are Ohio property maps updated regularly?

Yes, Ohio property maps are frequently updated to reflect changes in property ownership, zoning laws, and land use. Counties often have designated schedules for updates, providing the most current information. Regular updates ensure buyers and sellers have the data they need for effective transactions.

-

Can I integrate the Ohio property map with other tools?

Yes, many platforms allow integration of the Ohio property map with tools like CRM systems and e-signature solutions. By using airSlate SignNow, you can seamlessly manage documents related to property sales while referencing the Ohio property map for accurate data.

Get more for ohio county property tax map

- Full article title the quotarticlequot word count keywords up to six 1 3 5 article category select the correct category form

- What is linux and why is it so popularhowstuffworks form

- Disclabel help form

- If you are filing this form

- Music minor form sjsu

- Tenant lease contract template form

- General contractor agreement template form

- Termination and release contract template form

Find out other property tax map

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online