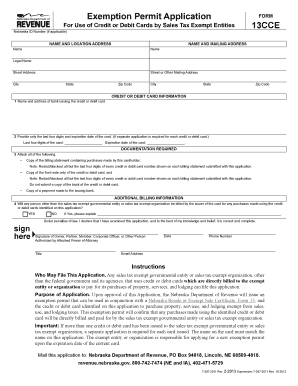

Form 13cce

What is the Form 13cce

The Form 13cce is a specific document used in various legal and administrative contexts within the United States. It serves as an essential tool for individuals and organizations to formally communicate information required by government entities or other organizations. Understanding the purpose and function of this form is crucial for ensuring compliance with relevant regulations.

How to use the Form 13cce

Using the Form 13cce involves several straightforward steps. First, gather all necessary information and documents that pertain to the form’s requirements. Next, fill out the form accurately, ensuring that all fields are completed as required. Once the form is filled, it can be submitted electronically or through traditional mail, depending on the specific instructions provided for that form. Utilizing a reliable eSignature platform can streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Form 13cce

Completing the Form 13cce involves a series of organized steps:

- Review the form instructions to understand the requirements.

- Gather all necessary supporting documents.

- Fill in your personal information, ensuring accuracy.

- Complete any specific sections required for your situation.

- Review the form for completeness and accuracy.

- Sign the form digitally or manually, as required.

- Submit the form via the designated method.

Legal use of the Form 13cce

The legal validity of the Form 13cce hinges on its proper completion and submission. When filled out correctly and signed, it can be considered a legally binding document. Compliance with relevant laws, such as the ESIGN Act, ensures that electronic signatures and submissions are recognized legally. It is essential to adhere to all guidelines to maintain the form's integrity and enforceability.

Key elements of the Form 13cce

Key elements of the Form 13cce include the following:

- Identification Information: Personal details of the individual or entity submitting the form.

- Purpose of Submission: A clear statement indicating why the form is being submitted.

- Signature Section: A designated area for the required signatures, which may include electronic options.

- Date of Submission: The date when the form is completed and submitted.

Form Submission Methods

The Form 13cce can typically be submitted through various methods, including:

- Online Submission: Many forms allow for electronic submission via a secure portal.

- Mail: Physical copies can be mailed to the appropriate address as specified in the instructions.

- In-Person: Some situations may require the form to be submitted directly to a designated office.

Quick guide on how to complete form 13cce

Prepare Form 13cce effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any delays. Handle Form 13cce on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form 13cce smoothly

- Obtain Form 13cce and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Form 13cce and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13cce

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 13cce?

Form 13cce is a specific document that businesses often need for various administrative processes. Using airSlate SignNow, you can easily create, send, and eSign form 13cce, streamlining your workflow and ensuring compliance.

-

How can airSlate SignNow help with filling out form 13cce?

airSlate SignNow offers intuitive templates for form 13cce, allowing users to fill out necessary fields quickly. With features like auto-fill and smart tags, completing form 13cce becomes efficient, saving you time and reducing errors.

-

What are the pricing plans for using form 13cce with airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to your business needs. Each plan includes the capability to manage form 13cce alongside numerous other document types, ensuring you get the best value for your investment.

-

Are there any integrations available for form 13cce with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms to enhance your workflow with form 13cce. You can connect with tools such as Google Drive, Salesforce, and others to manage your documents effortlessly.

-

What are the benefits of using airSlate SignNow for form 13cce?

Using airSlate SignNow for form 13cce provides several benefits, including improved efficiency, reduced paper usage, and enhanced security. The platform allows for quick electronic signatures, ensuring your documents are processed faster.

-

Is it secure to eSign form 13cce using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to protect your eSigned form 13cce. You can trust that your sensitive information remains confidential and secure throughout the signing process.

-

Can I track the status of my form 13cce with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your form 13cce. You can monitor when it has been sent, viewed, and signed, ensuring you stay updated on the status of your documents at all times.

Get more for Form 13cce

- Alaska permanent fund application form

- Pua designation form

- This tenancy agreement is a legal and binding contract and the tenant is responsible for payment of the rent for the entire form

- Automobile serves pdf fill form

- New york state emt 20 349 form

- Department of motor vehicles tallahassee form

- Template fake insurance card form

- Colocation contract template form

Find out other Form 13cce

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free