LOAN APPLICATION FORM Aditya Birla Housing Finance Limited

Understanding the Aditya Birla Loan Application Form

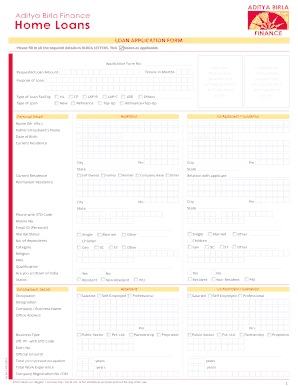

The Aditya Birla loan application form is a crucial document for individuals seeking financial assistance from Aditya Birla Housing Finance Limited. This form collects essential information about the applicant's financial background, employment status, and the purpose of the loan. Understanding the components of this form is vital for a smooth application process. Key sections typically include personal details, income verification, and property information if applicable. Each section must be filled out accurately to avoid delays in processing.

Steps to Complete the Aditya Birla Loan Application Form

Completing the Aditya Birla loan application form involves several straightforward steps. Begin by gathering necessary documents, such as proof of identity, income statements, and any relevant financial records. Next, fill out the form carefully, ensuring that all information is accurate and up to date. After completing the form, review it for any errors or omissions. Finally, submit the application online through the designated platform, ensuring that all required documents are attached. This process ensures that your application is processed efficiently.

Key Elements of the Aditya Birla Loan Application Form

Several key elements must be included in the Aditya Birla loan application form to ensure its validity. These elements typically encompass personal identification details, financial information, and loan specifics. Personal identification may include your name, address, and Social Security number. Financial information should outline your income sources and expenses. Additionally, specifying the loan amount and purpose is crucial for the lender's assessment. Ensuring these elements are complete and accurate is essential for a successful application.

Legal Use of the Aditya Birla Loan Application Form

The Aditya Birla loan application form is legally binding once submitted, provided it meets specific criteria. To ensure compliance, the form must be filled out truthfully and submitted through authorized channels. Electronic submissions are valid under U.S. eSignature laws, provided that the signatures are captured using a compliant platform. This legal recognition allows for a streamlined application process while ensuring that both the applicant and lender adhere to legal standards.

Eligibility Criteria for the Aditya Birla Loan

To qualify for a loan through the Aditya Birla loan application form, applicants must meet certain eligibility criteria. Typically, these criteria include age requirements, income thresholds, and credit score benchmarks. Applicants should be at least eighteen years old and demonstrate a stable income sufficient to cover loan repayments. A good credit score can significantly enhance the chances of approval. Understanding these criteria beforehand can help applicants prepare their financial documentation effectively.

Application Process & Approval Time

The application process for the Aditya Birla loan typically involves several stages. After submitting the loan application form, the lender reviews the provided information and conducts a credit assessment. This process can take anywhere from a few days to a couple of weeks, depending on the complexity of the application and the lender's workload. Applicants are usually notified of the decision via email or phone. Understanding this timeline can help applicants manage their expectations regarding loan disbursement.

Quick guide on how to complete loan application form aditya birla housing finance limited

Effortlessly Complete LOAN APPLICATION FORM Aditya Birla Housing Finance Limited on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary format and safely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without any hassles. Manage LOAN APPLICATION FORM Aditya Birla Housing Finance Limited on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

Steps to Edit and Electronically Sign LOAN APPLICATION FORM Aditya Birla Housing Finance Limited with Ease

- Obtain LOAN APPLICATION FORM Aditya Birla Housing Finance Limited and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important parts of your documents or obscure sensitive information with specialized tools offered by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your preference. Edit and electronically sign LOAN APPLICATION FORM Aditya Birla Housing Finance Limited and maintain effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan application form aditya birla housing finance limited

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to aditya birla apply loan online?

To aditya birla apply loan online, you need to visit the official website and navigate to the loan application section. Fill out the required information, including personal details and financial information. After submitting your application, you will receive updates regarding your loan status through email or SMS.

-

What documents are required to aditya birla apply loan online?

When you aditya birla apply loan online, you'll need to provide certain documents such as proof of identity, proof of income, and address verification. These documents help the lenders assess your eligibility for the loan. Make sure all documents are up-to-date to avoid any delays in processing your application.

-

Are there any fees associated with aditya birla apply loan online?

Yes, there may be processing fees and other charges when you aditya birla apply loan online. These fees vary depending on the loan amount and terms. It is recommended to review the fee structure on the website before applying to ensure you understand all potential costs.

-

What are the benefits of choosing Aditya Birla for my loan?

Choosing Aditya Birla when you aditya birla apply loan online means you get competitive interest rates, flexible repayment options, and a quick application process. They offer personalized customer support to guide you through every step. The trust associated with the Aditya Birla brand also adds a layer of assurance to your financial decision.

-

Can I track my loan application after I aditya birla apply loan online?

Yes, once you aditya birla apply loan online, you can track the status of your application through the online portal. You'll receive notifications via email or SMS regarding any updates. This feature provides transparency and keeps you informed about the progress of your loan application.

-

What types of loans can I aditya birla apply loan online for?

You can aditya birla apply loan online for various types of loans including personal loans, home loans, and auto loans. Each category has its specific eligibility criteria and terms. It’s essential to choose the type of loan that best suits your financial needs and goals.

-

Is the online loan application process secure?

Absolutely! The process to aditya birla apply loan online is secure, utilizing advanced encryption technologies to protect your personal and financial information. Aditya Birla takes data security seriously, ensuring that your details are safe throughout the application process.

Get more for LOAN APPLICATION FORM Aditya Birla Housing Finance Limited

- Taekwondo registration form

- Sleeping and napping arrangement form nyc

- Globalnet claim form

- Steering group agenda template form

- Domestic well water addendum spds form

- Special rate disability pension form

- Team certificate of entry dizzy dean baseball inc dizzydeanbbinc form

- Organist contract template form

Find out other LOAN APPLICATION FORM Aditya Birla Housing Finance Limited

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement