Fsadc Form

What is the fsadc?

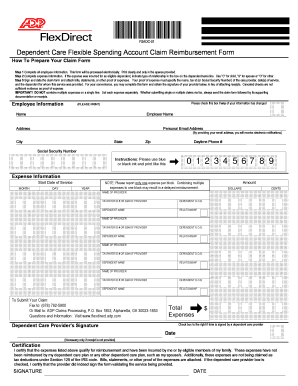

The fsadc, or ADP Dependent Care Claim Form, is a crucial document used by employees to claim reimbursement for eligible dependent care expenses. This form is specifically designed for individuals who participate in employer-sponsored dependent care flexible spending accounts (FSAs). By submitting the fsadc, employees can receive funds for costs associated with caring for dependents, such as children or disabled family members, allowing them to work or seek employment without the burden of high care expenses.

How to use the fsadc

Using the fsadc involves a straightforward process. First, gather all necessary receipts and documentation of your dependent care expenses. Next, complete the form with accurate information, including your personal details, the care provider's information, and the total amount you are claiming. Ensure that you have included any required signatures. Once completed, submit the form according to your employer's guidelines, either electronically or via mail, to initiate the reimbursement process.

Steps to complete the fsadc

Completing the fsadc effectively requires several key steps:

- Collect all relevant receipts and invoices for dependent care expenses.

- Fill out your personal information, including your name, address, and employee identification number.

- Provide details about the care provider, such as their name, address, and taxpayer identification number.

- List the dates of service and the corresponding amounts for each expense.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer's benefits department or designated claims processor.

Legal use of the fsadc

The fsadc is legally recognized as a valid claim form for dependent care expenses under the Internal Revenue Code. To ensure compliance with IRS guidelines, it is essential to maintain accurate records of all expenses and to submit the form within the designated time frames. Using the fsadc appropriately allows employees to benefit from tax advantages associated with dependent care FSAs while adhering to legal requirements.

Eligibility Criteria

To be eligible to use the fsadc, employees must be enrolled in a dependent care flexible spending account offered by their employer. Additionally, the expenses claimed must be for care provided to qualifying dependents, typically children under the age of thirteen or dependents who are physically or mentally incapable of self-care. It is important to review your employer's specific eligibility requirements and the types of expenses that qualify for reimbursement.

Required Documents

When completing the fsadc, certain documents are required to support your claim. These typically include:

- Receipts or invoices from the care provider detailing the services rendered.

- Proof of payment, such as canceled checks or bank statements.

- Any additional documentation requested by your employer to verify the claim.

Form Submission Methods

The fsadc can usually be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online submission via your employer's benefits portal.

- Mailing a hard copy of the completed form to the designated claims processor.

- In-person submission to your employer's human resources or benefits department.

Quick guide on how to complete fsadc

Effortlessly Prepare Fsadc on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely archive it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Process Fsadc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Modify and Electronically Sign Fsadc with Ease

- Obtain Fsadc and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign Fsadc and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsadc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fsadc and how does it relate to airSlate SignNow?

Fsadc refers to the financial and signature authorization document control within airSlate SignNow. This feature enables businesses to manage and secure their documents efficiently, ensuring compliance and accuracy in financial transactions.

-

How much does airSlate SignNow cost and does it support fsadc?

AirSlate SignNow offers competitive pricing plans that cater to various business needs while incorporating fsadc functionalities. Customers can choose from different tiers based on their usage and features, ensuring they get the best value for managing document workflows.

-

What features does airSlate SignNow offer for fsadc?

AirSlate SignNow includes a variety of features tailored for fsadc, such as eSigning, document templates, and cloud storage. These tools streamline the signing process, allowing users to handle their authorization needs seamlessly and securely.

-

How does airSlate SignNow enhance document security with fsadc?

With fsadc, airSlate SignNow provides top-notch security features such as encryption, authentication, and audit trails. These measures ensure that sensitive financial documents are protected, enhancing trust and compliance with legal standards.

-

Can airSlate SignNow integrate with other software for fsadc?

Yes, airSlate SignNow offers integrations with various applications, enhancing its fsadc capabilities. Users can connect it with CRM systems, payment platforms, and other tools to create a comprehensive document management solution.

-

What are the benefits of using airSlate SignNow for fsadc over traditional methods?

Using airSlate SignNow for fsadc eliminates the hassles of traditional paperwork, speeding up the signing process and reducing errors. This digital approach not only saves time but also cuts costs associated with printing and mailing documents.

-

Is support available for users navigating fsadc features in airSlate SignNow?

Absolutely! AirSlate SignNow provides robust customer support to assist users with their fsadc needs. Whether you have questions about features or troubleshooting, the support team is accessible via chat, email, or phone.

Get more for Fsadc

- Tertiary survey template form

- Srg1202 form

- Guardianship in california form

- Police department county of suffolk pistol license applicant form

- City of opa locka building licensing www opalock form

- Simplified form

- Retiree rebate application fpl com form

- Notice of asbestos renovation of demolition dep form 62 2579001

Find out other Fsadc

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service