Form 5329 for

What is the Form 5329 For

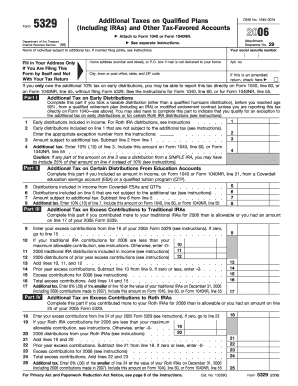

The Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans, including IRAs (Individual Retirement Accounts). It is primarily utilized to address situations involving excess contributions, early distributions, and failures to take required minimum distributions (RMDs). This form helps taxpayers ensure compliance with IRS regulations regarding retirement accounts and avoid potential penalties.

How to use the Form 5329 For

To effectively use the Form 5329, taxpayers must first determine the specific reason for filing. Common scenarios include reporting excess contributions to retirement accounts, calculating penalties for early withdrawals, or addressing missed RMDs. After identifying the applicable section of the form, individuals should accurately fill in their personal information, the type of retirement account involved, and the details regarding the additional tax owed. It is essential to consult IRS guidelines to ensure all information is complete and accurate.

Steps to complete the Form 5329 For

Completing the Form 5329 involves several key steps:

- Gather necessary documents, including retirement account statements and prior tax returns.

- Identify the reason for filing the form, such as excess contributions or early distributions.

- Fill in your personal information, including your name, address, and Social Security number.

- Complete the relevant sections of the form, ensuring all calculations for additional taxes are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 5329 For

The legal use of Form 5329 is crucial for ensuring compliance with IRS regulations. Filing this form appropriately can help taxpayers avoid penalties associated with excess contributions or early withdrawals from retirement accounts. It is essential to understand the legal implications of the information provided on the form, as inaccuracies may lead to audits or additional tax liabilities. Consulting a tax professional can provide guidance on the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for Form 5329 align with the standard tax return deadlines. Typically, individuals must submit their Form 5329 along with their annual tax return by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failure to file Form 5329 when required can result in significant penalties. The IRS may impose a penalty of up to six percent per year on excess contributions to retirement accounts. Additionally, taxpayers who do not take required minimum distributions may face a penalty of fifty percent of the amount that should have been withdrawn. Understanding these penalties emphasizes the importance of timely and accurate filing of the form.

Quick guide on how to complete form 5329 for

Complete Form 5329 For effortlessly on any device

Online document management has gained popularity with organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents quickly without delays. Manage Form 5329 For on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to adjust and eSign Form 5329 For with ease

- Find Form 5329 For and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5329 For while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5329 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5329 for?

Form 5329 for is a tax form used to report additional taxes on certain retirement accounts. It is primarily filed by individuals who have failed to take required minimum distributions or have excess contributions to their plans. Understanding how to properly fill out Form 5329 for can help you avoid penalties.

-

How can airSlate SignNow help with Form 5329 for e-signatures?

airSlate SignNow provides an efficient solution for electronically signing Form 5329 for, ensuring all stakeholders can quickly review and approve the document. By using airSlate SignNow, you can streamline the signing process and reduce the turnaround time for important tax forms. This can be especially beneficial during tax season.

-

What features does airSlate SignNow offer for managing Form 5329 for?

With airSlate SignNow, users can create templates for Form 5329 for, send documents for e-signature, and track their status in real time. The intuitive interface makes it easy to customize forms to meet your specific needs. Plus, you can securely store and access all signed documents in one centralized location.

-

Is there a cost associated with using airSlate SignNow for Form 5329 for?

Yes, there is a subscription cost associated with using airSlate SignNow for Form 5329 for. The pricing varies based on the chosen plan, which offers different levels of features suited to individual or business needs. However, the cost is generally competitive and offers signNow savings compared to traditional signing methods.

-

What are the benefits of using airSlate SignNow for Form 5329 for?

The benefits of using airSlate SignNow for Form 5329 for include enhanced efficiency in document handling, reduced paper waste, and a secure e-signature process that complies with legal regulations. Users can also save time by automating repetitive tasks associated with form submissions. Ultimately, it leads to faster completion and filing of essential documents.

-

Can airSlate SignNow integrate with accounting software for Form 5329 for management?

Yes, airSlate SignNow can integrate with various accounting and financial software to manage Form 5329 for efficiently. These integrations help streamline workflows, allowing you to seamlessly transfer data and documents between platforms. This can aid in maintaining accurate financial records and simplify tax preparation.

-

Is airSlate SignNow secure for handling sensitive information on Form 5329 for?

Definitely! airSlate SignNow prioritizes user security and compliance, particularly when dealing with sensitive information on Form 5329 for. The platform utilizes encryption, secure data storage, and stringent access controls to ensure that all documents are protected against unauthorized access or bsignNowes.

Get more for Form 5329 For

- Supplemental structure verification form

- Notice of right to cancel form

- City of beaumont texas alarm permit application form

- Certificate of incapacity form clark county nevada clarkcountynv

- Myfloridalicense 16939898 form

- Affidavit authorized agent form

- Plant order form plants in design inc

- This form can be uploaded to the portal once

Find out other Form 5329 For

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF