It Aff2 Form

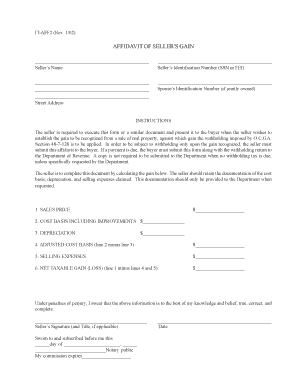

What is the It Aff2

The It Aff2 form is a specific document used primarily for tax-related purposes in the United States. This form is often required by various agencies and organizations to verify information related to income, deductions, or other financial matters. Understanding the purpose of the It Aff2 is essential for ensuring compliance with tax regulations and for facilitating accurate reporting of financial data.

How to use the It Aff2

Using the It Aff2 form involves several steps to ensure that all required information is accurately completed. First, gather all necessary documentation that supports the information you will provide on the form. This may include income statements, previous tax returns, or other financial records. Next, carefully fill out the form, ensuring that each section is completed thoroughly. Once completed, review the form for any errors or omissions before submission. Proper use of the It Aff2 form can help avoid delays in processing and ensure compliance with tax regulations.

Steps to complete the It Aff2

Completing the It Aff2 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documents, such as income statements and identification.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out each section of the form, ensuring that all information is accurate and complete.

- Double-check your entries for any errors or missing information.

- Sign and date the form as required.

- Submit the form according to the specified submission methods.

Legal use of the It Aff2

The It Aff2 form must be used in accordance with relevant legal guidelines to ensure its validity. This includes adhering to federal and state regulations regarding tax documentation. The form can be considered legally binding when completed correctly and submitted on time. It is important to keep copies of the completed form and any supporting documents for your records, as these may be required for audits or other legal inquiries.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use and submission of the It Aff2 form. These guidelines outline the necessary information to be included, deadlines for submission, and any additional documentation that may be required. Familiarizing yourself with these guidelines can help ensure that you are in compliance and that your form is processed without issues.

Filing Deadlines / Important Dates

Filing deadlines for the It Aff2 form are crucial to avoid penalties and ensure compliance with tax regulations. Typically, forms must be submitted by specific dates set by the IRS or state tax authorities. It is important to mark these deadlines on your calendar and prepare your documentation well in advance to avoid last-minute issues. Staying informed about any changes to deadlines is also essential for timely filing.

Quick guide on how to complete it aff2

Effortlessly Prepare It Aff2 on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly, without any delays. Manage It Aff2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign It Aff2 with Ease

- Find It Aff2 and select Get Form to begin.

- Use the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues related to lost or misplaced documents, cumbersome form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Modify and eSign It Aff2 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it aff2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it aff2?

airSlate SignNow is a comprehensive eSignature solution that allows businesses to send and sign documents electronically. With its user-friendly interface and features, it aff2 plays a pivotal role in streamlining document workflows, making it easier for companies to manage their signing process efficiently.

-

How much does airSlate SignNow cost in relation to it aff2?

The pricing of airSlate SignNow varies based on the features and number of users. However, it aff2 provides a cost-effective solution with flexible pricing tiers, ensuring businesses of all sizes can find a plan that fits their budget and needs.

-

What features does airSlate SignNow offer that make it aff2 a top choice for businesses?

airSlate SignNow offers numerous features such as templates, bulk sending, and mobile accessibility. These capabilities, in conjunction with it aff2, ensure that businesses can efficiently handle document signing while maximizing productivity and reducing turnaround time.

-

How can airSlate SignNow improve document workflow compared to traditional methods, especially with it aff2?

By utilizing airSlate SignNow, businesses can greatly enhance their document workflow by eliminating the need for paper documents. It aff2 not only speeds up the process of getting documents signed but also reduces errors and legal risks that commonly occur with paper-based methods.

-

Are there integrations available with airSlate SignNow and how does it support it aff2?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and more. These integrations complement it aff2 by allowing businesses to import and send documents directly from their preferred platforms, fostering a more cohesive workflow.

-

What are the security features of airSlate SignNow and how do they align with it aff2?

airSlate SignNow prioritizes security with features like two-factor authentication, encryption, and compliance with industry standards. These measures help ensure that your documents are safe, making it aff2 a reliable option for businesses concerned about data protection.

-

Can airSlate SignNow be used on mobile devices, and how does this support it aff2?

Absolutely! airSlate SignNow is fully functional on mobile devices, allowing users to send and sign documents on the go. This mobility supports it aff2 by ensuring that businesses can complete transactions anytime, anywhere, enhancing convenience and flexibility.

Get more for It Aff2

- Application for bmv fee installment plan ohio department of public publicsafety ohio form

- Mobility assessment and prior authorization pa request medicaid nv form

- Facility of payment affidavit wordpress com form

- Integrated science cycles worksheet form

- Submit the completed application and payment in the form of a personal check money order or cashiers check with proof of

- Agriculture lease agreement template form

- Airbnb sublease agreement template form

- Aircraft dry lease agreement template form

Find out other It Aff2

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF