What Amount of Consideration Should Be Put on a Deed to Transfer Form

Understanding the Consideration in a Deed to Transfer

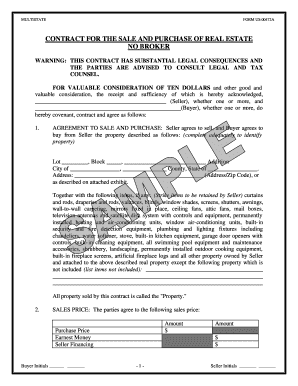

The consideration in a deed to transfer property refers to the actual amount paid for the property. This amount is crucial as it establishes the value exchanged between the buyer and the seller. Typically, the deed will explicitly state this amount to ensure clarity and legal validity. In most cases, the full actual consideration paid for the property is included in the deed to provide transparency and to comply with state regulations. This practice helps prevent disputes regarding the property's value and ensures that all parties are aware of the financial terms involved in the transaction.

Steps to Complete the Deed with Actual Consideration

Filling out a deed to transfer property with the actual consideration involves several key steps:

- Gather necessary information, including the names of the buyer and seller, property description, and the actual consideration amount.

- Obtain the correct deed form, which may vary by state. Ensure it is the most current version.

- Fill in the form accurately, including the full actual consideration paid for the property in the designated section.

- Review the completed deed for accuracy and completeness before signing.

- Sign the deed in the presence of a notary public to ensure its legal validity.

- File the signed deed with the appropriate county office to officially record the transaction.

Legal Use of Consideration in a Deed

The legal use of consideration in a deed to transfer property is fundamental in establishing the terms of the sale. It serves as evidence of the transaction and is often required by law to be disclosed. In many jurisdictions, failing to accurately report the actual consideration can lead to legal complications, including potential disputes over property ownership and tax implications. Therefore, it is essential to ensure that the consideration stated in the deed reflects the true amount paid, as this can affect the property's tax assessment and future transactions.

State-Specific Rules for Consideration in Deeds

Each state in the United States has its own regulations regarding the requirement of stating consideration in a deed. Some states may mandate that the actual consideration be disclosed, while others may allow for a nominal amount to be stated. It is important to consult state-specific laws or a legal professional to understand the requirements in your jurisdiction. This ensures compliance and helps avoid potential issues during the property transfer process.

Examples of Actual Consideration in Deeds

When drafting a deed, the actual consideration can take various forms, depending on the nature of the transaction. Here are a few examples:

- A residential property sold for $250,000 would have that amount listed as the actual consideration in the deed.

- A commercial property transferred for $1,000,000 would similarly state that figure.

- In some cases, properties may be transferred as gifts or for nominal amounts, such as $1, which should still be clearly stated in the deed.

Required Documents for Filing a Deed

To file a deed to transfer property, several documents are typically required, including:

- The completed deed form with the actual consideration stated.

- A valid form of identification for both the buyer and seller.

- Any additional documents required by the state, such as a property survey or tax clearance certificate.

Having all necessary documents prepared can facilitate a smoother filing process and help ensure compliance with local regulations.

Quick guide on how to complete what amount of consideration should be put on a deed to transfer

Complete What Amount Of Consideration Should Be Put On A Deed To Transfer effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly without any delays. Handle What Amount Of Consideration Should Be Put On A Deed To Transfer on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign What Amount Of Consideration Should Be Put On A Deed To Transfer with ease

- Locate What Amount Of Consideration Should Be Put On A Deed To Transfer and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Mark essential sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for such purposes.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign What Amount Of Consideration Should Be Put On A Deed To Transfer to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what amount of consideration should be put on a deed to transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What type of deed should I use if I want to document the full actual consideration paid for a property?

The deed that would be most likely to recite the full actual consideration paid for the property is typically a warranty deed. This type of deed provides a guarantee that the seller holds clear title to the property and is legally able to transfer ownership. Additionally, warranty deeds usually include the sale price, ensuring transparency in the transaction.

-

How can airSlate SignNow help me create a deed that discloses the consideration paid for my property?

airSlate SignNow offers an intuitive platform for creating legally binding documents, including deeds. You can easily customize your deed template to include fields for the full actual consideration paid for the property, making it simple to ensure that all pertinent information is documented correctly and securely.

-

Is there a specific feature in airSlate SignNow that helps with real estate transactions?

Yes, airSlate SignNow provides several features that streamline real estate transactions, including templates for various types of deeds. With these templates, you can specifically address which deed would be most likely to recite the full actual consideration paid for the property, ensuring compliance and clarity in your documentation.

-

What are the pricing options for using airSlate SignNow for eSigning deeds?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses alike. Each plan includes access to features that assist in real estate transactions, including the ability to create and eSign deeds referencing which deed would be most likely to recite the full actual consideration paid for the property more effectively.

-

Can I integrate airSlate SignNow with other tools I am currently using?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, allowing you to enhance your document management process. This means you can easily share your finalized deeds, including those that document the full actual consideration paid for the property, with your existing CRM or project management tools.

-

What benefits does using airSlate SignNow provide for managing real estate documents?

Using airSlate SignNow for managing real estate documents streamlines the process by providing secure eSigning capabilities, document tracking, and easy access to templates. This efficiency is particularly valuable when dealing with documents like deeds that need to specify which deed would be most likely to recite the full actual consideration paid for the property, ensuring smooth transactions.

-

What kind of support does airSlate SignNow offer if I encounter issues with my deed?

airSlate SignNow provides robust customer support through various channels, including live chat and email. Whether you have questions about creating a deed or need assistance with details like which deed would be most likely to recite the full actual consideration paid for the property, our support team is ready to help you promptly.

Get more for What Amount Of Consideration Should Be Put On A Deed To Transfer

- Formulario unico de tramite

- Auto draft authorization formampquot keyword found websites

- Building department submittal requirements town of miami lakes miamilakes fl form

- Boxers federal identification card application georgia form

- Spay neuter clinic form

- T79 form american airlines

- Oklahoma license surrender form ok

- Tax vermont exempt form

Find out other What Amount Of Consideration Should Be Put On A Deed To Transfer

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online