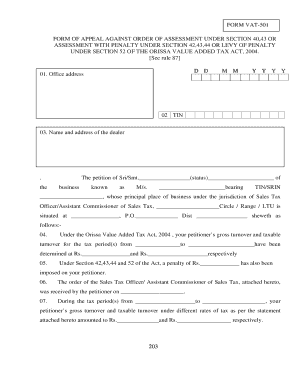

Vat 501 Form

What is the VAT 501?

The VAT 501 form is a document used for reporting value-added tax (VAT) obligations in the United States. It serves as a means for businesses to declare their VAT liabilities and ensure compliance with tax regulations. This form is essential for businesses that engage in taxable transactions and need to report their VAT collected and paid. Understanding the VAT 501 is crucial for maintaining accurate financial records and fulfilling legal obligations related to VAT.

How to Obtain the VAT 501

Obtaining the VAT 501 form is straightforward. Businesses can typically download the form from the official state tax authority website or request a physical copy from their local tax office. It is important to ensure that the version of the form is current and applicable to the specific tax period being reported. Additionally, some states may offer the option to complete the VAT 501 online through their tax filing portals.

Steps to Complete the VAT 501

Completing the VAT 501 form involves several key steps:

- Gather financial records: Collect all relevant documents, including sales invoices, purchase receipts, and prior VAT filings.

- Calculate VAT collected: Determine the total VAT collected from sales during the reporting period.

- Calculate VAT paid: Sum the VAT paid on eligible purchases and expenses.

- Fill out the form: Enter the calculated figures into the appropriate sections of the VAT 501.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the form: Follow the submission guidelines, whether filing online, by mail, or in person.

Legal Use of the VAT 501

The VAT 501 form must be completed and submitted in accordance with state and federal tax laws. Legal use of the form ensures that businesses remain compliant with VAT regulations, which can vary by state. Failure to use the form correctly can result in penalties, fines, or legal repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding the legal requirements associated with the VAT 501.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the reporting and payment of VAT for businesses. While the VAT 501 is primarily a state-level form, understanding IRS regulations is essential for ensuring compliance with federal tax laws. Businesses should familiarize themselves with IRS publications related to VAT to avoid any discrepancies in their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 501 can vary based on the state and the specific tax period. Most states require businesses to submit the VAT 501 on a quarterly or annual basis. It is crucial to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to VAT filings can help ensure timely submissions.

Quick guide on how to complete vat 501

Complete vat 501 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage vat 501 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to alter and eSign vat 501 effortlessly

- Locate vat 501 and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign vat 501 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to vat 501

Create this form in 5 minutes!

How to create an eSignature for the vat 501

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask vat 501

-

What is VAT 501 and how does it relate to airSlate SignNow?

VAT 501 is a crucial document for businesses when dealing with VAT obligations. With airSlate SignNow, you can easily create, eSign, and send VAT 501 forms, ensuring compliance and streamlining your financial processes.

-

How can airSlate SignNow help with VAT 501 documentation?

AirSlate SignNow simplifies the management of VAT 501 documentation by providing a secure platform for digital signatures. This means you can quickly and efficiently handle your VAT 501 forms without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for VAT 501?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. By choosing the right plan, you can utilize features that specifically assist with VAT 501, ensuring you get maximum value for your investment.

-

Can airSlate SignNow integrate with other accounting software for VAT 501?

Yes, airSlate SignNow seamlessly integrates with various accounting software to facilitate the management of VAT 501 forms. This integration allows for streamlined data flow and better tracking of your VAT obligations.

-

What features of airSlate SignNow are beneficial for handling VAT 501?

Key features of airSlate SignNow that benefit VAT 501 management include template creation, real-time tracking, and automated reminders. These tools enhance efficiency and help ensure that your VAT 501 submissions are timely and compliant.

-

How secure is my VAT 501 data with airSlate SignNow?

AirSlate SignNow prioritizes the security of your data, including VAT 501 forms. With features like end-to-end encryption and secure cloud storage, your sensitive information remains protected throughout the signing process.

-

Is airSlate SignNow user-friendly for businesses using VAT 501?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform. This ensures that even those new to VAT 501 can manage their documents effortlessly.

Get more for vat 501

- Eb 2eb 3 information form

- Instructions for completing the online nomination form university of hawaii

- Accommodation information hotel accommodation hawaii

- Natorules pdf nato the next war in europe boardgamegeek form

- Model 039 form

- Formulario 039

- Certificado de deuda a anular form

- Certificado de ingresos posteriores al envio para gestin en va de apremio form

Find out other vat 501

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation