Formulario 481 1

What is the Formulario 481 1

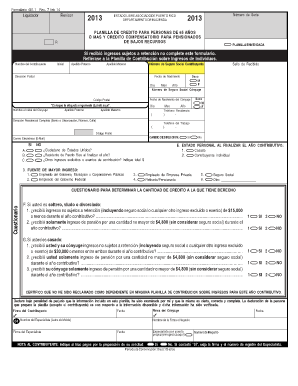

The formulario 481 1 is a specific form used for reporting certain financial information, particularly in tax-related contexts. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal regulations. The form collects data necessary for the Internal Revenue Service (IRS) to assess tax liabilities and entitlements.

How to use the Formulario 481 1

Using the formulario 481 1 involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form accurately, ensuring that all figures are correct and correspond to your financial records. Once completed, review the form for any errors before submission.

Steps to complete the Formulario 481 1

Completing the formulario 481 1 requires a systematic approach:

- Gather relevant financial documentation.

- Review the form's instructions thoroughly.

- Fill in personal information, including name, address, and Social Security number.

- Report income and any deductions accurately.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Formulario 481 1

The formulario 481 1 must be used in accordance with IRS regulations to be considered legally binding. This means that all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties or legal consequences. It is crucial to ensure compliance with all applicable laws and guidelines when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the formulario 481 1 are typically aligned with the annual tax filing schedule. It is important to be aware of these dates to avoid penalties. Generally, individual taxpayers must submit their forms by April 15 of each year, while businesses may have different deadlines based on their fiscal year. Always check for any updates or changes to these deadlines to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The formulario 481 1 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the IRS website or authorized e-filing services.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Each method has its own processing times and requirements, so choose the one that best suits your needs.

Quick guide on how to complete formulario 481 1

Effortlessly Prepare Formulario 481 1 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly without any holdups. Manage Formulario 481 1 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to Edit and Electronically Sign Formulario 481 1 with Ease

- Find Formulario 481 1 and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, and mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Formulario 481 1 to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 481 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is formulario 481 1?

Formulario 481 1 is a specialized document designed for specific workflows. It often requires electronic signatures and can be efficiently managed using airSlate SignNow. Our platform simplifies the completion and submission of formulario 481 1, ensuring compliance and accuracy.

-

How does airSlate SignNow help with formulario 481 1?

AirSlate SignNow provides an intuitive interface to fill out and eSign formulario 481 1 quickly. Our platform offers features like templates and workflow automation that streamline the process. You can easily track the status of your formulario 481 1 in real time.

-

Is there a cost associated with using airSlate SignNow for formulario 481 1?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective. Pricing plans are flexible and cater to various business needs, providing excellent value for handling your formulario 481 1 and other documents. A free trial is also available for you to explore the features.

-

Can I integrate airSlate SignNow with other software for formulario 481 1 processing?

Absolutely! AirSlate SignNow offers seamless integration with various tools, enabling efficient processing of formulario 481 1. These integrations help automate workflows and centralize document management, ensuring a smooth operation across your business applications.

-

What are the key benefits of using airSlate SignNow for formulario 481 1?

Using airSlate SignNow for formulario 481 1 provides enhanced efficiency and legality in document transactions. It reduces paperwork, accelerates the signing process, and ensures documents are securely stored. Additionally, the platform offers tracking capabilities for real-time updates.

-

Is airSlate SignNow secure for managing formulario 481 1?

Yes, airSlate SignNow prioritizes security for all documents, including formulario 481 1. We employ strong encryption protocols and follow industry standards to protect your information. Rest assured that your documents are secure throughout the signing and storage process.

-

How can I get started with formulario 481 1 on airSlate SignNow?

Getting started with formulario 481 1 on airSlate SignNow is simple. You can sign up for a free trial to explore our features, create your document template, and begin the signing process. Our user-friendly interface makes it easy to navigate through all necessary steps.

Get more for Formulario 481 1

- Medical board of california enf 22 revised 8 form

- Youth club membership form template 207416034

- Elko county ambulance physician certification for transport form

- Gunandgame form

- Form n 200v

- Loaner agreement template form

- Loaner car agreement template 787744251 form

- Loaner equipment agreement template form

Find out other Formulario 481 1

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document