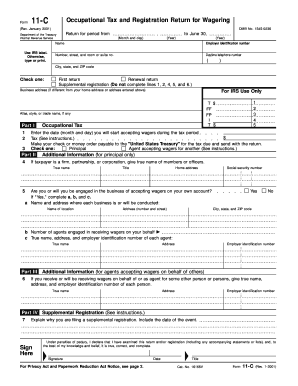

Form 11 C

What is the Form 11 C

The Form 11 C is a crucial document used in the United States for reporting and compliance purposes, particularly in the context of federal taxes. This form is typically associated with the reporting of certain tax liabilities and is essential for individuals and businesses to ensure they meet their obligations. Understanding the specifics of the Form 11 C can help taxpayers navigate their responsibilities more effectively.

How to use the Form 11 C

Using the Form 11 C involves several steps that require careful attention to detail. First, individuals must gather all necessary financial information relevant to their tax situation. This may include income statements, deductions, and any other pertinent financial documents. Once the information is compiled, the taxpayer can accurately fill out the form, ensuring that all sections are completed as required. It is important to review the form for accuracy before submission to avoid potential issues with the IRS.

Steps to complete the Form 11 C

Completing the Form 11 C involves a series of methodical steps:

- Gather all relevant financial documents, including income and expense records.

- Access the Form 11 C from the IRS website or a reliable source.

- Fill out the form, ensuring all required fields are accurately completed.

- Double-check the information for any errors or omissions.

- Sign and date the form where indicated.

- Submit the form via the preferred method, whether online, by mail, or in person.

Legal use of the Form 11 C

The legal use of the Form 11 C is governed by federal tax regulations. It is essential for the form to be completed accurately and submitted on time to avoid penalties. The form serves as a legal declaration of tax obligations, and any discrepancies can lead to audits or other legal consequences. Therefore, understanding the legal implications of the Form 11 C is vital for compliance and protection against potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 11 C are critical to ensure compliance with IRS regulations. Typically, forms must be submitted by specific dates during the tax season. Taxpayers should be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates, such as the start of the tax filing season and the final submission date, is essential for timely compliance.

Who Issues the Form

The Form 11 C is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and updates regarding the form, including any changes in requirements or procedures. Taxpayers should refer to the IRS for the most current information regarding the Form 11 C.

Quick guide on how to complete form 11 c

Effortlessly prepare Form 11 C on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without any delays. Handle Form 11 C on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and eSign Form 11 C with ease

- Obtain Form 11 C and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new printed document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 11 C and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 11 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 11c and how can airSlate SignNow help?

Form 11c is an essential document used in various business processes. With airSlate SignNow, you can easily create, send, and eSign form 11c, streamlining your workflow. Our platform ensures that all your signatures and documents stay organized and secure, helping you save time and avoid errors.

-

How much does it cost to use airSlate SignNow for form 11c?

airSlate SignNow offers competitive pricing plans tailored to your needs. Whether you’re a small business or a large enterprise, you can choose a plan that suits your usage of form 11c. We provide a cost-effective solution that enhances your document management without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for form 11c?

Yes, airSlate SignNow integrates with numerous popular applications to enhance your productivity. You can seamlessly connect platforms like Google Drive, Dropbox, and many more to manage your form 11c easily. Such integrations allow for automated workflows, ensuring that your document processing is efficient and streamlined.

-

What features does airSlate SignNow offer for managing form 11c?

airSlate SignNow provides a range of features designed specifically for managing form 11c. These include customizable templates, real-time tracking of document status, and mobile accessibility. With these features, you can ensure your form 11c is managed efficiently and effectively.

-

Is airSlate SignNow secure for handling form 11c documents?

Absolutely! Security is a top priority at airSlate SignNow. Our platform uses advanced encryption to protect your form 11c and other documents, ensuring that your sensitive information remains private and secure throughout the signing process.

-

How can airSlate SignNow improve my workflow for form 11c?

airSlate SignNow can signNowly improve your workflow for form 11c by digitizing your document processes. With electronic signatures and automated reminders, you can reduce the time spent on paperwork and focus on more critical business tasks. Our platform is designed to optimize your document flow and ensure timely completion.

-

What benefits can I expect from using airSlate SignNow for form 11c?

Using airSlate SignNow for form 11c brings numerous benefits, including reduced turnaround time, improved collaboration, and enhanced document accuracy. Businesses can streamline their signing processes and eliminate tedious paper trails, which ultimately leads to greater efficiency and cost savings.

Get more for Form 11 C

- Va alive and well esnmccom form

- Dl 143 form

- Good samaritan home health agency form

- Ekurhuleni municipality proof of residence pdf 302556714 form

- Acrod application form 31823612

- Chiropractic exam forms pdffiller on line pdf form

- Form 590 withholding exemption certificate form 590 withholding exemption certificate 771777434

- Lease fillable agreement template form

Find out other Form 11 C

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors