Indemnity Bond Format for Employees

Understanding the Indemnity Bond Format for Employees

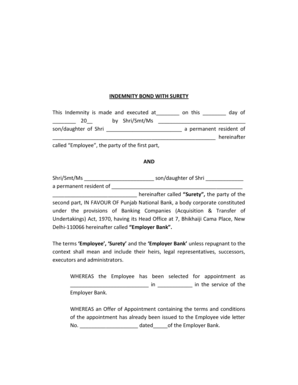

An indemnity bond for employees is a legal document that protects an employer against potential losses or damages caused by an employee's actions. This bond is particularly relevant in situations where an employee is entrusted with significant responsibilities, such as handling company funds or sensitive information. The indemnity bond format for employees typically includes essential details such as the names of the parties involved, the specific obligations of the employee, and the conditions under which the bond is enforceable. Understanding this format is crucial for both employers and employees to ensure clarity and compliance with legal standards.

Steps to Complete the Indemnity Bond Format for Employees

Completing the indemnity bond format for employees involves several important steps:

- Gather necessary information, including the names and addresses of the employer and employee.

- Clearly outline the responsibilities and obligations of the employee in the bond.

- Specify the amount of indemnity that the bond will cover, ensuring it reflects the potential risks involved.

- Include any relevant terms and conditions that govern the bond's execution.

- Review the document for accuracy and completeness before signing.

Following these steps helps ensure that the indemnity bond is legally binding and protects both parties involved.

Legal Use of the Indemnity Bond Format for Employees

The legal use of the indemnity bond format for employees is governed by various state and federal laws. It is essential for employers to ensure that the bond complies with applicable regulations to be enforceable in a court of law. This includes adhering to the requirements set forth by the Uniform Commercial Code (UCC) and any specific state statutes that may apply. Proper execution of the bond, including obtaining signatures from all parties and possibly a witness, is also crucial for its validity. Understanding these legal aspects helps mitigate risks associated with employee actions.

Key Elements of the Indemnity Bond Format for Employees

Several key elements must be included in the indemnity bond format for employees to ensure its effectiveness:

- Parties Involved: Clearly identify the employer and employee.

- Scope of Indemnity: Define the extent of indemnification for losses incurred due to the employee's actions.

- Duration: Specify the time period during which the bond is effective.

- Conditions: Outline any conditions under which the indemnity will be activated.

- Signatures: Ensure that all parties sign the document to validate it legally.

Incorporating these elements helps create a robust indemnity bond that protects the interests of both the employer and employee.

How to Use the Indemnity Bond Format for Employees

Using the indemnity bond format for employees involves several straightforward steps:

- Download the appropriate indemnity bond format PDF from a reliable source.

- Fill in the required information accurately, ensuring all details are correct.

- Review the completed document for any errors or omissions.

- Obtain necessary signatures from both the employer and employee.

- Store the signed document securely, as it may be needed for future reference.

Utilizing this format effectively ensures that both parties understand their rights and obligations under the bond.

Examples of Using the Indemnity Bond Format for Employees

Indemnity bonds for employees can be employed in various scenarios, including:

- An employee handling cash transactions in a retail environment.

- A contractor managing company equipment on job sites.

- Employees with access to confidential client information in a financial institution.

These examples illustrate the diverse applications of indemnity bonds, highlighting their importance in safeguarding business interests.

Quick guide on how to complete indemnity bond format for employees

Prepare Indemnity Bond Format For Employees effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Indemnity Bond Format For Employees on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Indemnity Bond Format For Employees with ease

- Obtain Indemnity Bond Format For Employees and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Indemnity Bond Format For Employees and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond format for employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond for bank transactions?

An indemnity bond for bank transactions is a legal agreement that protects the bank from potential losses. It assures the bank that it can recover funds if certain conditions are not met. Understanding this bond is crucial for businesses engaging in signNow financial transactions.

-

How much does an indemnity bond for bank cost?

The cost of an indemnity bond for bank transactions can vary widely based on the bond amount and the issuer’s requirements. Generally, fees are a small percentage of the total bond amount. It's advisable to compare rates from different providers to find the best deal.

-

What are the key features of airSlate SignNow's indemnity bond for bank solutions?

airSlate SignNow's indemnity bond for bank products feature easy documentation workflows, secure eSigning, and seamless integration with existing systems. These features ensure that businesses can manage their bonds efficiently. Additionally, our platform offers real-time tracking for complete transparency.

-

How does an indemnity bond for bank help businesses?

An indemnity bond for bank supports businesses by safeguarding their interests in financial transactions. It provides assurance to banks and can expedite loan approvals or credit applications. This bond ultimately enhances business credibility and trustworthiness.

-

Do I need an indemnity bond for bank if I have insurance?

While insurance may cover some risks, an indemnity bond for bank specifically protects financial transactions and contractual obligations. In many cases, banks require an indemnity bond regardless of existing insurance. It's best to consult with your bank to understand their specific requirements.

-

Can I integrate airSlate SignNow with my current banking software for indemnity bonds?

Absolutely! AirSlate SignNow allows seamless integration with various banking software for managing indemnity bonds. This integration streamlines the process, allowing businesses to send, sign, and manage bonds directly from their existing systems.

-

What benefits does airSlate SignNow offer for managing indemnity bonds?

Using airSlate SignNow for managing indemnity bonds offers numerous benefits, including enhanced security, easy document management, and reduced processing times. Our user-friendly platform simplifies the eSigning process, making it easier to handle important documents quickly and efficiently.

Get more for Indemnity Bond Format For Employees

Find out other Indemnity Bond Format For Employees

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement