Form 723 Pbgc

What is the Form 723 Pbgc

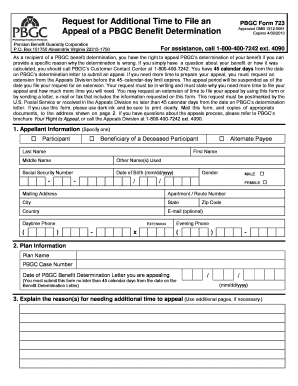

The Form 723 Pbgc is a critical document used in the context of pension benefit guaranty. This form is specifically designed to facilitate the reporting and management of pension plans under the jurisdiction of the Pension Benefit Guaranty Corporation (PBGC). It serves as a means for plan sponsors to communicate essential information regarding their pension plans, ensuring compliance with federal regulations. Understanding the purpose and requirements of Form 723 is essential for any organization managing a pension plan to avoid penalties and ensure proper reporting.

How to use the Form 723 Pbgc

Using the Form 723 Pbgc involves several key steps to ensure accurate completion and submission. First, gather all necessary information related to the pension plan, including plan details, sponsor information, and participant data. Next, carefully fill out the form, paying close attention to each section to avoid errors. After completing the form, review it for accuracy and ensure all required signatures are present. Finally, submit the form according to the specified guidelines, whether online or through traditional mail, to ensure it reaches the PBGC in a timely manner.

Steps to complete the Form 723 Pbgc

Completing the Form 723 Pbgc requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather necessary documentation, including plan details and participant information.

- Begin filling out the form by entering the plan sponsor's name and contact information.

- Provide detailed information about the pension plan, including its type and funding status.

- Include participant data as required, ensuring accuracy in numbers and details.

- Review the completed form for any errors or missing information.

- Sign and date the form, ensuring all required parties have signed.

- Submit the form as per the PBGC's guidelines, either electronically or by mail.

Legal use of the Form 723 Pbgc

The legal use of Form 723 Pbgc is governed by federal regulations pertaining to pension plans. To ensure the form is legally binding, it must be completed in accordance with the guidelines set forth by the PBGC. This includes providing accurate and truthful information, obtaining necessary signatures, and adhering to submission deadlines. Failure to comply with these legal requirements can result in penalties or issues with the pension plan's status, making it crucial for plan sponsors to understand their obligations.

Key elements of the Form 723 Pbgc

Form 723 Pbgc includes several key elements that are essential for proper completion. These elements typically consist of:

- Plan sponsor's name and contact information.

- Details about the pension plan, including its type and funding status.

- Participant information, including names and identification numbers.

- Signatures of authorized representatives, confirming the accuracy of the information provided.

- Any additional documentation required to support the information reported on the form.

Form Submission Methods

Submitting the Form 723 Pbgc can be done through various methods, ensuring flexibility for plan sponsors. The most common submission methods include:

- Online Submission: Many organizations prefer to submit the form electronically through the PBGC's online portal, which can expedite processing.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate PBGC address.

- In-Person Submission: Some organizations may choose to deliver the form in person, ensuring immediate receipt and confirmation.

Quick guide on how to complete pbgc form 723

Effortlessly prepare pbgc form 723 on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage form 723 pbgc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign pbgc form 723 effortlessly

- Locate what is 723 724 form in pbgc and click on Access Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Signature tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Finish button to retain your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign form 723 pbgc and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to what is 723 724 form in pbgc

Create this form in 5 minutes!

How to create an eSignature for the form 723 pbgc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask what is 723 724 form in pbgc

-

What is the form 723 pbgc used for?

The form 723 pbgc is used to report information to the Pension Benefit Guaranty Corporation (PBGC) regarding certain retirement plan benefits. This form ensures compliance with federal regulations and helps organizations manage their pension responsibilities effectively. Completing the form accurately is essential to avoid potential penalties or issues with the PBGC.

-

How can airSlate SignNow help with the form 723 pbgc?

airSlate SignNow simplifies the process of preparing and submitting the form 723 pbgc by providing easy-to-use document templates and eSignature capabilities. With our platform, businesses can quickly fill out the necessary information, sign the document electronically, and send it to the PBGC without hassle. This streamlines your compliance efforts and saves valuable time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans designed to accommodate different business needs, including options for individuals, small businesses, and enterprises. Each plan includes features that facilitate the management of documents like the form 723 pbgc. We encourage you to visit our pricing page for detailed information on each plan and its benefits.

-

Are there any integrations available for managing form 723 pbgc?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your document management process, including CRM and cloud storage solutions. These integrations allow you to easily access and manage your files related to the form 723 pbgc. This ensures a smooth workflow, from document creation to final submission.

-

What features does airSlate SignNow offer for handling form 723 pbgc?

airSlate SignNow provides a comprehensive suite of features for handling documents like form 723 pbgc, including customizable templates, eSignature capabilities, and automated workflows. Our platform is designed to improve efficiency and accuracy, making it easier for businesses to comply with PBGC regulations. Additionally, our intuitive interface simplifies document creation and management.

-

Can I track the status of my form 723 pbgc submissions with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their submissions, including the form 723 pbgc, in real-time. You will receive notifications when your document is viewed, signed, or completed, enabling you to stay updated throughout the process. This feature enhances transparency and ensures you remain compliant with PBGC requirements.

-

Is airSlate SignNow secure for handling form 723 pbgc?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to ensure that all documents, including the form 723 pbgc, are protected. Our platform is fully compliant with industry standards, giving you peace of mind when managing sensitive information related to pension plans.

Get more for form 723 pbgc

- Quantitative asset management learning sas financial databases and financial modeling through examples form

- Vva chapter election report form

- How to fill a mc52 2010 form

- Hampr block bank ira distribution form

- Fms2231 form

- Printable form 8800

- Form 3538

- 1999 pa individual income tax return short form pa 40ez cs cmu

Find out other pbgc form 723

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF