Form 8606

What is the Form 8606?

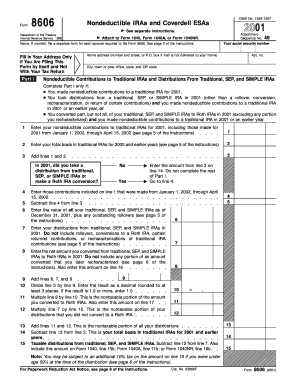

The Form 8606 is a tax document used by individuals in the United States to report nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and to track the basis of these contributions. This form is essential for taxpayers who have made contributions that are not tax-deductible, as it helps ensure that they do not pay taxes on these amounts when they withdraw them in retirement. It is also used to report conversions from traditional IRAs to Roth IRAs, which can have significant tax implications. Understanding the purpose and requirements of the Form 8606 is crucial for effective tax planning and compliance.

How to obtain the Form 8606

To obtain the Form 8606, individuals can visit the official IRS website, where the form is available for download in PDF format. It is important to ensure that you are using the most current version of the form, as tax regulations can change. Additionally, taxpayers can access the form through tax preparation software, which often includes the latest forms and guidance on how to fill them out. For those who prefer physical copies, local IRS offices and some libraries may also have printed versions available.

Steps to complete the Form 8606

Completing the Form 8606 involves several key steps:

- Begin by entering your personal information, including your name and Social Security number.

- Report your nondeductible contributions to traditional IRAs on Part I of the form. This includes contributions made during the tax year.

- If you converted any amounts from traditional IRAs to Roth IRAs, report those transactions in Part II.

- Calculate your basis in traditional IRAs in Part III, which is crucial for determining the tax implications of future distributions.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 8606

The Form 8606 is legally recognized by the IRS as a necessary document for reporting specific IRA transactions. To ensure its legal validity, it must be completed accurately and submitted with your annual tax return. Failure to file the form when required can lead to penalties and complications with your tax filings. It is essential to maintain proper records of your contributions and conversions, as these will support the information reported on the form and help avoid potential disputes with the IRS.

Filing Deadlines / Important Dates

The Form 8606 must be filed with your federal tax return by the standard tax filing deadline, which is typically April 15 of each year. If you are unable to meet this deadline, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these deadlines is vital for ensuring compliance and avoiding unnecessary complications with your tax obligations.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Form 8606 to the IRS:

- Online: If you are using tax preparation software, you can electronically file your tax return, which includes the Form 8606.

- Mail: You can print the completed form and mail it to the appropriate IRS address, which varies based on your location and whether you are enclosing a payment.

- In-Person: While not common, you may be able to deliver your tax return and Form 8606 in person at a local IRS office, though it is advisable to check in advance for availability and procedures.

Quick guide on how to complete form 8606 1664751

Complete Form 8606 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 8606 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form 8606 with ease

- Obtain Form 8606 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign Form 8606 while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8606 1664751

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8606 pdf and why do I need it?

Form 8606 pdf is a tax document used to report nondeductible contributions to traditional IRAs and distributions from traditional and Roth IRAs. You need it to ensure compliance with IRS regulations regarding retirement accounts and to accurately report your contributions and distributions.

-

How can I fill out form 8606 pdf using airSlate SignNow?

You can easily fill out form 8606 pdf by uploading the document to airSlate SignNow and using our intuitive online editor. The platform allows you to add text, checkboxes, and signatures, making it simple to complete the form efficiently.

-

Is there a cost to use airSlate SignNow for managing form 8606 pdf?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from a free trial. You can manage and eSign form 8606 pdf without incurring any hidden fees, ensuring a transparent pricing structure.

-

Can I share form 8606 pdf with my accountant through airSlate SignNow?

Yes, airSlate SignNow makes it easy to share form 8606 pdf with your accountant by sending a secure link or email. This ensures that your documents are shared safely and can be accessed whenever needed.

-

What features does airSlate SignNow offer for handling form 8606 pdf?

airSlate SignNow provides a range of features including document templates, eSignature options, and real-time collaboration for form 8606 pdf. These features enhance the user experience and streamline the form-filling process.

-

Does airSlate SignNow support integrations for form 8606 pdf management?

Absolutely! airSlate SignNow supports multiple integrations with popular business applications, allowing you to manage form 8606 pdf alongside other tools seamlessly. This interoperability enhances productivity for users.

-

Are there any security measures in place for form 8606 pdf on airSlate SignNow?

Yes, airSlate SignNow prioritizes security, employing encryption and secure servers to protect your form 8606 pdf and other sensitive documents. You can rest assured that your data is safe while using our service.

Get more for Form 8606

- Bluebird auto rental form

- Va 1199a direct deposit form

- Organ donation form

- Cgppc 3600 form

- Sample affidavit for lost matric certificate south africa form

- Commercial real estate commission agreement template form

- Commercial real estate purchase agreement template form

- Commercial real estate confidentiality agreement template form

Find out other Form 8606

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation