City of Flint Tax Forms

What is the City of Flint Tax Forms

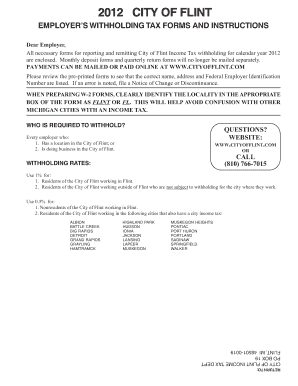

The City of Flint tax forms are official documents required for residents and businesses to report their income and calculate their tax liabilities. These forms are essential for ensuring compliance with local tax regulations. They include various types of tax filings, such as income tax returns and property tax assessments. Understanding these forms is crucial for accurate reporting and avoiding penalties.

How to Use the City of Flint Tax Forms

Using the City of Flint tax forms involves several steps. First, identify the specific form required for your situation, whether it’s for individual income tax or business tax. Next, gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Once you have the required information, fill out the form accurately, ensuring all sections are completed. After completing the form, review it for any errors before submission.

Steps to Complete the City of Flint Tax Forms

Completing the City of Flint tax forms can be streamlined by following these steps:

- Determine the correct tax form needed based on your filing status.

- Collect all relevant financial documentation, including income statements and deductions.

- Fill out the form carefully, ensuring accuracy in all entries.

- Double-check your calculations and information for any mistakes.

- Submit the completed form by the designated deadline, either online or via mail.

Legal Use of the City of Flint Tax Forms

The legal use of the City of Flint tax forms is governed by local tax laws and regulations. To be considered valid, these forms must be filled out completely and accurately. Electronic submissions are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant legislation. Ensuring that the forms are signed and submitted properly is essential for their legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the City of Flint tax forms vary depending on the type of tax being filed. Typically, individual income tax returns are due by April 15 each year. Business tax forms may have different deadlines, often aligned with the business's fiscal year. It is important to stay informed about these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The City of Flint tax forms can be submitted through various methods to accommodate different preferences. Residents can file their forms online using the city’s official tax portal, which offers a secure and efficient way to submit documents. Alternatively, forms can be mailed to the appropriate tax office or submitted in person. Each method has specific guidelines, so it is important to follow the instructions provided for each submission option.

Quick guide on how to complete city of flint tax forms 100023768

Effortlessly Prepare City Of Flint Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals. It serves as a seamless eco-friendly alternative to traditional printed and signed documents, allowing you to locate the desired form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without any hold-ups. Manage City Of Flint Tax Forms on any platform using airSlate SignNow apps for Android or iOS and streamline your document workflows today.

The most efficient way to modify and eSign City Of Flint Tax Forms effortlessly

- Find City Of Flint Tax Forms and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or disorganized files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Revise and eSign City Of Flint Tax Forms to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of flint tax forms 100023768

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling city of Flint tax forms?

airSlate SignNow offers several features designed to simplify the process of managing city of Flint tax forms. This includes easy document upload, seamless electronic signatures, and customizable templates. Users can track the status of their tax documents in real-time, ensuring they stay organized and compliant.

-

How does airSlate SignNow ensure the security of my city of Flint tax forms?

Security is a top priority for airSlate SignNow when handling city of Flint tax forms. The platform utilizes bank-level encryption and secure cloud storage to protect sensitive information. Additionally, users can employ multi-factor authentication to further enhance their document security.

-

Is there a free trial available for airSlate SignNow users needing city of Flint tax forms?

Yes, airSlate SignNow offers a free trial for new users, allowing them to explore features related to city of Flint tax forms without any commitment. This trial period lets prospective customers assess the platform's capabilities and see how it can benefit their tax documentation needs.

-

What is the pricing structure for using airSlate SignNow with city of Flint tax forms?

airSlate SignNow provides a competitive pricing structure tailored to various business sizes. Users can choose plans that fit their needs, particularly for managing city of Flint tax forms, ensuring cost-effectiveness while accessing all essential features.

-

Can I integrate airSlate SignNow with other applications for city of Flint tax forms?

Absolutely! airSlate SignNow supports integrations with various applications like Google Drive, Dropbox, and CRM systems, making it easier to manage city of Flint tax forms. This interoperability helps streamline workflows and enhance productivity by connecting different tools.

-

How does using airSlate SignNow improve the efficiency of city of Flint tax form processing?

Using airSlate SignNow signNowly improves the efficiency of processing city of Flint tax forms by automating document workflows. With features like reusable templates and bulk sending capabilities, businesses can save time and reduce errors, thus expediting the tax filing process.

-

What support options are available for airSlate SignNow users dealing with city of Flint tax forms?

Users of airSlate SignNow can access various support options, including a comprehensive help center, live chat, and email support. This ensures that any queries related to city of Flint tax forms are promptly addressed, allowing users to effectively navigate the platform.

Get more for City Of Flint Tax Forms

- I 20 certificate of eligibility for nonimmigrant student status sevp official form

- Letter of representation new york state department of labor labor ny form

- Kyc declaration form standard chartered bank

- San antonio sat airport parking validation form date booth sanantonio

- Credit card authorization form powersportsmax

- Bcs refund formdocx

- Download an english translation of your contract form

- Dcss 0069 2009 2019 form

Find out other City Of Flint Tax Forms

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure