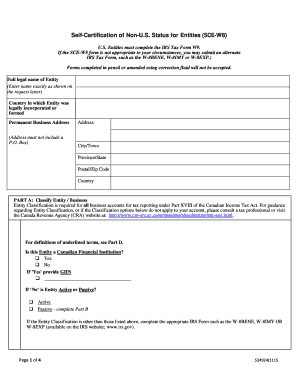

Sce W8 Form

What is the Sce W8

The Sce W8 form is a tax document used primarily by foreign individuals and entities to certify their foreign status for U.S. tax purposes. This form helps determine the appropriate withholding tax rate on income earned in the United States. By submitting the Sce W8, the filer asserts that they are not a U.S. person and are therefore eligible for certain tax exemptions or reduced withholding rates under applicable tax treaties. Understanding the purpose of the Sce W8 is essential for anyone engaged in business or earning income in the U.S. from abroad.

How to use the Sce W8

Using the Sce W8 form involves several key steps to ensure compliance with IRS regulations. First, the individual or entity must complete the form accurately, providing necessary information such as name, country of citizenship, and taxpayer identification number. Once completed, the form should be submitted to the U.S. withholding agent or financial institution that requires it. It is important to keep a copy of the submitted form for personal records. Additionally, the Sce W8 should be updated periodically, especially if there are changes in circumstances that affect the filer’s tax status.

Steps to complete the Sce W8

Completing the Sce W8 form requires careful attention to detail. Here are the essential steps:

- Download the latest version of the Sce W8 form from the IRS website.

- Fill in your personal information, including your name, address, and country of citizenship.

- Provide your foreign tax identification number, if applicable.

- Indicate the type of income you expect to receive from U.S. sources.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate withholding agent or financial institution.

Legal use of the Sce W8

The Sce W8 form is legally binding and must be used in compliance with IRS regulations. It serves as a declaration of foreign status and helps prevent unnecessary withholding of taxes on income earned in the United States. To ensure legal validity, the form must be completed correctly and submitted to the appropriate parties. Failure to provide a valid Sce W8 can result in higher withholding rates and potential penalties. It is advisable to consult a tax professional if there are any uncertainties regarding the completion or submission of the form.

Key elements of the Sce W8

Understanding the key elements of the Sce W8 form is crucial for proper completion. The form typically includes:

- Identification Information: Name, address, and country of citizenship.

- Tax Identification Number: Foreign tax identification number or U.S. taxpayer identification number, if applicable.

- Income Type: Specification of the type of income being received, such as dividends, interest, or royalties.

- Certification: A declaration confirming the accuracy of the information provided and the filer's foreign status.

Filing Deadlines / Important Dates

Timely submission of the Sce W8 form is essential to avoid unnecessary withholding taxes. While there is no specific deadline for submitting the form, it should be provided before any payment is made to the filer. It is advisable to submit the Sce W8 as soon as income is anticipated to ensure the correct withholding rate is applied. Additionally, the form should be updated and resubmitted whenever there are changes in the filer's status or if it has been more than three years since the last submission.

Quick guide on how to complete sce w8 254426216

Complete Sce W8 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Sce W8 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Sce W8 with ease

- Locate Sce W8 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Revise and eSign Sce W8 while ensuring effective communication at any step of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sce w8 254426216

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sce w8 form used for?

The sce w8 form is used by foreign individuals and entities to signNow their foreign status for tax purposes in the United States. By providing this form, users can avoid unnecessary withholding taxes on certain types of income. It is essential for ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the sce w8 form?

airSlate SignNow simplifies the process of filling out and signing the sce w8 form electronically. With our user-friendly interface, users can easily complete the form, ensuring that all required fields are accurately filled. This saves time and minimizes the risk of errors.

-

What are the pricing options for airSlate SignNow when dealing with the sce w8 form?

airSlate SignNow offers a variety of pricing plans to fit different business needs when handling the sce w8 form. Each plan includes essential features such as unlimited document signing and access to templates. Users can choose a plan that best suits their volume and frequency of use.

-

What features does airSlate SignNow provide for managing the sce w8 form?

With airSlate SignNow, users can take advantage of features such as document templates, real-time tracking, and alerts for the sce w8 form. These features streamline the signing process and ensure that users stay informed every step of the way. Additionally, the platform supports secure cloud storage for easy access.

-

Can airSlate SignNow integrate with other applications when handling the sce w8 form?

Yes, airSlate SignNow offers seamless integrations with various applications that can assist in managing the sce w8 form. This includes tools like Salesforce, Google Drive, and Dropbox. Such integrations allow users to streamline their workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for the sce w8 form compared to traditional methods?

Using airSlate SignNow for the sce w8 form provides numerous benefits over traditional methods, such as improved efficiency and reduced paperwork. The electronic signing process eliminates the need for printing, scanning, or mailing documents. Furthermore, it enhances security and keeps all documents organized in one place.

-

Is airSlate SignNow secure for handling sensitive information like the sce w8 form?

Absolutely! airSlate SignNow employs advanced encryption protocols and complies with privacy regulations to ensure that sensitive information like the sce w8 form is protected. Users can rest assured that their data remains confidential and secure throughout the signing process.

Get more for Sce W8

Find out other Sce W8

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document