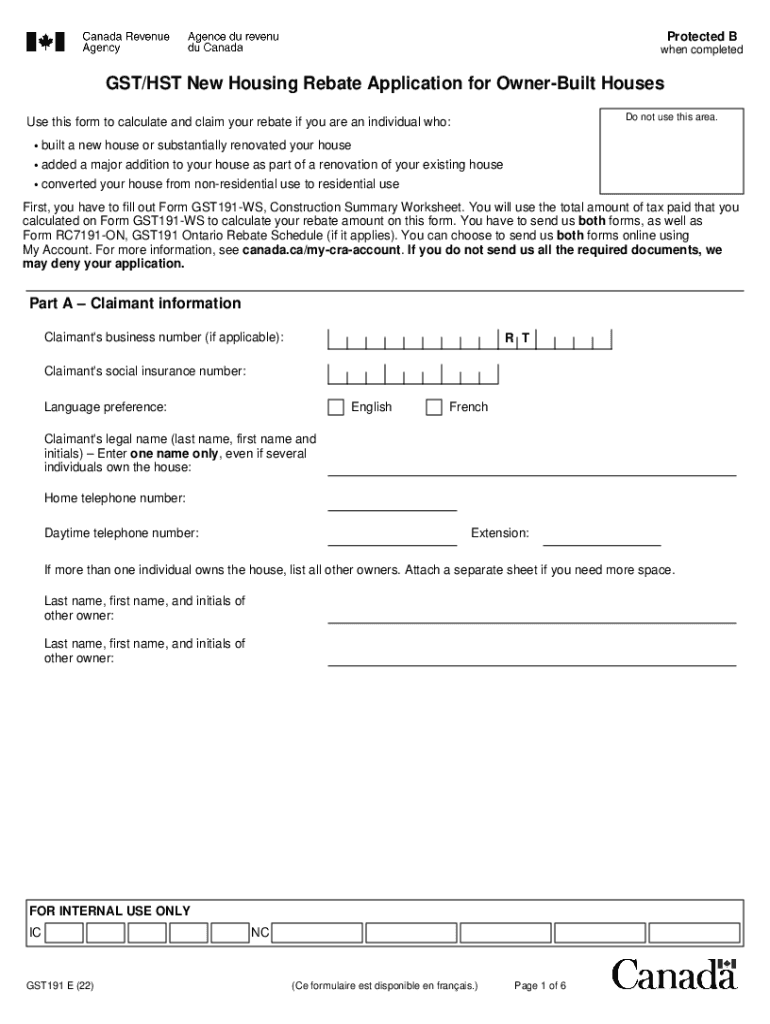

Canada Gst Revenue Agency Form

What is the Canada GST Revenue Agency?

The Canada GST Revenue Agency, commonly referred to as the CRA, is the federal agency responsible for administering tax laws for the Government of Canada. It oversees the collection of Goods and Services Tax (GST) and Harmonized Sales Tax (HST), ensuring compliance with tax regulations. The CRA also manages various tax credits and rebates, including the 2022 GST HST rebate, which aims to provide financial relief to eligible individuals and families. Understanding the CRA's role is crucial for taxpayers who wish to navigate the tax system effectively.

Eligibility Criteria for the 2022 GST HST Rebate

To qualify for the 2022 GST HST rebate, applicants must meet specific eligibility criteria set by the CRA. Generally, individuals must be residents of Canada and have a valid Social Insurance Number (SIN). Income thresholds also apply; those earning below a certain amount may be eligible for a higher rebate. Additionally, applicants must have filed their income tax returns for the previous year to ensure accurate assessment of their eligibility. Familiarizing oneself with these criteria can streamline the application process.

Steps to Complete the Canada GST HST Rebate Application

Completing the application for the 2022 GST HST rebate involves several straightforward steps. First, gather all necessary documents, including your SIN and income statements. Next, access the application form, which can typically be found on the CRA website or through authorized tax software. Fill out the form accurately, ensuring all information is current and correct. After completing the form, submit it either online through the CRA portal or by mailing a paper copy to the designated address. Keeping a copy of the submitted application for your records is advisable.

Required Documents for the Application

When applying for the 2022 GST HST rebate, having the right documents is essential for a smooth process. Key documents include:

- Your Social Insurance Number (SIN)

- Proof of income, such as tax returns or pay stubs

- Any previous correspondence from the CRA regarding your tax status

- Bank account information for direct deposit, if applicable

Ensuring that all documents are accurate and complete will help avoid delays in processing your application.

Form Submission Methods

There are multiple ways to submit your application for the 2022 GST HST rebate. The most efficient method is through the CRA's online portal, which allows for immediate processing and confirmation. Alternatively, applicants can choose to mail a paper version of the application. If opting for this method, ensure that the form is sent to the correct address and that it is postmarked by the submission deadline. In-person submissions are generally not available, emphasizing the importance of online and mail options.

Penalties for Non-Compliance

Understanding the potential penalties for non-compliance with the CRA's regulations is crucial for all applicants. Failure to submit the 2022 GST HST rebate application on time or providing inaccurate information can result in penalties. These may include fines or delays in receiving the rebate. In severe cases, repeated non-compliance may lead to further legal action by the CRA. Staying informed about compliance requirements can help mitigate these risks.

Quick guide on how to complete canada gst revenue agency

Access Canada Gst Revenue Agency effortlessly on any device

Managing documents online has become a trend for businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and easily. Handle Canada Gst Revenue Agency on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign Canada Gst Revenue Agency without stress

- Find Canada Gst Revenue Agency and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs with just a few clicks on any device of your choosing. Modify and eSign Canada Gst Revenue Agency and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada gst revenue agency

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 GST HST rebate?

The 2022 GST HST rebate is a financial benefit provided by the government that allows eligible businesses to recover a portion of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) paid on certain expenses. This rebate is crucial for minimizing tax burdens and improving cash flow for businesses. Understanding the requirements can help you take full advantage of this opportunity.

-

Who is eligible for the 2022 GST HST rebate?

Eligibility for the 2022 GST HST rebate typically includes small businesses and self-employed individuals that have incurred GST or HST expenses in their operations. Specific thresholds and criteria must be met, such as total revenue and the nature of expenses. It is advisable to consult with a tax professional to determine your eligibility.

-

How can I apply for the 2022 GST HST rebate through airSlate SignNow?

To apply for the 2022 GST HST rebate using airSlate SignNow, you can eSign your rebate application and other necessary documents digitally. This streamlined process not only saves time but also ensures secure handling of sensitive financial information. Simply follow the guided steps in our platform to complete your application.

-

What features does airSlate SignNow offer for managing GST HST rebate documents?

airSlate SignNow provides features like document templates, eSignature capabilities, and cloud storage specifically designed for managing GST HST rebate documents. These features facilitate quick and efficient document preparation and storage, making it easier to submit your rebate applications. Plus, our notifications keep you updated on any actions required.

-

Is airSlate SignNow cost-effective for small businesses seeking the 2022 GST HST rebate?

Yes, airSlate SignNow is a cost-effective solution for small businesses pursuing the 2022 GST HST rebate. Our pricing plans cater to various budgets while ensuring access to essential features and support. This makes it an ideal option for businesses looking to save money while efficiently managing their eSigning needs.

-

What are the benefits of using airSlate SignNow for GST HST rebate paperwork?

Using airSlate SignNow for your GST HST rebate paperwork offers numerous benefits, including faster processing times and enhanced security for your documents. The electronic signing feature reduces the need for physical paperwork, which can expedite your rebate claims. Additionally, our user-friendly interface simplifies the entire process, making it accessible for all business owners.

-

Can airSlate SignNow integrate with other accounting software for tracking the 2022 GST HST rebate?

Yes, airSlate SignNow can integrate seamlessly with various accounting software to help you manage your 2022 GST HST rebate efficiently. This integration allows you to sync critical financial data and documents, ensuring that you have all necessary information at your fingertips. Contact our support team to learn more about available integrations.

Get more for Canada Gst Revenue Agency

- Personal effects accounting document document de dclaration en dtail des effets personnels form

- General motors certificate of incumbency form

- Employment application education maxim staffing solutions form

- Complete the sentence using the verbs from above form

- Covenant hospice massage therapy competencies confex form

- Safcgpsafc student travel reimbursement addendum cornell form

- Student confirmation and payment agreement msu northern form

- Campus map pdf vassar college form

Find out other Canada Gst Revenue Agency

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document