Tpt Ez 2016-2026

What is the TPT EZ?

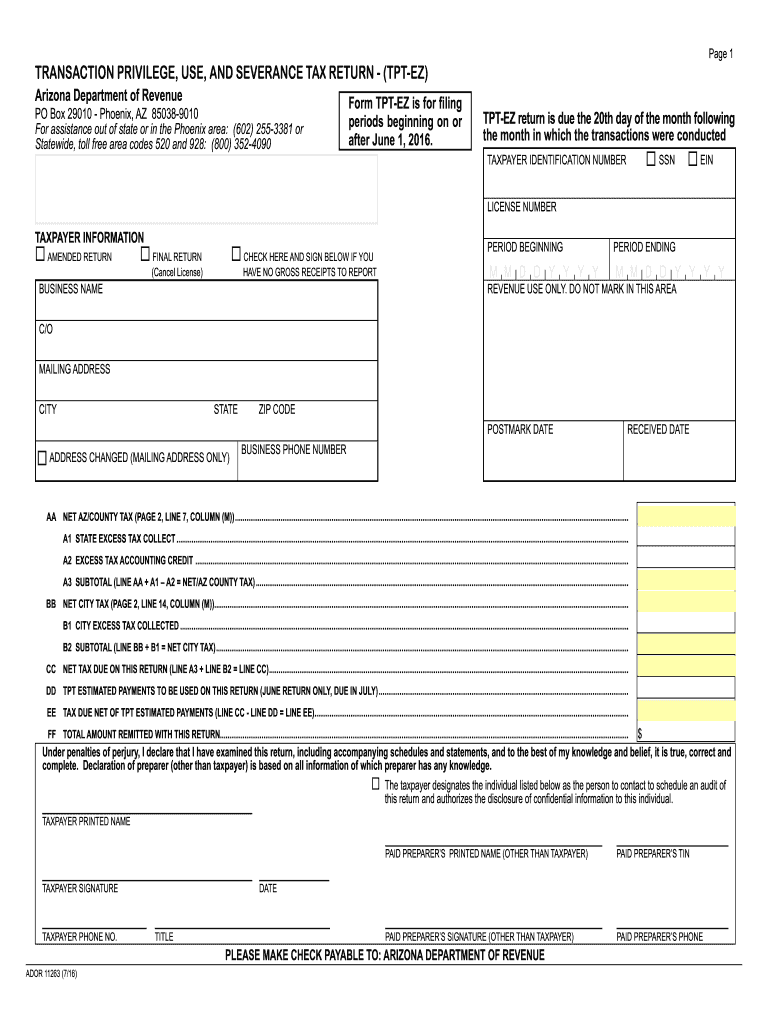

The TPT EZ, or Transaction Privilege Tax EZ form, is a simplified tax document used in Arizona for reporting transaction privilege taxes. This form is specifically designed for businesses that have minimal tax liability, making it easier for them to comply with state tax regulations. The TPT EZ form allows taxpayers to report their gross income and calculate the tax owed without the complexity of more detailed forms. Understanding the purpose of the TPT EZ is essential for businesses aiming to maintain compliance with Arizona's tax laws.

How to Use the TPT EZ

Using the TPT EZ form involves a straightforward process that simplifies tax reporting for eligible businesses. First, gather all necessary financial information, including total sales and any deductions applicable. Next, access the fillable TPT EZ form online, ensuring you have the latest version. Complete the form by entering your business details, including your Arizona transaction privilege tax account number. After filling out the required fields, review the information for accuracy before submitting it electronically or printing it for mail submission.

Steps to Complete the TPT EZ

Completing the TPT EZ form requires careful attention to detail. Follow these steps:

- Gather your business financial records, including sales receipts and previous tax filings.

- Access the TPT EZ form through the Arizona Department of Revenue's website.

- Fill in your business information, including your name, address, and tax identification number.

- Report your total gross income for the reporting period.

- Calculate the tax owed based on the applicable rates.

- Review all entries for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate address.

Legal Use of the TPT EZ

The TPT EZ form is legally recognized by the Arizona Department of Revenue for reporting transaction privilege taxes. To ensure compliance, businesses must meet specific criteria, including having a minimal tax liability. Using the TPT EZ form correctly helps businesses avoid penalties and ensures they fulfill their tax obligations. It is crucial to keep accurate records and submit the form by the designated deadlines to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the TPT EZ form vary based on the reporting period. Generally, businesses must submit their forms on a monthly or quarterly basis, depending on their tax liability. It is essential to be aware of these deadlines to avoid late fees and penalties. The Arizona Department of Revenue provides a calendar of important dates, which can help businesses stay on track with their tax submissions.

Form Submission Methods

The TPT EZ form can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online Submission: Businesses can submit the TPT EZ form electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the designated tax office.

- In-Person: Some businesses may choose to deliver their forms in person at local tax offices.

Key Elements of the TPT EZ

The TPT EZ form includes several key elements that are crucial for accurate tax reporting. These elements typically consist of:

- Business Information: Name, address, and tax identification number.

- Gross Income: Total sales for the reporting period.

- Tax Calculation: The amount of transaction privilege tax owed based on reported income.

- Signature: Required for the form to be legally binding.

Quick guide on how to complete transaction privilege use and severance tax return tpt ez azdor

Your assistance manual on how to prepare your Tpt Ez

If you're curious about how to generate and transmit your Tpt Ez, here are some concise instructions on how to simplify tax processing.

First, you simply need to sign up for your airSlate SignNow account to revolutionize the way you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Tpt Ez in just a few minutes:

- Create your profile and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Tpt Ez in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to increased filing errors and delayed refunds. Naturally, prior to e-filing your taxes, consult the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transaction privilege use and severance tax return tpt ez azdor

How to create an electronic signature for your Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor online

How to generate an eSignature for your Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor in Chrome

How to create an electronic signature for signing the Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor in Gmail

How to generate an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor straight from your mobile device

How to create an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor on iOS devices

How to make an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor on Android OS

People also ask

-

What is the tpt ez arizona form?

The tpt ez arizona form is a simplified tax form used by businesses in Arizona to report and pay transaction privilege taxes. It simplifies the tax filing process for small businesses, ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily sign and submit the tpt ez arizona form digitally.

-

How does airSlate SignNow facilitate the completion of the tpt ez arizona form?

airSlate SignNow allows users to create, sign, and send the tpt ez arizona form electronically, streamlining the process. With intuitive templates and user-friendly interfaces, you can fill out required information quickly and accurately. This saves time and reduces errors associated with paper submissions.

-

Is there a cost associated with using airSlate SignNow for the tpt ez arizona form?

airSlate SignNow offers various pricing plans that provide access to its features for handling the tpt ez arizona form. Subscribers benefit from unlimited electronic signatures, document storage, and advanced features. Potential customers are encouraged to explore the pricing options on our website to find a plan that meets their needs.

-

What are the benefits of using airSlate SignNow for handling the tpt ez arizona form?

Using airSlate SignNow for the tpt ez arizona form ensures a smooth, efficient, and legally compliant process. The platform enhances collaboration by allowing multiple stakeholders to review and sign documents seamlessly. Additionally, the electronic process contributes to sustainability by reducing paper waste.

-

Can I integrate airSlate SignNow with other software to manage the tpt ez arizona form?

Yes, airSlate SignNow offers integration capabilities with various business applications, enabling seamless data transfer for the tpt ez arizona form. Popular integrations include CRM systems, cloud storage solutions, and accounting software. This allows you to streamline your workflow and improve overall efficiency.

-

How secure is the airSlate SignNow platform for handling the tpt ez arizona form?

airSlate SignNow prioritizes security and compliance when processing the tpt ez arizona form. The platform utilizes industry-standard encryption protocols to protect your sensitive data. Regular audits and compliance checks ensure that your documents remain secure during the signing process.

-

What features does airSlate SignNow offer that are beneficial for the tpt ez arizona form?

Key features of airSlate SignNow beneficial for the tpt ez arizona form include easy document editing, reusable templates, and real-time tracking of document status. These features help you monitor the signing process and ensure timely submission. Enhanced notification settings keep you updated on any required actions.

Get more for Tpt Ez

Find out other Tpt Ez

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT