Form M2210

What is the Form M2210

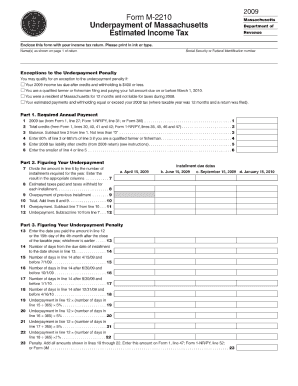

The 2018 Form M2210 is a tax form used by residents of Massachusetts to calculate their underpayment of estimated income tax. This form is essential for individuals who may not have paid enough tax throughout the year and need to determine if they owe additional tax or penalties. It helps taxpayers avoid unexpected tax liabilities when filing their annual returns.

How to use the Form M2210

To effectively use the Form M2210, taxpayers should first gather their financial documents, including income statements and previous tax returns. The form requires information on total income, estimated tax payments made, and any applicable credits. By carefully filling out each section, individuals can accurately assess whether they owe any penalties for underpayment. It is advisable to consult the instructions provided with the form to ensure all calculations are correct.

Steps to complete the Form M2210

Completing the Form M2210 involves several key steps:

- Gather necessary financial documents, including income records and prior tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Calculate your total income for the year and any estimated tax payments made.

- Determine if you owe any penalties by comparing your payments to the required amounts.

- Review the completed form for accuracy before submission.

Legal use of the Form M2210

The legal use of the Form M2210 is governed by Massachusetts tax laws. To ensure compliance, it is crucial that taxpayers fill out the form accurately and submit it by the designated deadlines. The form must be signed and dated to be considered valid. Utilizing a reliable eSignature solution can enhance the security and legality of the submission process, ensuring that all signatures are verified and compliant with state regulations.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the Form M2210. Typically, the form should be filed with the Massachusetts Department of Revenue by the due date of the annual income tax return. If you are filing an extension, be sure to check for any specific deadlines related to estimated tax payments to avoid penalties.

Required Documents

To complete the Form M2210, taxpayers should prepare several documents, including:

- Income statements (W-2s, 1099s, etc.)

- Records of estimated tax payments made throughout the year

- Previous year's tax return for reference

- Any relevant tax credits or deductions documentation

Form Submission Methods (Online / Mail / In-Person)

The Form M2210 can be submitted through various methods. Taxpayers have the option to file online through the Massachusetts Department of Revenue's website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided in the instructions. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability.

Quick guide on how to complete form m2210

Accomplish Form M2210 effortlessly on any gadget

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the functionalities needed to create, modify, and eSign your documents quickly without interruptions. Handle Form M2210 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form M2210 effortlessly

- Obtain Form M2210 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, exhausting form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign Form M2210 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form m 2210 and why is it important?

The 2018 form m 2210 is used by taxpayers in Massachusetts to calculate penalties for underpayment of estimated tax. Understanding this form is crucial for avoiding unexpected fees and ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with completing the 2018 form m 2210?

airSlate SignNow provides a seamless and efficient platform for completing the 2018 form m 2210 by allowing users to fill, sign, and send the document electronically. This simplifies the tax filing process and reduces the potential for errors.

-

What are the pricing options for using airSlate SignNow for the 2018 form m 2210?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Whether you require basic features or advanced options for managing the 2018 form m 2210, there is a plan that can fit your budget.

-

Can airSlate SignNow integrate with accounting software for the 2018 form m 2210?

Yes, airSlate SignNow can integrate with various accounting software solutions, streamlining the process of preparing the 2018 form m 2210. This helps users maintain accurate records and simplifies data transfer.

-

What features does airSlate SignNow offer for eSigning the 2018 form m 2210?

airSlate SignNow offers features such as secure eSigning, document tracking, and templates specifically designed for the 2018 form m 2210. These tools enhance the user experience and ensure that documents are completed promptly.

-

Is airSlate SignNow secure for handling tax documents like the 2018 form m 2210?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information when handling tax documents like the 2018 form m 2210. User data is encrypted and stored securely to ensure confidentiality.

-

How does airSlate SignNow enhance collaboration for the 2018 form m 2210?

With airSlate SignNow, users can easily share the 2018 form m 2210 with team members or stakeholders, enabling real-time collaboration and feedback. This enhances the efficiency of completing and reviewing the tax form.

Get more for Form M2210

Find out other Form M2210

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself