Treasury Challan Meghalaya Form

What is the Treasury Challan Meghalaya?

The Treasury Challan Meghalaya is an official document used for making payments to the government in Meghalaya. It serves as a receipt for the payment made and is essential for various financial transactions, including taxes, fees, and other dues. This form is crucial for individuals and businesses to comply with state regulations and ensure proper record-keeping for financial activities.

How to use the Treasury Challan Meghalaya

Using the Treasury Challan Meghalaya involves filling out the form accurately to facilitate the payment process. Users need to provide specific details such as the purpose of payment, amount, and personal or business information. Once completed, the form can be submitted at designated payment locations or online platforms that accept electronic submissions. Ensuring correct information is vital to avoid delays or issues with payment processing.

Steps to complete the Treasury Challan Meghalaya

Completing the Treasury Challan Meghalaya involves several key steps:

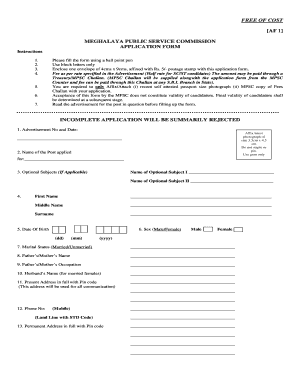

- Download the treasury challan form from an official source.

- Fill in the required fields with accurate information, including the payment purpose and amount.

- Double-check all entries for accuracy to prevent errors.

- Submit the completed form either online or at a designated payment center.

- Keep a copy of the submitted form as proof of payment.

Key elements of the Treasury Challan Meghalaya

Several key elements are essential for the Treasury Challan Meghalaya:

- Challan Number: A unique identifier for tracking the payment.

- Payment Amount: The total amount being paid to the government.

- Purpose of Payment: A description of what the payment is for, ensuring clarity.

- Payee Information: Details about the individual or entity making the payment.

- Date of Payment: The date when the payment is made, important for record-keeping.

Legal use of the Treasury Challan Meghalaya

The Treasury Challan Meghalaya is legally binding when filled out and submitted according to state regulations. It serves as proof of payment and can be used in legal contexts to demonstrate compliance with financial obligations. Ensuring that the form is completed accurately and submitted through the correct channels is crucial for its legal standing.

Form Submission Methods

The Treasury Challan Meghalaya can be submitted through various methods:

- Online Submission: Many users opt for electronic submission through official government portals.

- In-Person Submission: The form can also be submitted at designated government offices or banks.

- Mail Submission: Some may choose to send the completed form via postal services, ensuring it reaches the appropriate office.

Quick guide on how to complete treasury challan meghalaya

Complete Treasury Challan Meghalaya effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Treasury Challan Meghalaya on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Treasury Challan Meghalaya with ease

- Find Treasury Challan Meghalaya and click Get Form to start.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and hit the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Treasury Challan Meghalaya and ensure excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the treasury challan meghalaya

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ট্রেজারি চালান ফরম?

A ট্রেজারি চালান ফরম is an official document used in financial transactions to facilitate payments and record keeping. It simplifies the process of transferring funds and is essential for businesses and government entities. Understanding its purpose can streamline your financial operations.

-

How can airSlate SignNow help with ট্রেজারি চালান ফরম?

airSlate SignNow allows users to easily create, sign, and manage ট্রেজারি চালান ফরম electronically. This eliminates the need for paper forms and speeds up the processing time. By using our solution, you can enhance efficiency and reduce errors in your financial transactions.

-

Is airSlate SignNow affordable for my business?

Yes, airSlate SignNow is a cost-effective solution for managing ট্রেজারি চালান ফরম. We offer various pricing plans that cater to businesses of all sizes, ensuring you find an option that meets your budget while delivering the necessary features. Check our pricing page for more details.

-

What features does airSlate SignNow offer for managing ট্রেজারি চালান ফরম?

Our platform offers multiple features for managing ট্রেজারি চালান ফরম, including document templates, electronic signatures, and automated workflows. These functionalities simplify the document management process, making it easier for you to prepare and distribute necessary forms efficiently.

-

Can I integrate airSlate SignNow with other tools for my ট্রেজারি চালান ফরম?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, such as CRM and accounting software, to streamline your workflow for managing ট্রেজারি চালান ফরম. This integration helps you maintain consistency and empowers your team to work more effectively.

-

What are the benefits of using airSlate SignNow for ট্রেজারি চালান ফরম?

Using airSlate SignNow for your ট্রেজারি চালান ফরম brings numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, providing peace of mind and improving your overall operational efficiency.

-

How secure is airSlate SignNow for handling ট্রেজারি চালান ফরম?

airSlate SignNow prioritizes security and compliance in handling your ট্রেজারি চালান ফরম. We utilize advanced encryption methods and adhere to industry standards to protect your sensitive information during the signing and storage processes. Your data's safety is our top concern.

Get more for Treasury Challan Meghalaya

- 204 kentucky transportation cabinet department of vehicle regulation division of motor vehicle licensing 07 application for form

- Mla conventions for using parenthetical citations worksheet answers form

- Aeroflow catheter order form

- Louisville metro revenue commission form ol 3d louisvilleky

- Ifta form 66204823

- Colorado bankers life insurance form

- Travel allowance request letter format

- Sample letter to request donations doc the jane goodall institute form

Find out other Treasury Challan Meghalaya

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template