Itr Form

What is the ITR Form

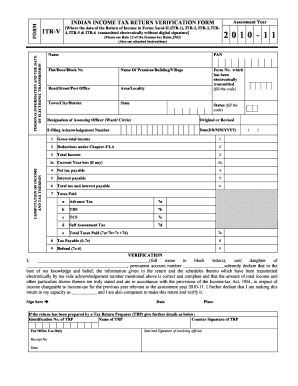

The ITR form, or Income Tax Return form, is a document used by taxpayers in the United States to report their income, expenses, and other pertinent tax information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to accurately calculate their tax obligations. By filing the ITR form, taxpayers can determine whether they owe additional taxes or are eligible for refunds. There are various versions of the ITR form designed for different types of taxpayers, including individuals, corporations, and partnerships.

Steps to Complete the ITR Form

Completing the ITR form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, choose the appropriate ITR form based on your filing status and income level. After selecting the form, fill in your personal information, including your Social Security number and address. Then, report your income and deductions accurately. Finally, review the completed form for errors before submitting it to the IRS, either electronically or by mail.

Legal Use of the ITR Form

The legal use of the ITR form is governed by IRS regulations. To ensure that your submission is valid, it is crucial to comply with all requirements outlined by the IRS. This includes using the correct form version, providing accurate information, and signing the form where required. Electronic submissions must also adhere to eSignature laws, ensuring that any digital signatures used are legally binding. Failure to comply with these regulations can result in penalties or delays in processing your return.

Filing Deadlines / Important Dates

Filing deadlines for the ITR form are crucial for taxpayers to keep in mind. Typically, the deadline for individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension to file their return, but this does not extend the time to pay any taxes owed. Important dates related to the ITR form also include deadlines for estimated tax payments, which are usually due quarterly.

Required Documents

To complete the ITR form accurately, several documents are typically required. These include income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and any documentation related to deductions or credits, such as mortgage interest statements or educational expenses. Taxpayers should also have their Social Security number and any previous year’s tax returns on hand to ensure all information is consistent and complete.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several methods available for submitting the ITR form. The most common method is electronic filing (e-filing), which allows for faster processing and quicker refunds. Alternatively, taxpayers can mail their completed forms to the appropriate IRS address based on their location and the type of form filed. In-person submission is also an option at designated IRS offices, although this method is less common. Each submission method has its own processing times and requirements, so it is essential to choose the one that best suits your needs.

Examples of Using the ITR Form

The ITR form can be utilized in various scenarios, depending on the taxpayer's situation. For instance, individuals who are self-employed will use the ITR form to report their business income and expenses. Similarly, families may use the form to claim deductions for dependents and education expenses. Corporations will file a different version of the ITR form to report their profits and losses. Understanding how to apply the ITR form in these contexts can help ensure compliance and optimize tax benefits.

Quick guide on how to complete itr form

Complete Itr Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without interruptions. Manage Itr Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Itr Form with ease

- Locate Itr Form and click on Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it onto your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies of the document. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Itr Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ITR form and why is it important?

An ITR form, or Income Tax Return form, is a crucial document that individuals and businesses must submit to the tax department to declare their income for a financial year. Submitting the ITR form accurately ensures compliance with tax regulations and helps avoid penalties.

-

How can airSlate SignNow assist with the ITR form?

airSlate SignNow offers a seamless way to electronically sign and send your ITR form to the relevant authorities. Our platform ensures that all documents are secure, legally binding, and easily trackable, streamlining your tax filing process.

-

What features does airSlate SignNow provide for ITR form submissions?

With airSlate SignNow, you can easily upload your ITR form, add necessary fields for signatures, and send them to recipients quickly. Additional features include document tracking, customizable templates, and integration with other tax software to simplify your workflow.

-

Is there a cost associated with using airSlate SignNow for ITR forms?

Yes, airSlate SignNow offers several pricing plans to suit different business needs. Each plan includes features that facilitate the efficient submission of ITR forms, providing excellent value for those looking to manage their documents and eSignatures effectively.

-

Can I integrate airSlate SignNow with other tools for managing ITR forms?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, including popular accounting and tax software, allowing you to manage your ITR form submissions smoothly. This integration enhances your workflow and minimizes manual errors.

-

What are the benefits of using airSlate SignNow for ITR form signing?

The main benefits include enhanced security, faster processing times, and reduced paperwork. With airSlate SignNow, you can expedite your ITR form signing process, ensuring timely submissions while maintaining compliance with tax regulations.

-

How secure is my data when using airSlate SignNow for ITR forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure servers to protect your ITR form and sensitive information, ensuring that your documents are safe from unauthorized access or bsignNowes.

Get more for Itr Form

- Ride along application city of greeley form

- Transact tp002 form

- Work ethics evaluation form oftc oftc

- Advanced placement in english literature and composition the kite runner kelli kuntz form

- 30 60 90 day plan form

- Consort checklist of items to include when reporting a randomized trial product name form

- Backflow preventer assembly test report siesta beach scgov form

- Data non disclosure agreement template form

Find out other Itr Form

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast