P60 Continuous Gov Uk Form

What is the P60 continuous Gov uk

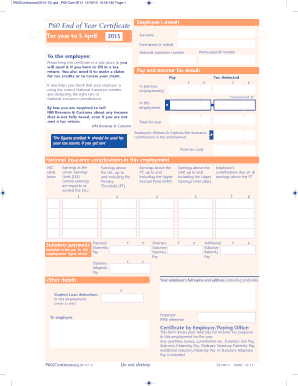

The P60 continuous form is a crucial document used in the United Kingdom to summarize an employee's total pay and deductions for a tax year. It is issued by employers to their employees at the end of each tax year, detailing the amount of income earned and the taxes withheld. While primarily relevant in the UK, understanding its purpose can be beneficial for U.S. businesses that engage with international employees or have operations in the UK. The P60 serves as an official record of income and tax contributions, making it essential for tax filing and financial planning.

How to obtain the P60 continuous Gov uk

Employees can obtain their P60 continuous form directly from their employer. Employers are legally required to provide this document by May 31 following the end of the tax year. If an employee does not receive their P60, they should first contact their employer's payroll department. In cases where the employer is unresponsive, employees can access their pay information through online payroll systems if available. It is important to keep this document safe, as it may be needed for tax returns and other financial matters.

Key elements of the P60 continuous Gov uk

The P60 continuous form contains several key elements that are vital for understanding an employee's tax situation. These include:

- Employee details: Name, address, and National Insurance number.

- Employer information: Name and PAYE reference number.

- Income summary: Total pay for the tax year.

- Deductions: Total tax and National Insurance contributions deducted.

- Tax code: Indicates the employee's tax status for the year.

Each of these components plays a significant role in tax reporting and compliance, ensuring that both employees and employers meet their legal obligations.

Steps to complete the P60 continuous Gov uk

Completing the P60 continuous form involves several straightforward steps. First, ensure that all employee and employer details are accurately filled out. Next, calculate the total income earned by the employee during the tax year, including bonuses and overtime. Then, determine the total tax and National Insurance contributions that have been deducted from the employee's pay. Finally, review the form for any errors before distributing it to employees. It is crucial to keep copies for record-keeping and compliance purposes.

Legal use of the P60 continuous Gov uk

The P60 continuous form is legally binding and serves as an official record of an employee's earnings and tax contributions. Employers must issue this form to comply with HM Revenue and Customs (HMRC) regulations in the UK. Failure to provide a P60 can result in penalties for employers and may complicate an employee's tax filing process. In the U.S. context, understanding the legal implications of similar forms can help businesses maintain compliance when dealing with international employees.

Penalties for Non-Compliance

Employers who fail to issue the P60 continuous form by the deadline may face penalties from HMRC. These penalties can vary based on the severity and duration of the non-compliance. Employees who do not receive their P60 may also encounter difficulties in filing their tax returns, leading to potential fines or additional scrutiny from tax authorities. It is essential for both employers and employees to understand these implications to ensure compliance and avoid unnecessary financial repercussions.

Quick guide on how to complete p60 continuous gov uk

Complete P60 continuous Gov uk effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources essential to create, modify, and electronically sign your documents swiftly without delays. Handle P60 continuous Gov uk across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign P60 continuous Gov uk easily

- Find P60 continuous Gov uk and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose how you prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign P60 continuous Gov uk to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p60 continuous gov uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a P60 and why is it important?

A P60 is an annual tax statement provided by employers to their employees in the UK. It summarizes an employee's total earnings and the tax that has been deducted during the tax year. Understanding the P60 is important as it helps you verify your income and tax payments, which is crucial for your financial records.

-

How can airSlate SignNow help with P60 documents?

AirSlate SignNow offers a seamless platform to send and eSign P60 documents securely. With its user-friendly interface, businesses can easily manage the distribution and signing of P60 forms, ensuring compliance and accuracy. This feature simplifies the process signNowly, making it easier for both employers and employees.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans designed to fit different business needs, all of which include features for managing P60 documents. You can choose from monthly or annual subscriptions, with options for advanced functionalities as your business grows. Detailed pricing information is available on the airSlate SignNow website.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow provides integrations with a variety of popular applications, enhancing its functionality for managing documents like the P60. You can connect it with tools such as Zapier, Google Suite, and other CRM platforms. This ensures a smooth workflow and effective management of all your document signing needs.

-

Is airSlate SignNow secure for handling sensitive documents like P60?

Absolutely. AirSlate SignNow employs advanced encryption and security measures to ensure that your P60 documents and personal information are protected. The platform complies with industry standards, giving you peace of mind while managing sensitive information like tax documents.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes features such as customizable templates, automatic reminders, and real-time tracking for document statuses, making it perfect for handling P60s. These tools streamline the signing process, facilitate quicker approvals, and help maintain organization within your document workflow.

-

How does airSlate SignNow improve the efficiency of handling P60 forms?

Using airSlate SignNow can signNowly enhance the efficiency of handling P60 forms by automating the sending and signing process. This reduces the time spent on paperwork, minimizes errors, and allows for quick access to important documents. Ultimately, it helps both employers and employees save time and resources.

Get more for P60 continuous Gov uk

Find out other P60 continuous Gov uk

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online