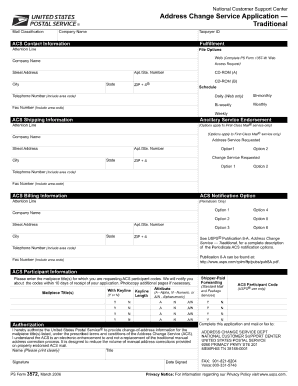

Form Ps 3572

What is the Form Ps 3572

The Form Ps 3572 is a specific document used primarily for reporting certain information related to tax obligations. It is designed to help individuals and businesses comply with U.S. tax laws by providing necessary details to the Internal Revenue Service (IRS). This form is essential for ensuring accurate reporting and can play a critical role in tax assessments and audits.

How to use the Form Ps 3572

Using the Form Ps 3572 involves several steps to ensure that all required information is accurately reported. First, gather all relevant financial documents and data that pertain to your tax situation. Next, carefully fill out the form, ensuring that each section is completed according to IRS guidelines. It is important to double-check the information for accuracy before submission. Once completed, you can submit the form electronically or via mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Form Ps 3572

Completing the Form Ps 3572 requires attention to detail. Follow these steps:

- Collect all necessary financial documents, including income statements and previous tax returns.

- Download the form from the appropriate IRS website or obtain a physical copy.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Form Ps 3572

The legal use of the Form Ps 3572 is governed by the IRS regulations, which stipulate that the information provided must be truthful and accurate. Falsifying information on this form can lead to penalties, including fines and potential legal action. It is crucial to ensure that all details are correct and that the form is submitted within the required timeframes to maintain compliance with tax laws.

Key elements of the Form Ps 3572

Key elements of the Form Ps 3572 include personal identification information, income details, and any deductions or credits being claimed. Each section of the form is designed to capture specific information that the IRS requires for processing tax returns. Understanding these elements can help ensure that the form is filled out correctly and completely.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ps 3572 are typically aligned with the general tax filing deadlines set by the IRS. It is essential to be aware of these dates to avoid late submissions, which can incur penalties. Generally, individual tax returns are due on April 15, while extensions may be filed to push the deadline to October 15. Always check for any updates or changes to these deadlines on the IRS website.

Form Submission Methods (Online / Mail / In-Person)

The Form Ps 3572 can be submitted through various methods, depending on individual preferences and IRS guidelines. Options include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a physical copy to the designated IRS address, ensuring that it is postmarked by the filing deadline.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete form ps 3572

Complete Form Ps 3572 easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Form Ps 3572 on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form Ps 3572 with ease

- Locate Form Ps 3572 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to finalize your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Form Ps 3572 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ps 3572

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ps 3572 and how does it work with airSlate SignNow?

Form ps 3572 is a crucial document for various business processes. With airSlate SignNow, you can easily create, fill, and eSign this form electronically, streamlining your workflows and enhancing efficiency. The platform ensures your form ps 3572 is completed correctly and is securely stored for future reference.

-

Is there any cost associated with using airSlate SignNow for form ps 3572?

Yes, airSlate SignNow offers several pricing plans designed to accommodate different business needs. Each plan provides access to essential features for managing documents, including form ps 3572. Check our pricing page for detailed information on costs and features included.

-

What features does airSlate SignNow offer for form ps 3572?

airSlate SignNow offers a range of features specifically designed to simplify the signing process for form ps 3572. These include customizable templates, automated reminders, and a secure signing process. You can manage multiple signatures on a single document seamlessly.

-

How can airSlate SignNow benefit my business when handling form ps 3572?

By using airSlate SignNow for form ps 3572, your business can signNowly reduce turnaround times and improve accuracy in document processing. Additionally, the platform offers mobile access, allowing users to manage forms on-the-go, enhancing productivity. This leads to better client satisfaction and operational efficiency.

-

Can I integrate airSlate SignNow with other tools for managing form ps 3572?

Absolutely! airSlate SignNow provides integration capabilities with various third-party applications. This means you can connect it with your CRM or document management systems to streamline handling of form ps 3572 and maintain a smooth workflow within your existing processes.

-

How secure is airSlate SignNow when processing form ps 3572?

Security is a top priority at airSlate SignNow. When processing form ps 3572, your data is protected with strong encryption protocols and secure access controls. This ensures that your information remains confidential and compliant with various regulatory standards.

-

Is it easy to create and customize form ps 3572 in airSlate SignNow?

Yes, airSlate SignNow allows you to easily create and customize form ps 3572 to meet your specific needs. The user-friendly interface enables you to design forms quickly without any technical expertise. You can add logos, fields, and text to make the form align with your branding.

Get more for Form Ps 3572

- Mage the awakening character sheet form

- Exposure prone declaration form griffith

- Purchase requisition form microsoft word

- Should npr run funding credits from the department of homeland form

- Virus and bacteria worksheet pdf answer key 249309868 form

- Measurement disclaimer form

- Credentialing application for practitioners standa form

- Signature agreement template form

Find out other Form Ps 3572

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request