Fatca Hsbc Form

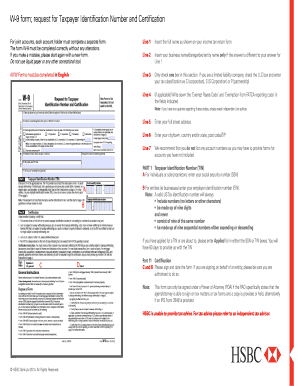

What is the HSBC FATCA form?

The HSBC FATCA form is a document required for compliance with the Foreign Account Tax Compliance Act (FATCA). This U.S. law mandates financial institutions outside the United States to report information about accounts held by U.S. taxpayers or foreign entities in which U.S. taxpayers hold substantial ownership. The form collects essential information about the account holder, including their tax identification number, to ensure proper reporting to the Internal Revenue Service (IRS).

Steps to complete the HSBC FATCA form

Completing the HSBC FATCA form involves several straightforward steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Provide details about your HSBC account, such as the account number and type.

- Indicate your tax residency status and any applicable tax treaty benefits.

- Review the form for accuracy and completeness before submission.

Ensuring all information is accurate is crucial, as errors may lead to compliance issues with the IRS.

Legal use of the HSBC FATCA form

The HSBC FATCA form is legally binding when completed correctly and submitted in accordance with IRS regulations. It serves as a declaration of your tax status and compliance with U.S. tax laws. To maintain its legal validity, the form must be signed and dated appropriately. Using a reliable electronic signature solution can enhance the security and authenticity of your submission.

Required documents for the HSBC FATCA form

When filling out the HSBC FATCA form, you may need to provide supporting documentation, such as:

- A valid U.S. taxpayer identification number (TIN).

- Proof of identity, such as a passport or driver's license.

- Documentation of your residency status, if applicable.

Having these documents ready can streamline the completion process and ensure compliance with FATCA requirements.

Form submission methods for the HSBC FATCA form

You can submit the HSBC FATCA form through various methods, including:

- Online submission via the HSBC online banking platform.

- Mailing a physical copy to the designated HSBC address.

- In-person submission at your local HSBC branch.

Choosing the right submission method can depend on your preference for speed and convenience.

IRS guidelines for the HSBC FATCA form

The IRS provides specific guidelines for completing and submitting the HSBC FATCA form. These guidelines outline the information required, the deadlines for submission, and the consequences of non-compliance. Familiarizing yourself with these guidelines is essential to ensure that you meet all legal obligations and avoid potential penalties.

Quick guide on how to complete fatca hsbc

Complete Fatca Hsbc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the features you require to create, edit, and electronically sign your documents quickly without delays. Handle Fatca Hsbc on any system using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to edit and electronically sign Fatca Hsbc with ease

- Find Fatca Hsbc and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just moments and carries the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fatca Hsbc and ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca hsbc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hsbc fatca declaration form?

The hsbc fatca declaration form is a necessary document for U.S. taxpayers to report their foreign financial accounts to the IRS. It helps HSBC comply with the Foreign Account Tax Compliance Act (FATCA). Ensuring you fill it out correctly is crucial for avoiding penalties.

-

How can airSlate SignNow assist with the hsbc fatca declaration form?

AirSlate SignNow streamlines the process of filling out and electronically signing your hsbc fatca declaration form. With user-friendly tools, you can easily add signatures and ensure that your forms are properly completed. This saves you time and minimizes the chances of errors.

-

Are there any costs associated with using airSlate SignNow for the hsbc fatca declaration form?

Yes, there are subscription plans available for airSlate SignNow that cater to different business needs. These plans offer a range of features including unlimited eSignatures and document storage. You can choose a plan that best fits your budget and requirements for handling hsbc fatca declaration forms.

-

What features does airSlate SignNow offer for managing the hsbc fatca declaration form?

AirSlate SignNow provides features such as customizable templates, secure storage, and easy sharing options for your hsbc fatca declaration form. Additionally, real-time tracking lets you monitor the document's progress, ensuring timely completion and submission.

-

Is airSlate SignNow secure for submitting the hsbc fatca declaration form?

Absolutely, airSlate SignNow employs advanced encryption and security measures to protect your sensitive data. Your hsbc fatca declaration form is securely stored and transmitted, giving you peace of mind while managing important financial documents.

-

Can I integrate airSlate SignNow with other software for the hsbc fatca declaration form?

Yes, airSlate SignNow supports integrations with various tools and platforms. This makes it easy to incorporate your hsbc fatca declaration form into your existing workflow, enhancing productivity and streamlining the overall signing process.

-

How do I ensure the hsbc fatca declaration form is filed on time using airSlate SignNow?

With airSlate SignNow, you can set reminders and automatic notifications for signing deadlines related to your hsbc fatca declaration form. This ensures that all parties are informed and helps you stay organized, preventing last-minute rushes and compliance issues.

Get more for Fatca Hsbc

- Claim for refund of german withholding taxes on dividends and or interest form

- Incoming direct registration systemsdeposit and merrill lynch form

- Onlinewedc form

- Instrument rental form lcps

- Afi 36 2115 form

- State of michigan homeless identification form

- Visitor feedback heritage open days form

- Remplissable form v visa chine

Find out other Fatca Hsbc

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament