941 Pr Fillable Form

What is the 941 Pr Fillable Form

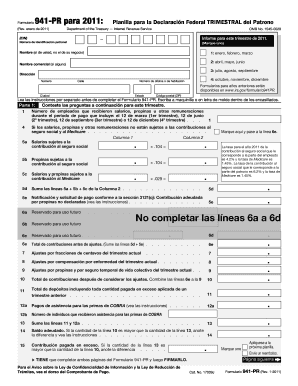

The 941 Pr Fillable Form is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax regulations. It is specifically designed for employers who pay wages to employees and must be filed quarterly. The form provides the IRS with information about the taxes withheld and the employer's share of Social Security and Medicare taxes.

How to use the 941 Pr Fillable Form

Using the 941 Pr Fillable Form involves several key steps. First, gather all necessary payroll information, including total wages paid to employees, the amount of federal income tax withheld, and the employer's share of Social Security and Medicare taxes. Next, access the fillable form online, where you can enter the required information directly into the fields. After completing the form, review all entries for accuracy to avoid potential penalties. Finally, submit the form electronically or print it for mailing, ensuring it is sent by the appropriate deadline.

Steps to complete the 941 Pr Fillable Form

Completing the 941 Pr Fillable Form requires careful attention to detail. Follow these steps:

- Step one: Enter your business information, including the employer identification number (EIN), business name, and address.

- Step two: Report the total number of employees and total wages paid during the quarter.

- Step three: Calculate the federal income tax withheld and the amounts for Social Security and Medicare taxes.

- Step four: Determine any adjustments for the current quarter, such as sick leave credits or other tax credits.

- Step five: Sign and date the form to certify that the information provided is accurate.

Legal use of the 941 Pr Fillable Form

The 941 Pr Fillable Form is legally binding when completed and submitted in compliance with IRS regulations. It is crucial for employers to provide accurate information, as discrepancies can lead to audits or penalties. The form must be filed quarterly, and failure to do so can result in fines. Moreover, using a secure platform for electronic submission ensures that the form is legally recognized and protects sensitive information.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the 941 Pr Fillable Form to avoid penalties. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First quarter (January to March): April 30

- Second quarter (April to June): July 31

- Third quarter (July to September): October 31

- Fourth quarter (October to December): January 31

Form Submission Methods (Online / Mail / In-Person)

The 941 Pr Fillable Form can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing a printed copy of the completed form to the appropriate IRS address based on the employer's location.

- In-person delivery at designated IRS offices, though this method is less common.

Quick guide on how to complete 941 pr fillable form

Prepare 941 Pr Fillable Form seamlessly on any gadget

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without any hold-up. Handle 941 Pr Fillable Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to alter and eSign 941 Pr Fillable Form effortlessly

- Locate 941 Pr Fillable Form and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 941 Pr Fillable Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941 pr fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 Pr Fillable Form and why is it important?

The 941 Pr Fillable Form is a critical document used for reporting federal payroll taxes. It is essential for businesses to accurately file this form to remain compliant with IRS regulations. Using a fillable version allows for easier completion and submission, ensuring you meet all deadlines without hassle.

-

How can airSlate SignNow help me with the 941 Pr Fillable Form?

airSlate SignNow provides an efficient platform to fill out and eSign the 941 Pr Fillable Form securely. Our solution offers customizable templates and easy document sharing, simplifying the process of managing payroll tax submissions. By leveraging our services, you can enhance accuracy and save valuable time.

-

Is there a cost associated with using the 941 Pr Fillable Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the 941 Pr Fillable Form. Our plans are designed to be budget-friendly, giving you comprehensive features that cater to different business needs. You can choose the package that best fits your requirements without compromising on quality.

-

What features does airSlate SignNow offer for the 941 Pr Fillable Form?

Our platform includes key features for the 941 Pr Fillable Form such as real-time collaboration, customizable fields, and secure eSignature capabilities. These features streamline the entire document handling process, from filling out the form to obtaining necessary approvals. This ensures your payroll tax documentation is handled swiftly and accurately.

-

Can I integrate airSlate SignNow with other software for the 941 Pr Fillable Form?

Absolutely! airSlate SignNow seamlessly integrates with various popular software solutions, making the management of the 941 Pr Fillable Form even easier. This integration allows you to sync data, automate workflows, and enhance efficiency across your business operations, ensuring a smoother process.

-

Is the 941 Pr Fillable Form secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage methods to protect your 941 Pr Fillable Form and any associated data. You can trust that your sensitive payroll information is safeguarded throughout the entire eSigning process.

-

How can I access the 941 Pr Fillable Form on airSlate SignNow?

You can easily access the 941 Pr Fillable Form by signing up for an airSlate SignNow account. Once logged in, you can start creating, filling out, and eSigning the form all in one place. Our user-friendly interface ensures that even those new to eSigning will find it straightforward to use.

Get more for 941 Pr Fillable Form

Find out other 941 Pr Fillable Form

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract