Eftps Form 9787

What is the Eftps Form 9787

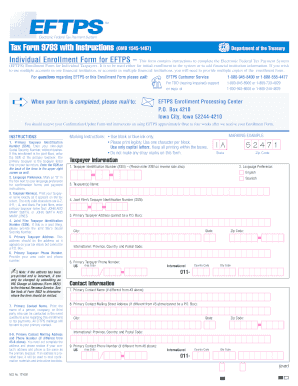

The Eftps Form 9787 is a crucial document used for electronic federal tax payment systems in the United States. This form allows taxpayers to enroll in the Electronic Federal Tax Payment System (EFTPS), enabling them to make secure electronic payments for various federal taxes. The form is essential for businesses and individuals who wish to manage their tax payments efficiently, ensuring compliance with IRS regulations.

How to use the Eftps Form 9787

Using the Eftps Form 9787 involves several key steps. First, ensure you have all necessary information, including your taxpayer identification number and banking details. Next, complete the form accurately, providing all required information. Once completed, submit the form electronically or via mail to the appropriate IRS address. After processing, you will receive confirmation of your enrollment, allowing you to start making electronic payments.

Steps to complete the Eftps Form 9787

Completing the Eftps Form 9787 requires careful attention to detail. Follow these steps:

- Gather required information, including your business name, address, and taxpayer identification number.

- Fill out the form with accurate banking information, ensuring the account is eligible for electronic payments.

- Review the completed form for any errors or omissions.

- Submit the form either online through the EFTPS website or by mailing it to the designated IRS address.

Legal use of the Eftps Form 9787

The legal use of the Eftps Form 9787 is governed by federal regulations that mandate compliance with the Internal Revenue Code. Properly executing this form ensures that taxpayers can make legitimate electronic payments for federal taxes. Additionally, the use of this form helps maintain accurate records for tax purposes, which can be crucial in the event of an audit.

Required Documents

To successfully complete the Eftps Form 9787, certain documents are required. These include:

- Your taxpayer identification number (TIN), which may be your Social Security number or Employer Identification Number.

- Bank account information, including the account number and routing number.

- Proof of identity, which may include a government-issued ID or other verification documents.

Form Submission Methods

The Eftps Form 9787 can be submitted through various methods. Taxpayers have the option to:

- Submit the form electronically through the EFTPS website for a quicker processing time.

- Mail the completed form to the designated IRS address, ensuring it is sent via a reliable postal service.

- Visit a local IRS office for in-person submission, if preferred.

Quick guide on how to complete eftps form 9787

Prepare Eftps Form 9787 effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Eftps Form 9787 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Eftps Form 9787 with ease

- Locate Eftps Form 9787 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Alter and eSign Eftps Form 9787 to ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eftps form 9787

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an EFTPS form and how can I use it with airSlate SignNow?

The EFTPS form is used for making electronic federal tax payments. With airSlate SignNow, you can easily upload and eSign your EFTPS form, ensuring that your tax payments are timely and tracked. Our platform offers an intuitive interface that guides you through the submission process.

-

How much does it cost to eSign an EFTPS form using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. You can sign up for a free trial to test the platform, and our plans start at competitive rates, making it a cost-effective solution for signing EFTPS forms and other documents.

-

Can I integrate airSlate SignNow with my accounting software for EFTPS forms?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing you to efficiently manage your EFTPS forms. This integration streamlines your workflow by automatically populating forms and simplifying document management, saving you time and reducing errors.

-

What features does airSlate SignNow offer for managing EFTPS forms?

airSlate SignNow includes features such as cloud storage, templates for EFTPS forms, and real-time tracking of document status. Additionally, you can set reminders for payment deadlines, ensuring that you never miss an important date related to your EFTPS submissions.

-

Is airSlate SignNow secure for handling EFTPS forms?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your documents, including EFTPS forms. Your sensitive information is secure throughout the signing process, ensuring compliance with industry standards.

-

Can multiple users collaborate on an EFTPS form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on an EFTPS form. You can invite team members to review and eSign the document, making it easy to gather necessary approvals without unnecessary delays.

-

What are the benefits of using airSlate SignNow for EFTPS forms?

Using airSlate SignNow for your EFTPS forms simplifies the signing process, saves time with electronic submission, and increases overall efficiency in handling tax payments. Additionally, you can access your forms from anywhere, making it a flexible solution for any business.

Get more for Eftps Form 9787

- Gymnastics certification online form

- Change of address in a non criminal case pinal county clerk of form

- Lumenwerx form

- Download the privacy release form matsui house

- Petition small claims court 7th judicial circuit court of missouri circuit7 form

- Pre sale property agreement template form

- Pre tenancy agreement template form

- Preconception agreement template 787746198 form

Find out other Eftps Form 9787

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free