Form 1041 Tax Organizer

What is the Form 1041 Tax Organizer

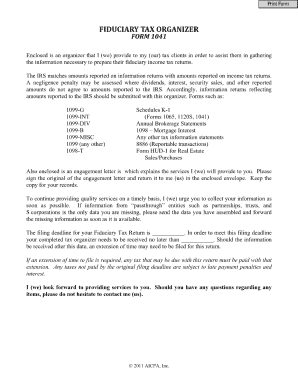

The Form 1041 Tax Organizer is a crucial document designed for estates and trusts in the United States. It serves as a tool to collect and organize financial information needed to accurately prepare the federal income tax return for estates and trusts. This form helps fiduciaries gather essential data, including income, deductions, and credits, ensuring compliance with IRS regulations. By using the organizer, individuals can streamline the tax preparation process, making it easier to report income generated by the estate or trust.

How to use the Form 1041 Tax Organizer

Using the Form 1041 Tax Organizer involves several steps to ensure all necessary information is accurately compiled. Start by gathering financial records related to the estate or trust, such as bank statements, investment income, and expenses. Next, fill out the organizer by categorizing income and deductions as specified. This organized approach not only simplifies the preparation of the Form 1041 but also aids in identifying potential tax liabilities or deductions. Once completed, the organizer can be used as a reference when filling out the actual tax return.

Steps to complete the Form 1041 Tax Organizer

Completing the Form 1041 Tax Organizer requires careful attention to detail. Follow these steps for effective completion:

- Gather all relevant financial documents, including income statements and expense receipts.

- Identify all sources of income generated by the estate or trust, such as dividends, interest, and rental income.

- Document all allowable deductions, including administrative expenses and distributions to beneficiaries.

- Review the completed organizer for accuracy and completeness before using it to prepare the Form 1041.

Legal use of the Form 1041 Tax Organizer

The Form 1041 Tax Organizer is legally recognized as a preparatory document that assists in the accurate filing of tax returns for estates and trusts. While the organizer itself is not submitted to the IRS, the information contained within must be truthful and complete, as it directly influences the Form 1041. Accurate completion of the organizer can help prevent issues with the IRS, including audits or penalties for incorrect filings. It is essential to adhere to all relevant tax laws and regulations when using the organizer.

Required Documents

To effectively complete the Form 1041 Tax Organizer, several documents are necessary. These include:

- Financial statements from banks and investment accounts.

- Documentation of income sources, such as W-2s or 1099 forms.

- Receipts for deductible expenses, including legal and administrative fees.

- Records of distributions made to beneficiaries.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for compliance. The Form 1041 must typically be filed by the 15th day of the fourth month following the end of the estate's or trust's tax year. For estates operating on a calendar year, this means the due date is April 15. If additional time is needed, a six-month extension can be requested using Form 7004. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 1041 tax organizer

Easily Prepare Form 1041 Tax Organizer on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Form 1041 Tax Organizer on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Edit and eSign Form 1041 Tax Organizer Effortlessly

- Find Form 1041 Tax Organizer and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important areas of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your edits.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 1041 Tax Organizer to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1041 tax organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 1041 Tax Organizer?

A Form 1041 Tax Organizer is a tool designed to help individuals or fiduciaries efficiently gather the necessary information for completing a Form 1041, which is used for estate and trust income tax returns. It centralizes data collection, making the tax preparation process smoother and less stressful.

-

How does airSlate SignNow integrate with Form 1041 Tax Organizer?

airSlate SignNow allows users to streamline the eSigning process for documents related to the Form 1041 Tax Organizer. By integrating electronic signatures, you can ensure that all necessary signatures are collected quickly and securely, reducing delays in tax filing.

-

Is there a cost associated with using the Form 1041 Tax Organizer?

Yes, there may be costs associated with using the Form 1041 Tax Organizer on the airSlate SignNow platform. Pricing varies depending on the features and volume of usage needed, but the solution is designed to be cost-effective for businesses of all sizes.

-

What are the key features of the airSlate SignNow Form 1041 Tax Organizer?

The key features of the airSlate SignNow Form 1041 Tax Organizer include customizable templates, easy data entry, and secure eSignature capabilities. These features facilitate accurate data collection and ensure compliance with tax regulations.

-

Can the Form 1041 Tax Organizer be used for multiple clients?

Absolutely! The Form 1041 Tax Organizer is designed to handle multiple clients efficiently. You can manage and organize tax documents for various estates and trusts, helping professionals streamline their workloads and improve client management.

-

What benefits does using the Form 1041 Tax Organizer offer?

Using the Form 1041 Tax Organizer offers signNow benefits, including time savings, enhanced accuracy, and improved organization. With this tool, tax preparers can minimize errors, speed up the filing process, and provide better service to their clients.

-

How can I get started with the Form 1041 Tax Organizer?

Getting started with the Form 1041 Tax Organizer is simple! You can sign up for airSlate SignNow, select the Form 1041 Tax Organizer from the templates, and begin customizing it to meet your needs. Detailed guides and customer support are available to assist you throughout the process.

Get more for Form 1041 Tax Organizer

- New customer application form

- Ace express private company management indemnity package renewal application form

- Teaching philosophy template doc form

- Youth sports coach application form

- Fox business systems form

- Periodicity chemistry worksheet form

- Dhs 2952 eng authorization for release of information about residence and shelter expenses form 1 pdf

- Verify identity form

Find out other Form 1041 Tax Organizer

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement