Fillable Form O 255

What is the Fillable Form O 255

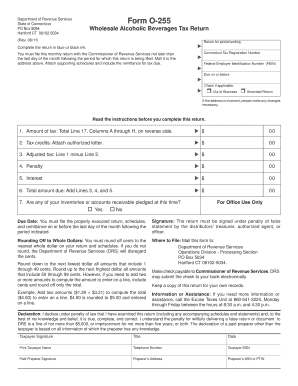

The fillable form O 255 is a specific document used in the United States for reporting certain tax-related information. This form is primarily utilized by businesses and individuals who need to report payments made to non-employees, such as independent contractors or freelancers. It serves as a record for the Internal Revenue Service (IRS) to ensure accurate tax reporting and compliance. Understanding the purpose and requirements of the fillable form O 255 is essential for proper tax management.

How to use the Fillable Form O 255

Using the fillable form O 255 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately report the payment amounts in the designated fields. It is crucial to review the completed form for any errors before submission. Once verified, the form can be submitted electronically or printed and mailed to the appropriate IRS office. Utilizing a digital platform can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Fillable Form O 255

Completing the fillable form O 255 involves a systematic approach to ensure all required information is accurately reported. Follow these steps:

- Obtain the latest version of the fillable form O 255 from the IRS website or a trusted source.

- Fill in the recipient's name, address, and TIN in the appropriate fields.

- Enter the total payment amounts made during the tax year.

- Review all entries for accuracy, ensuring no fields are left blank.

- Save the completed form electronically or print it for mailing.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Fillable Form O 255

The legal use of the fillable form O 255 is governed by IRS regulations, which dictate how and when the form should be filed. It is essential that the form is completed accurately to avoid issues with the IRS. Misreporting or failing to file the form can lead to penalties or audits. Additionally, maintaining records of all submitted forms is recommended for compliance and future reference. Understanding the legal implications of using this form helps ensure that businesses and individuals remain compliant with tax laws.

IRS Guidelines

The IRS provides specific guidelines for the fillable form O 255, detailing the information required and the filing process. These guidelines include instructions on who must file the form, the types of payments that need to be reported, and the deadlines for submission. It is important to stay updated with any changes to these guidelines, as they can affect how the form should be completed and filed. Familiarity with IRS guidelines ensures that users can navigate the requirements effectively.

Filing Deadlines / Important Dates

Filing deadlines for the fillable form O 255 are critical to avoid penalties. Generally, the form must be submitted by January 31 of the year following the tax year in which the payments were made. It is advisable to mark this date on your calendar and prepare the form in advance to ensure timely submission. Additionally, keeping track of any changes to filing deadlines announced by the IRS can help maintain compliance and avoid last-minute issues.

Quick guide on how to complete fillable form o 255

Complete Fillable Form O 255 effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, alter, and eSign your documents swiftly without delays. Handle Fillable Form O 255 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Fillable Form O 255 with no hassle

- Locate Fillable Form O 255 and click Get Form to begin.

- Utilize the tools we supply to finish your form.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Fillable Form O 255 and ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form o 255

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable form o 255 and how does it work?

A fillable form o 255 is a specialized document designed for easy data entry and electronic signatures. With airSlate SignNow, users can create and customize this form, allowing recipients to seamlessly complete required fields online. This digital solution streamlines the process, making it efficient and user-friendly.

-

How can airSlate SignNow help me create a fillable form o 255?

airSlate SignNow offers intuitive tools for creating a fillable form o 255 quickly and easily. Users can drag and drop fields, customize layouts, and ensure that essential information is captured accurately. This functionality enhances productivity and improves document workflows.

-

What are the pricing options for using airSlate SignNow to manage fillable form o 255?

airSlate SignNow provides flexible pricing plans designed to fit various business needs, including those who require fillable form o 255. Depending on your chosen plan, you can access features like unlimited signatures and advanced templates. It's an affordable solution for businesses looking to optimize their document management.

-

Can I integrate other applications with airSlate SignNow's fillable form o 255?

Yes, airSlate SignNow supports integration with numerous applications, enhancing the functionality of your fillable form o 255. This includes platforms like Google Drive, Dropbox, and various CRM systems. These integrations help streamline your document management and improve overall efficiency.

-

What are the key benefits of using a fillable form o 255 with airSlate SignNow?

Using a fillable form o 255 with airSlate SignNow offers numerous benefits, such as increased accuracy, faster turnaround times, and enhanced user experience. The ability to capture data electronically minimizes errors and ensures compliance. Additionally, eSigning reduces the time spent on document handling.

-

Is it secure to use airSlate SignNow for fillable form o 255?

Absolutely, airSlate SignNow prioritizes security, employing encryption and other protective measures for your fillable form o 255. User data is safeguarded, ensuring confidentiality and compliance with legal standards. You can trust airSlate SignNow to keep your documents secure.

-

How can I track the status of fillable form o 255 using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your fillable form o 255 in real time. The platform provides notifications and updates that inform you when a document is viewed, signed, or completed. This feature enhances your ability to manage workflows efficiently.

Get more for Fillable Form O 255

Find out other Fillable Form O 255

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form