Form 3ca

What is the Form 3ca

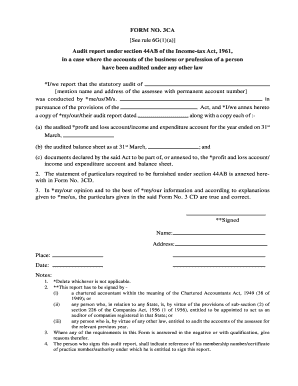

The Form 3ca is a specific document used in various administrative processes. It serves a distinct purpose, often related to compliance and reporting requirements. Understanding the nature of this form is essential for individuals and businesses alike, as it plays a crucial role in ensuring that necessary information is accurately conveyed to the relevant authorities.

How to use the Form 3ca

Using the Form 3ca involves several steps to ensure proper completion and submission. Begin by gathering all required information and documents needed to fill out the form. Carefully follow the instructions provided with the form to avoid errors. Once completed, review the form for accuracy before submitting it to the appropriate agency or department.

Steps to complete the Form 3ca

Completing the Form 3ca requires attention to detail. Follow these steps:

- Start with personal or business identification details.

- Provide any necessary financial information related to the form's purpose.

- Ensure all sections are filled out completely and accurately.

- Review the form for any mistakes or omissions.

- Sign and date the form as required.

Legal use of the Form 3ca

The legal use of the Form 3ca is governed by specific regulations and guidelines. To ensure that the form is legally binding, it must be completed in accordance with applicable laws. This includes providing accurate information and signatures. Compliance with relevant legal frameworks enhances the validity of the form in any official capacity.

Key elements of the Form 3ca

Key elements of the Form 3ca include essential information that must be accurately reported. This typically involves:

- Identification details of the individual or entity completing the form.

- Specific data relevant to the purpose of the form.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3ca are crucial to ensure compliance. These dates can vary based on the specific requirements of the agency or department requesting the form. It is important to stay informed about any deadlines to avoid penalties or complications. Always check for updates regarding filing dates to ensure timely submission.

Quick guide on how to complete form 3ca

Effortlessly Prepare Form 3ca on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 3ca on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form 3ca with Ease

- Obtain Form 3ca and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with a few clicks from any device of your choosing. Edit and electronically sign Form 3ca to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 3ca in the context of airSlate SignNow?

3ca refers to the streamlined capabilities of airSlate SignNow, which allows businesses to create, send, and eSign documents efficiently. This powerful solution simplifies the signing process and enhances document workflow, making it an essential tool for modern businesses.

-

How does airSlate SignNow pricing work for the 3ca features?

The pricing for airSlate SignNow is designed to be flexible and cost-effective, ensuring that businesses can access the complete 3ca features without breaking the bank. Plans vary based on user needs and the level of functionality required, making it accessible for companies of all sizes.

-

What are the key features of airSlate SignNow related to 3ca?

Key features of airSlate SignNow that relate to 3ca include easy document creation, robust eSignature capabilities, workflow automation, and integration with various applications. These features work together to enhance overall productivity and efficiency in document handling.

-

What benefits can businesses expect from using 3ca with airSlate SignNow?

By using 3ca with airSlate SignNow, businesses can expect faster document processing, improved customer satisfaction, and reduced paper usage. This leads to greater efficiency and allows teams to focus on more strategic tasks rather than getting bogged down in administrative work.

-

Can airSlate SignNow integrate with other applications while using 3ca features?

Yes, airSlate SignNow offers seamless integration with a variety of applications while utilizing 3ca features. This flexibility allows businesses to connect their existing tools and streamline their workflows, enhancing overall productivity across their operations.

-

Is airSlate SignNow secure for handling sensitive documents with 3ca?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that sensitive documents are handled securely when utilizing 3ca features. With industry-leading encryption and robust authentication measures, users can trust that their data remains protected.

-

How easy is it to use airSlate SignNow with the 3ca interface?

The 3ca interface of airSlate SignNow is designed for ease of use, allowing users to navigate effortlessly through document creation and signing processes. With an intuitive design, even those with minimal technical skills can quickly become proficient.

Get more for Form 3ca

- Bloomsburg university of pennsylvania applicant bloomu form

- Custom crush agreement 1 company address 2 law uoregon form

- Malay chamber of commerce certificate of origin form

- Adventist university of the philippines online application form

- Nozha language school sheets form

- Film license agreement template 787742285 form

- Film location agreement template form

- Film producer agreement template form

Find out other Form 3ca

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy