Bank of Guam Loan Application Form

What is the Bank of Guam Loan Application

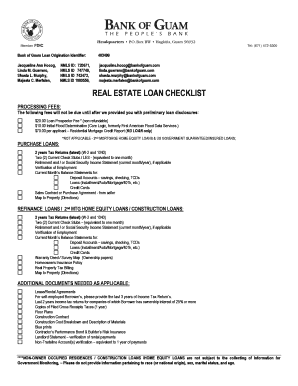

The Bank of Guam loan application is a formal document used by individuals seeking to obtain a loan from the Bank of Guam. This application is essential for initiating the loan process, allowing the bank to assess the borrower's financial situation and creditworthiness. The application typically requires personal information, details about the loan amount requested, and the purpose of the loan. It is crucial for applicants to provide accurate and complete information to facilitate a smooth review process.

Steps to complete the Bank of Guam Loan Application

Completing the Bank of Guam loan application involves several key steps to ensure that all necessary information is accurately provided. Here are the steps to follow:

- Gather required documents, such as identification, proof of income, and credit history.

- Access the Bank of Guam loan application PDF, which can be downloaded from their official website.

- Fill out the application form, ensuring all sections are completed accurately.

- Review the application for any errors or missing information.

- Submit the completed application either online, by mail, or in person at a local branch.

How to obtain the Bank of Guam Loan Application

The Bank of Guam loan application can be obtained through various methods. Applicants can download the loan application PDF directly from the Bank of Guam's official website. Additionally, physical copies of the application may be available at any Bank of Guam branch, where staff can also provide assistance in completing the form. It is advisable to ensure that you have the most current version of the application to avoid any processing delays.

Legal use of the Bank of Guam Loan Application

The legal use of the Bank of Guam loan application is governed by specific regulations that ensure the validity and enforceability of the document. To be considered legally binding, the application must comply with federal and state laws regarding loan agreements. This includes obtaining the necessary signatures and ensuring that the applicant understands the terms and conditions of the loan. Utilizing a secure platform for electronic signatures can enhance the legal standing of the application.

Required Documents

When completing the Bank of Guam loan application, several documents are typically required to support the application. These may include:

- Government-issued identification (e.g., driver's license or passport).

- Proof of income, such as recent pay stubs or tax returns.

- Credit history or a credit report.

- Details of any existing debts or financial obligations.

Providing these documents helps the bank assess the applicant's financial situation and make informed lending decisions.

Application Process & Approval Time

The application process for a Bank of Guam loan typically involves several stages. After submitting the completed loan application, the bank will review the information provided, which may take a few days to a couple of weeks, depending on the complexity of the application and the volume of requests. During this time, the bank may contact the applicant for additional information or clarification. Once the review is complete, the applicant will be notified of the approval status and any further steps required to finalize the loan.

Quick guide on how to complete bank of guam loan application

Effortlessly Prepare Bank Of Guam Loan Application on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Administer Bank Of Guam Loan Application on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-based tasks today.

The Easiest Way to Modify and eSign Bank Of Guam Loan Application Seamlessly

- Locate Bank Of Guam Loan Application and click on Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Bank Of Guam Loan Application to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of guam loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bank of Guam loan application pdf?

The bank of Guam loan application pdf is a digital form that applicants can easily fill out and submit when applying for a loan. This PDF format allows for convenient access and filing, ensuring that all necessary information is provided efficiently. Utilizing this application can help streamline your loan process.

-

How can I obtain the bank of Guam loan application pdf?

You can download the bank of Guam loan application pdf directly from the bank's official website or request it from your local branch. Ensure you have the latest version to avoid any issues during your application process. Having the correct document is crucial to expedite your loan request.

-

Are there any fees associated with submitting the bank of Guam loan application pdf?

There are typically no fees for submitting the bank of Guam loan application pdf itself. However, other fees may apply during the loan process, such as processing fees or any applicable charges based on your loan terms. It’s advisable to review these details with the bank to avoid any surprises.

-

What information is required on the bank of Guam loan application pdf?

The bank of Guam loan application pdf generally requires personal information such as your name, address, income details, and the type of loan you are applying for. Additional documentation may also be needed, so ensure to check the specific requirements for a smooth application experience. Completing all sections accurately will facilitate a quicker approval process.

-

How does eSigning the bank of Guam loan application pdf work?

eSigning the bank of Guam loan application pdf can be done through platforms like airSlate SignNow, which is designed to securely sign documents electronically. This process involves uploading your PDF, adding your signature, and then submitting it directly to the bank. Using an eSign solution not only speeds up the approval but also provides a digital trail of your submission.

-

What are the benefits of using the bank of Guam loan application pdf?

Using the bank of Guam loan application pdf simplifies the loan process by providing a standardized format that is easy to fill out and submit. It can save you time and reduce errors, leading to a faster loan approval. Additionally, it helps ensure that all required information is provided upfront, enhancing your chances for a successful application.

-

Can I edit the bank of Guam loan application pdf after filling it out?

Once you have filled out the bank of Guam loan application pdf, it’s generally advisable to review your entries for accuracy before submission. Depending on the PDF software used, you may be able to edit the document as needed. However, some signatures or formal submissions might limit your ability to make changes after a certain point.

Get more for Bank Of Guam Loan Application

- Aero nz auckland goods return form docx

- Fillable bankruptcy questionnaire form

- Sti drug order request form bc centre for disease control bccdc

- Nlc application form 389901695

- As per jawahar navodaya vidyalaya form

- Royal mail claim form fill online printable fillable blank

- Restaurant management agreement template form

- Restaurant management service agreement template form

Find out other Bank Of Guam Loan Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors